Question: please answer all questions 7 B D 1 2 3 4 -5 6 37 20 Bobby Due Libri Bobby Due Libri is an accounting firm

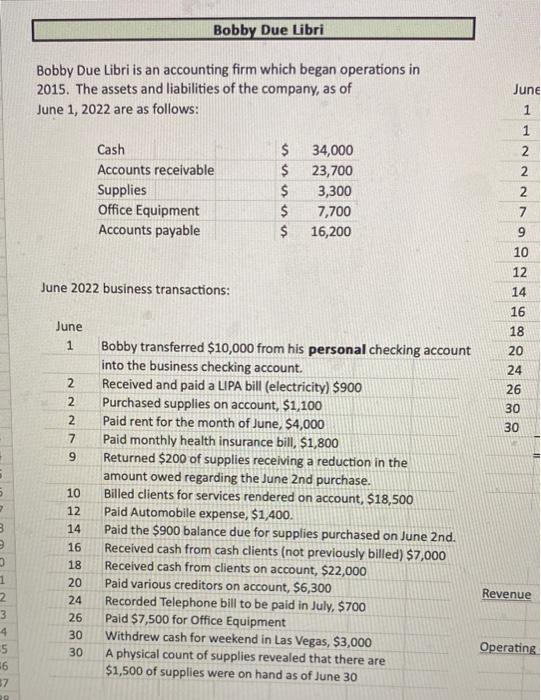

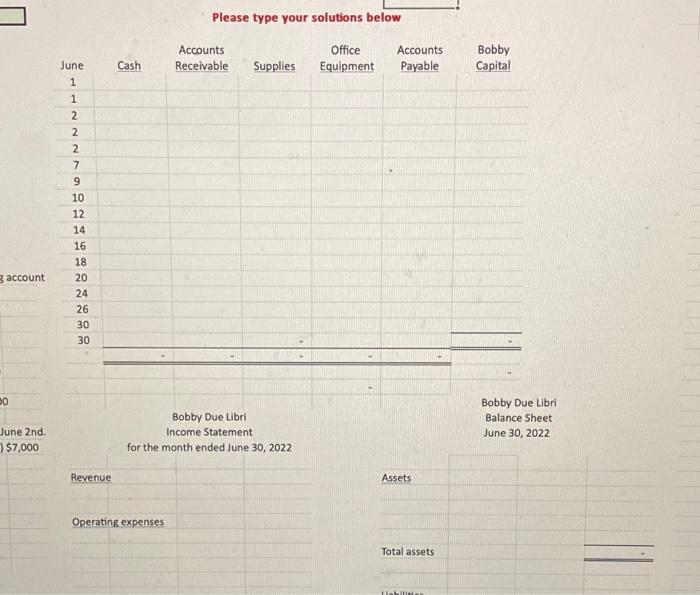

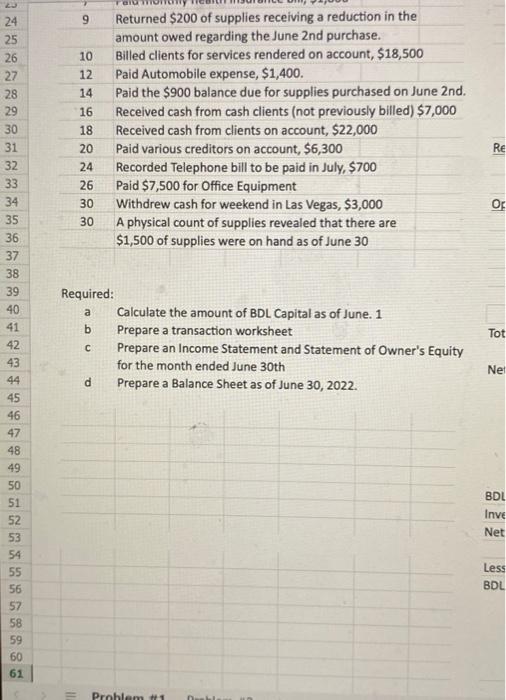

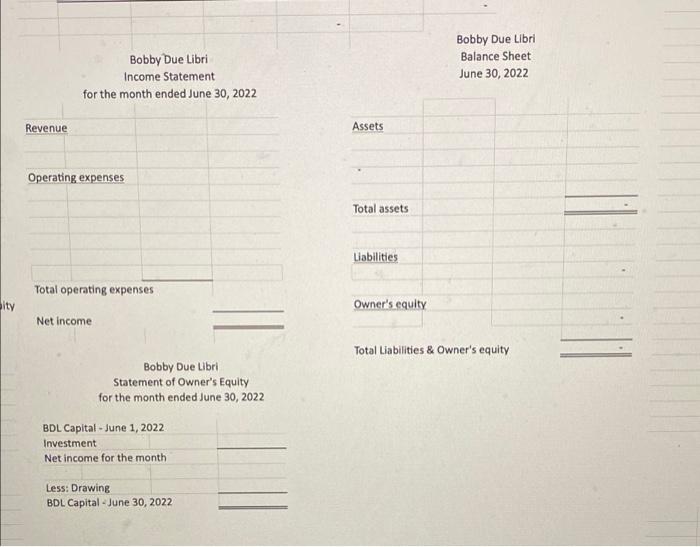

7 B D 1 2 3 4 -5 6 37 20 Bobby Due Libri Bobby Due Libri is an accounting firm which began operations in 2015. The assets and liabilities of the company, as of June 1, 2022 are as follows: Cash $ 34,000 Accounts receivable 23,700 Supplies 3,300 Office Equipment 7,700 Accounts payable 16,200 June 2022 business transactions: June 1 Bobby transferred $10,000 from his personal checking account into the business checking account. 2 Received and paid a LIPA bill (electricity) $900 Purchased supplies on account, $1,100 Paid rent for the month of June, $4,000 Paid monthly health insurance bill, $1,800 Returned $200 of supplies receiving a reduction in the amount owed regarding the June 2nd purchase. Billed clients for services rendered on account, $18,500 Paid Automobile expense, $1,400. 14 Paid the $900 balance due for supplies purchased on June 2nd. 16 Received cash from cash clients (not previously billed) $7,000 Received cash from clients on account, $22,000 20 Paid various creditors on account, $6,300 24 Recorded Telephone bill to be paid in July, $700 26 Paid $7,500 for Office Equipment 30 Withdrew cash for weekend in Las Vegas, $3,000 A physical count of supplies revealed that there are $1,500 of supplies were on hand as of June 30 30 2 2 7 9 10 12 122288 $ $ $ June 7 9 10 12 14 16 18 20 24 26 30 30 Revenue Operating g account 00 June 2nd. $7,000 June 1 1 2 2 2 7 9 10 12 14 16 18 20 24 26 30 30 Cash Please type your solutions below Office Equipment Revenue Operating expenses Accounts Receivable Supplies Bobby Due Libri Income Statement for the month ended June 30, 2022 Accounts Payable Assets Total assets Habilities Bobby Capital Bobby Due Libri Balance Sheet June 30, 2022 4 25 26 27 28 29 30 31 2 33 34 35 36 37 38 39 0 1234456F84550 51 35557 58 59 60 61 24 32 40 47 49 52 54 56 9 Returned $200 of supplies receiving a reduction in the amount owed regarding the June 2nd purchase. 10 Billed clients for services rendered on account, $18,500 12 Paid Automobile expense, $1,400. 14 Paid the $900 balance due for supplies purchased on June 2nd. 16 Received cash from cash clients (not previously billed) $7,000 18 Received cash from clients on account, $22,000 20 Paid various creditors on account, $6,300 24 Recorded Telephone bill to be paid in July, $700 26 Paid $7,500 for Office Equipment 30 Withdrew cash for weekend in Las Vegas, $3,000 30 A physical count of supplies revealed that there are $1,500 of supplies were on hand as of June 30 Required: a Calculate the amount of BDL Capital as of June. 1 Prepare a transaction worksheet C Prepare an Income Statement and Statement of Owner's Equity for the month ended June 30th d Prepare a Balance Sheet as of June 30, 2022. b Problem #1 Re Op Tot Net BDL Inve Net Less BDL ity Bobby Due Libri Income Statement for the month ended June 30, 2022 Revenue Operating expenses Total operating expenses Net income BDL Capital - June 1, 2022 Investment Net income for the month Less: Drawing BDL Capital - June 30, 2022 Bobby Due Libri Statement of Owner's Equity for the month ended June 30, 2022 Bobby Due Libri Balance Sheet June 30, 2022 Assets Total assets Liabilities Owner's equity Total Liabilities & Owner's equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts