Question: Please answer all question as only one ask remains! Thumbs up! Consider a stock that will have dividend growth rates in the next three periods

Please answer all question as only one ask remains! Thumbs up!

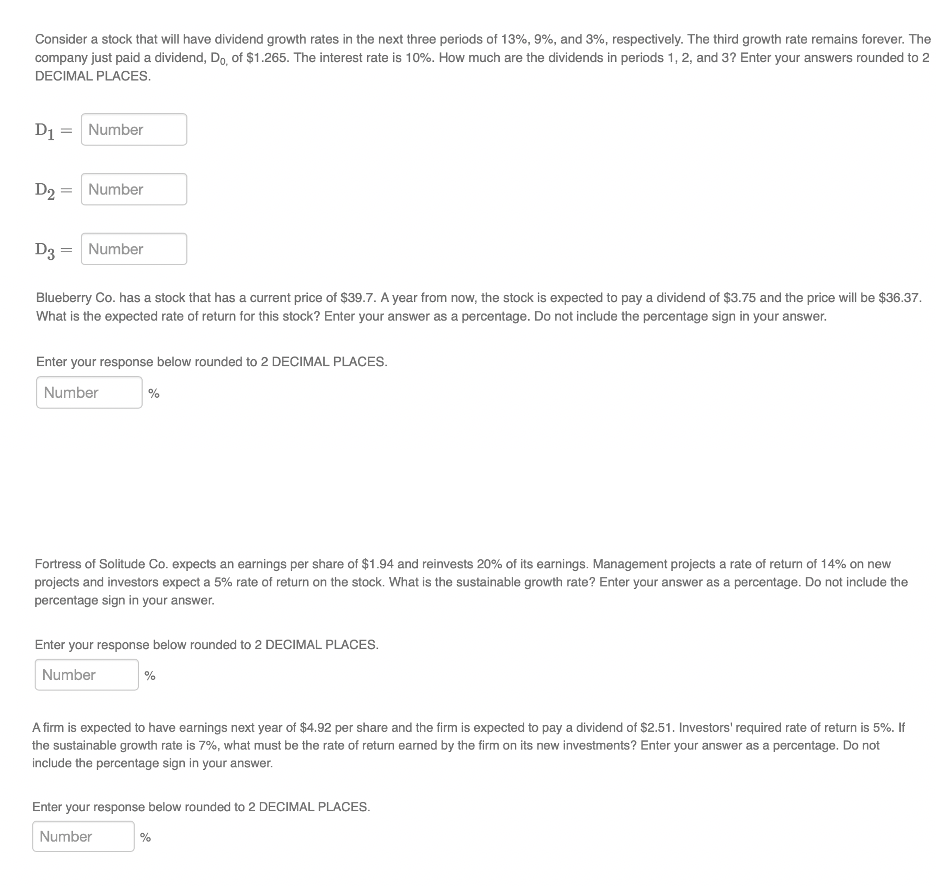

Consider a stock that will have dividend growth rates in the next three periods of 13%, 9%, and 3%, respectively. The third growth rate remains forever. The company just paid a dividend, D., of $1.265. The interest rate is 10%. How much are the dividends in periods 1, 2, and 3? Enter your answers rounded to 2 DECIMAL PLACES. D1 = Number D2 Number D3 = Number Blueberry Co. has a stock that has a current price of $39.7. A year from now, the stock is expected to pay a dividend of $3.75 and the price will be $36.37. What is the expected rate of return for this stock? Enter your answer as a percentage. Do not include the percentage sign in your answer. Enter your response below rounded to 2 DECIMAL PLACES. Number % Fortress of Solitude Co. expects an earnings per share of $1.94 and reinvests 20% of its earnings. Management projects a rate of return of 14% on new projects and investors expect a 5% rate of return on the stock. What is the sustainable growth rate? Enter your answer as a percentage. Do not include the percentage sign in your answer. Enter your response below rounded to 2 DECIMAL PLACES. Number % A firm is expected to have earnings next year of $4.92 per share and the firm is expected to pay a dividend of $2.51. Investors' required rate of return is 5%. If the sustainable growth rate is 7%, what must be the rate of return earned by the firm on its new investments? Enter your answer as a percentage. Do not include the percentage sign in your answer. Enter your response below rounded to 2 DECIMAL PLACES. Number %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts