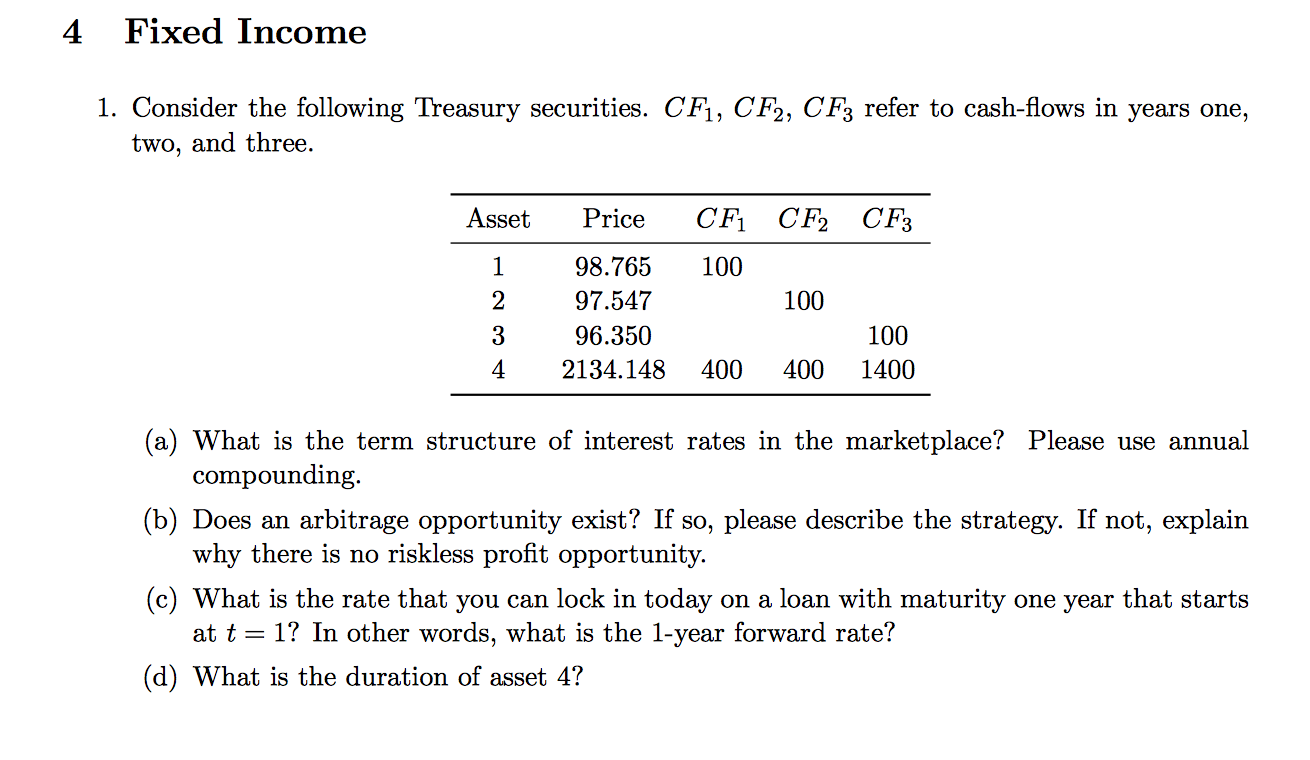

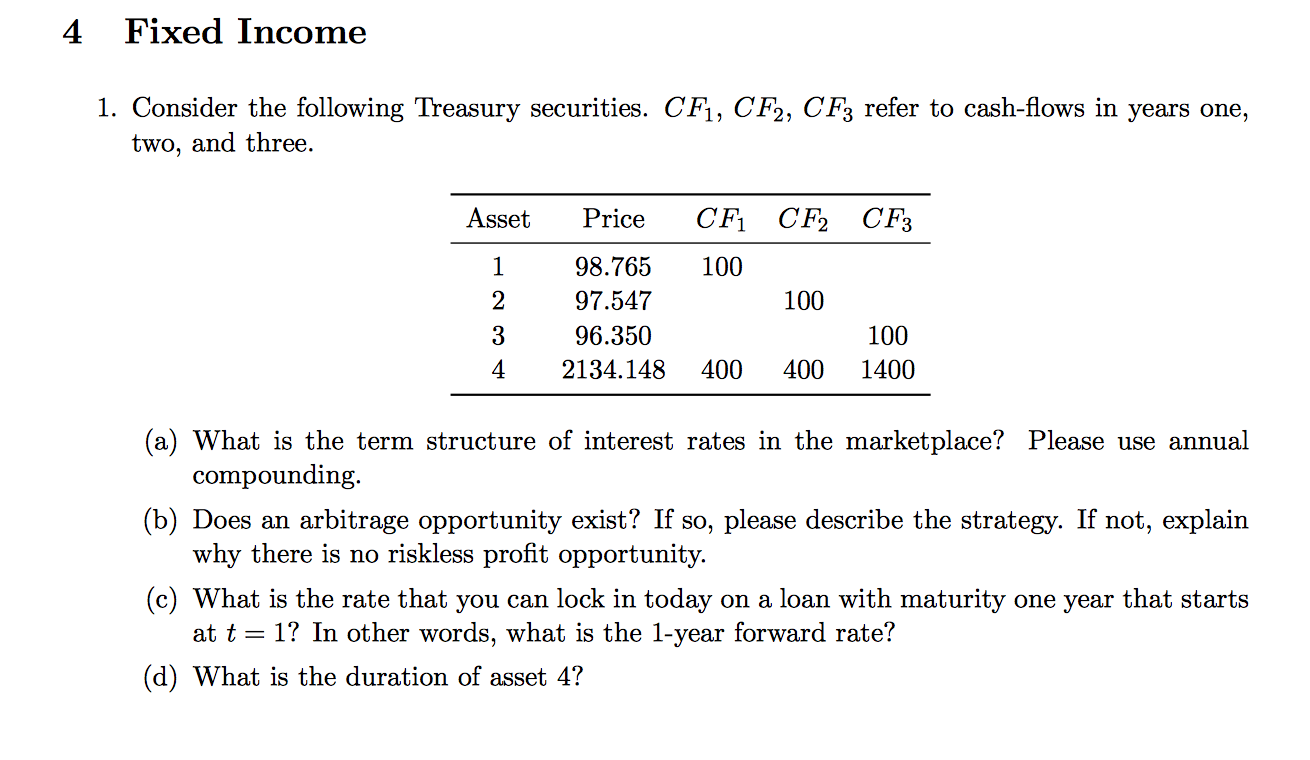

Question: Please answer all questions. 4 Fixed Income 1. Consider the following Treasury securities. CF1, CF2, CF3 refer to cash-flows in years one, two, and three.

Please answer all questions.

4 Fixed Income 1. Consider the following Treasury securities. CF1, CF2, CF3 refer to cash-flows in years one, two, and three. Asset Price CF CF CF3 98.765 100 97.547 100 96.350 100 2134.148 400 400 1400 (a) What is the term structure of interest rates in the marketplace? Please use annual compounding. (b) Does an arbitrage opportunity exist? If so, please describe the strategy. If not, explain why there is no riskless profit opportunity. (c) What is the rate that you can lock in today on a loan with maturity one year that starts at t = 1? In other words, what is the 1-year forward rate? (d) What is the duration of asset 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts