Question: please answer all questions 1. (10 points) Spongebob and luis best friend Patrick Star have decided to open a bubble stand. Unfortunately, Spongebob and Patrick

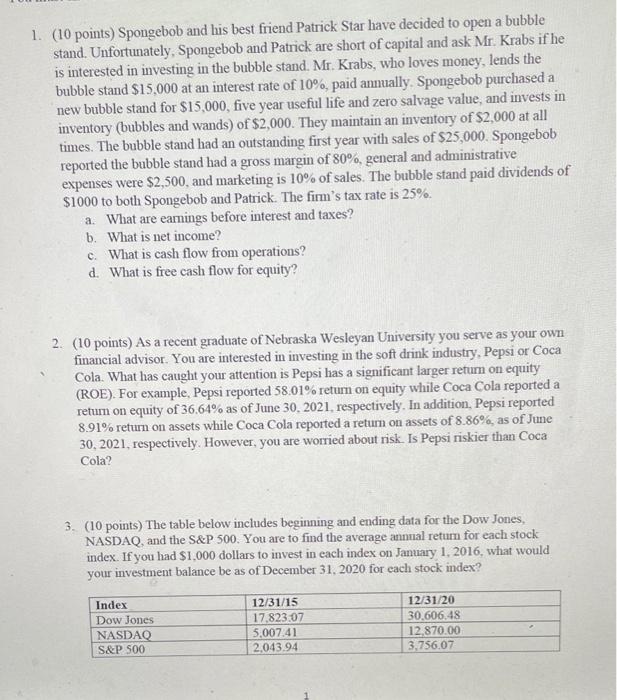

1. (10 points) Spongebob and luis best friend Patrick Star have decided to open a bubble stand. Unfortunately, Spongebob and Patrick are short of capital and ask Mr. Krabs if he is interested in investing in the bubble stand. Mr. Krabs, who loves money, lends the bubble stand $15,000 at an interest rate of 10%, paid anmally. Spongebob purchased a new bubble stand for $15,000, five year useful life and zero salvage value and invests in inventory (bubbles and wands) of $2,000. They maintain an inventory of $2,000 at all times. The bubble stand had an outstanding first year with sales of $25,000. Spongebob reported the bubble stand had a gross margin of 80%, general and administrative expenses were $2,500, and marketing is 10% of sales. The bubble stand paid dividends of $1000 to both Spongebob and Patrick. The firm's tax rate is 25%. a. What are eamings before interest and taxes? b. What is net income? c. What is cash flow from operations? d. What is free cash flow for equity? 2. (10 points) As a recent graduate of Nebraska Wesleyan University you serve as your own financial advisor. You are interested in investing in the soft drink industry, Pepsi or Coca Cola. What has caught your attention is Pepsi has a significant larger return on equity (ROE). For example, Pepsi reported 58.01% return on equity while Coca Cola reported a return on equity of 36.64% as of June 30, 2021, respectively. In addition, Pepsi reported 8.91% return on assets while Coca Cola reported a return on assets of 8.86%, as of June 30, 2021, respectively. However, you are worried about risk. Is Pepsi riskier than Coca Cola? 3. (10 points) The table below includes beginning and ending data for the Dow Jones, NASDAQ, and the S&P 500. You are to find the average annual return for each stock index. If you had $1.000 dollars to invest in each index on January 1, 2016, what would your investment balance be as of December 31, 2020 for each stock index? Index Dow Jones NASDAQ S&P 500 12/31/15 17.823.07 5.00741 2.043.94 12/31/20 30.606.48 12.870.00 3,756.07 1. (10 points) Spongebob and luis best friend Patrick Star have decided to open a bubble stand. Unfortunately, Spongebob and Patrick are short of capital and ask Mr. Krabs if he is interested in investing in the bubble stand. Mr. Krabs, who loves money, lends the bubble stand $15,000 at an interest rate of 10%, paid anmally. Spongebob purchased a new bubble stand for $15,000, five year useful life and zero salvage value and invests in inventory (bubbles and wands) of $2,000. They maintain an inventory of $2,000 at all times. The bubble stand had an outstanding first year with sales of $25,000. Spongebob reported the bubble stand had a gross margin of 80%, general and administrative expenses were $2,500, and marketing is 10% of sales. The bubble stand paid dividends of $1000 to both Spongebob and Patrick. The firm's tax rate is 25%. a. What are eamings before interest and taxes? b. What is net income? c. What is cash flow from operations? d. What is free cash flow for equity? 2. (10 points) As a recent graduate of Nebraska Wesleyan University you serve as your own financial advisor. You are interested in investing in the soft drink industry, Pepsi or Coca Cola. What has caught your attention is Pepsi has a significant larger return on equity (ROE). For example, Pepsi reported 58.01% return on equity while Coca Cola reported a return on equity of 36.64% as of June 30, 2021, respectively. In addition, Pepsi reported 8.91% return on assets while Coca Cola reported a return on assets of 8.86%, as of June 30, 2021, respectively. However, you are worried about risk. Is Pepsi riskier than Coca Cola? 3. (10 points) The table below includes beginning and ending data for the Dow Jones, NASDAQ, and the S&P 500. You are to find the average annual return for each stock index. If you had $1.000 dollars to invest in each index on January 1, 2016, what would your investment balance be as of December 31, 2020 for each stock index? Index Dow Jones NASDAQ S&P 500 12/31/15 17.823.07 5.00741 2.043.94 12/31/20 30.606.48 12.870.00 3,756.07

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts