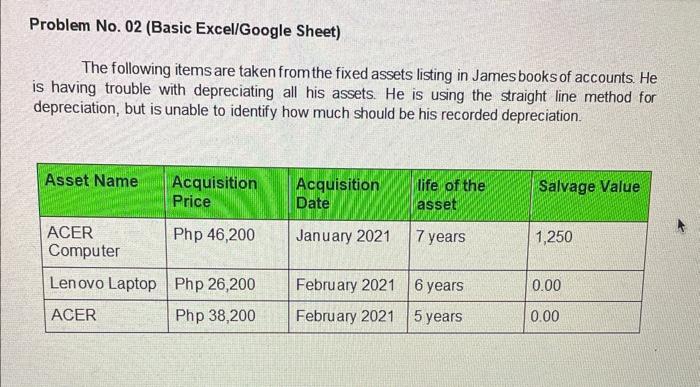

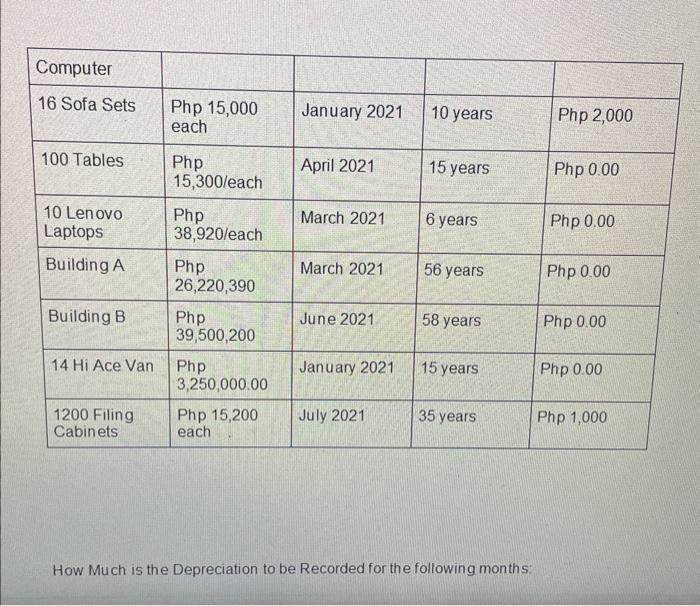

Question: Please answer all Problem No. 02 (Basic Excel/Google Sheet) The following items are taken from the fixed assets listing in James books of accounts. He

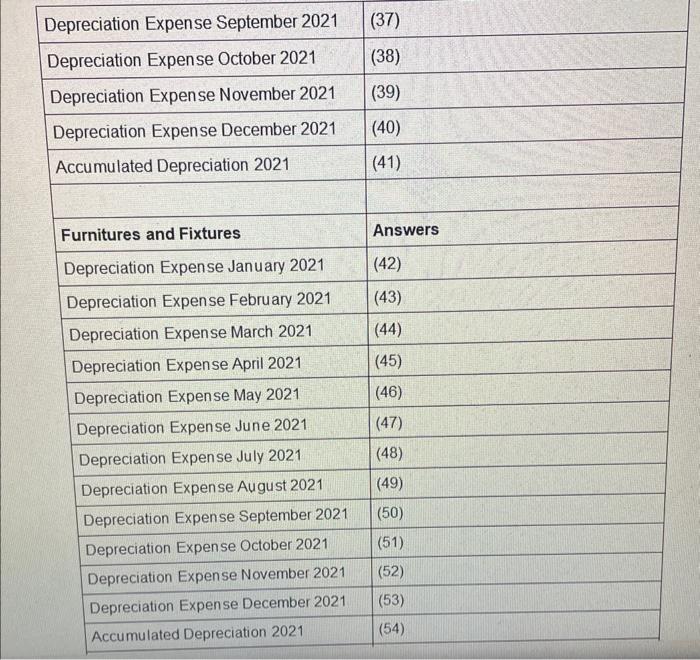

Problem No. 02 (Basic Excel/Google Sheet) The following items are taken from the fixed assets listing in James books of accounts. He is having trouble with depreciating all his assets. He is using the straight line method for depreciation, but is unable to identify how much should be his recorded depreciation. How Much is the Depreciation to be Recorded for the following months: \begin{tabular}{|l|l|} \hline Depreciation Expense September 2021 & (37) \\ \hline Depreciation Expense October 2021 & (38) \\ \hline Depreciation Expense November 2021 & (39) \\ \hline Depreciation Expense December 2021 & (40) \\ \hline Accumulated Depreciation 2021 & (41) \\ \hline & \\ \hline Furnitures and Fixtures & Answers \\ \hline Depreciation Expense January 2021 & (42) \\ \hline Depreciation Expense February 2021 & (43) \\ \hline Depreciation Expense March 2021 & (44) \\ \hline Depreciation Expense April 2021 & (45) \\ \hline Depreciation Expense May 2021 & (46) \\ \hline Depreciation Expense June 2021 & (47) \\ \hline Depreciation Expense July 2021 & (48) \\ \hline Depreciation Expense August 2021 & (49) \\ \hline Depreciation Expense September 2021 & (50) \\ \hline Depreciation Expense October 2021 & (51) \\ \hline Depreciation Expense November 2021 & (52) \\ \hline Depreciation Expense December 2021 & (53) \\ \hline Accumulated Depreciation 2021 & (54) \\ \hline \end{tabular} Problem No. 02 (Basic Excel/Google Sheet) The following items are taken from the fixed assets listing in James books of accounts. He is having trouble with depreciating all his assets. He is using the straight line method for depreciation, but is unable to identify how much should be his recorded depreciation. How Much is the Depreciation to be Recorded for the following months: \begin{tabular}{|l|l|} \hline Depreciation Expense September 2021 & (37) \\ \hline Depreciation Expense October 2021 & (38) \\ \hline Depreciation Expense November 2021 & (39) \\ \hline Depreciation Expense December 2021 & (40) \\ \hline Accumulated Depreciation 2021 & (41) \\ \hline & \\ \hline Furnitures and Fixtures & Answers \\ \hline Depreciation Expense January 2021 & (42) \\ \hline Depreciation Expense February 2021 & (43) \\ \hline Depreciation Expense March 2021 & (44) \\ \hline Depreciation Expense April 2021 & (45) \\ \hline Depreciation Expense May 2021 & (46) \\ \hline Depreciation Expense June 2021 & (47) \\ \hline Depreciation Expense July 2021 & (48) \\ \hline Depreciation Expense August 2021 & (49) \\ \hline Depreciation Expense September 2021 & (50) \\ \hline Depreciation Expense October 2021 & (51) \\ \hline Depreciation Expense November 2021 & (52) \\ \hline Depreciation Expense December 2021 & (53) \\ \hline Accumulated Depreciation 2021 & (54) \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts