Question: need part 3, pls show how to do it Consider a stock that will have dividend growth rates in the next three periods of 9%,

need part 3, pls show how to do it

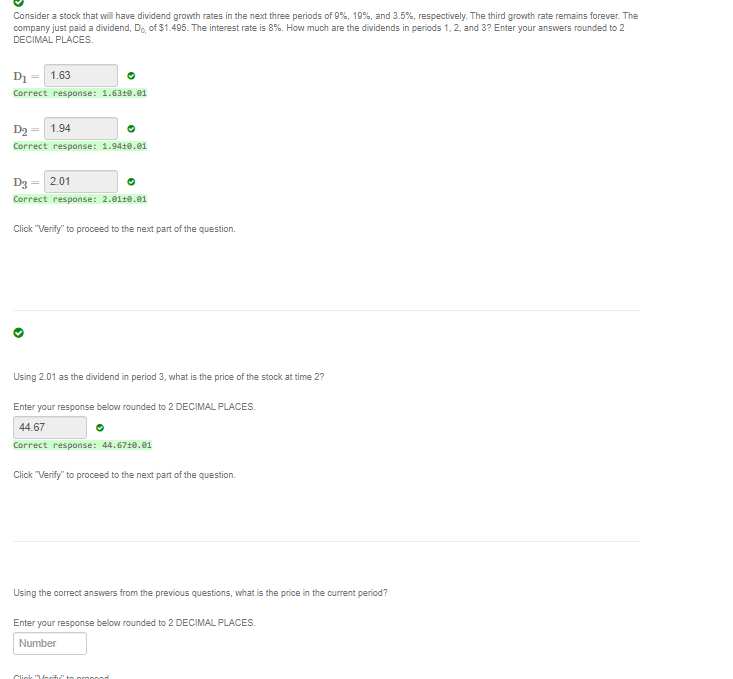

Consider a stock that will have dividend growth rates in the next three periods of 9%, 19%, and 3.5%, respectively. The third growth rate remains forever. The company just paid a dividend, D., of $1.495. The interest rate is 8%. How much are the dividends in periods 1.2 and 32 Enter your answers rounded to 2 DECIMAL PLACES D1 = 1.63 Correct response: 1.630.01 D2 = 1.94 Correct response: 1.94+0.01 D3 = 2.01 Correct response: 2.0110.01 Click "Verify" to proceed to the next part of the question. Using 2.01 as the dividend in period 3, what is the price of the stock at time 2? Enter your response below rounded to 2 DECIMAL PLACES. 44.67 Correct response: 44.67+0.01 Click "Verify" to proceed to the next part of the question. Using the correct answers from the previous questions, what is the price in the current period? Enter your response below rounded to 2 DECIMAL PLACES. Number Clin

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts