Question: PLEASE ANSWER ALL QUESTION 17. During 2021, calendar year Corp. A purchases office furniture costing $10,000 on May 11, computers costing $12,000 on September 23,

PLEASE ANSWER ALL QUESTION

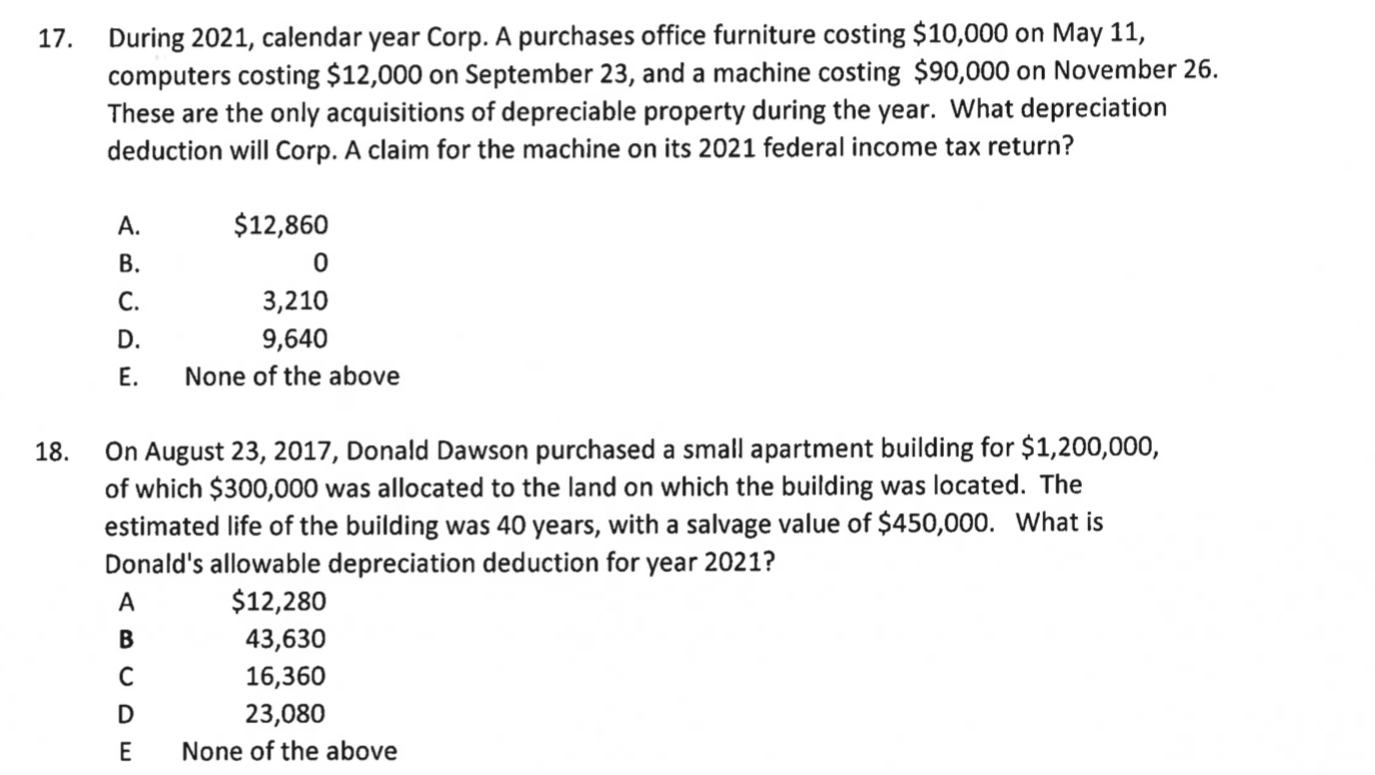

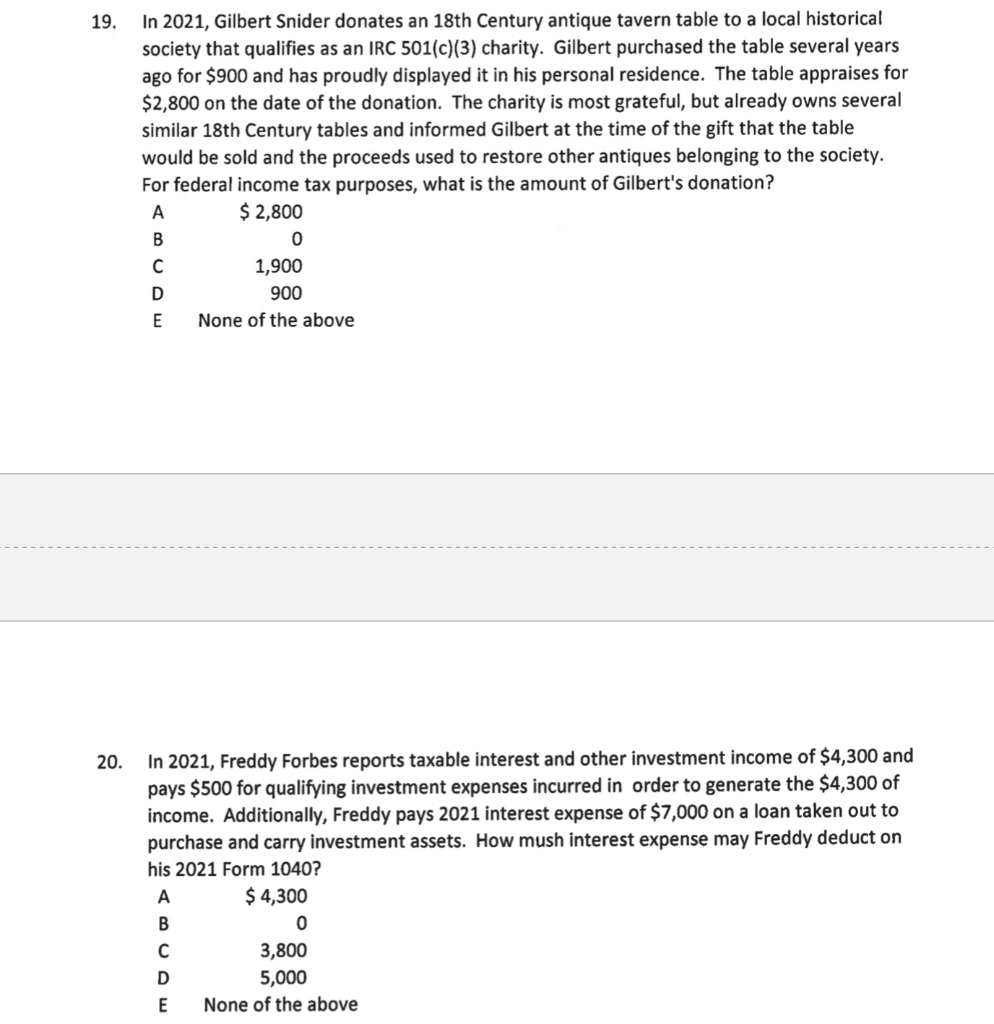

17. During 2021, calendar year Corp. A purchases office furniture costing $10,000 on May 11, computers costing $12,000 on September 23, and a machine costing $90,000 on November 26. These are the only acquisitions of depreciable property during the year. What depreciation deduction will Corp. A claim for the machine on its 2021 federal income tax return? A. $12,860 B. 0 C. 3,210 D. 9,640 E. None of the above 18. On August 23, 2017, Donald Dawson purchased a small apartment building for $1,200,000, of which $300,000 was allocated to the land on which the building was located. The estimated life of the building was 40 years, with a salvage value of $450,000. What is Donald's allowable depreciation deduction for year 2021? A $12,280 B 43,630 C 16,360 D 23,080 E None of the above 19. In 2021, Gilbert Snider donates an 18th Century antique tavern table to a local historical society that qualifies as an IRC 501(c)(3) charity. Gilbert purchased the table several years ago for $900 and has proudly displayed it in his personal residence. The table appraises for $2,800 on the date of the donation. The charity is most grateful, but already owns several similar 18th Century tables and informed Gilbert at the time of the gift that the table would be sold and the proceeds used to restore other antiques belonging to the society. For federal income tax purposes, what is the amount of Gilbert's donation? A $ 2,800 B 0 C 1,900 D 900 None of the above E 20. In 2021, Freddy Forbes reports taxable interest and other investment income of $4,300 and pays $500 for qualifying investment expenses incurred in order to generate the $4,300 of income. Additionally, Freddy pays 2021 interest expense of $7,000 on a loan taken out to purchase and carry investment assets. How mush interest expense may Freddy deduct on his 2021 Form 1040? A $ 4,300 B 0 C 3,800 D 5,000 E None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts