Question: please answer all questions All answers rounded to the nearest $10 13. Taxpayer, Donna Dawson, on her 2021 federal income tax return correctly claims her

please answer all questions

All answers rounded to the nearest $10

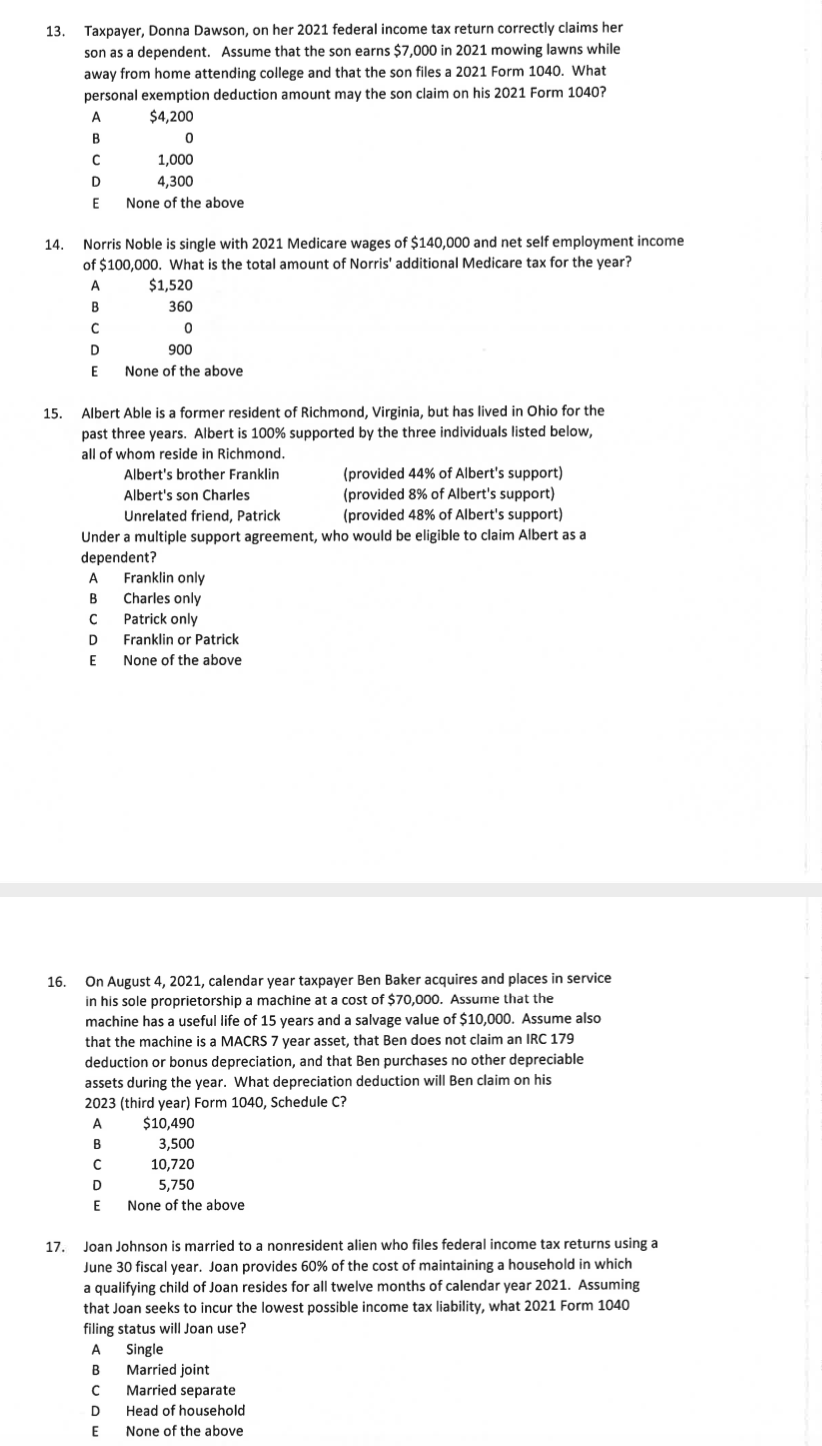

13. Taxpayer, Donna Dawson, on her 2021 federal income tax return correctly claims her son as a dependent. Assume that the son earns $7,000 in 2021 mowing lawns while away from home attending college and that the son files a 2021 Form 1040. What personal exemption deduction amount may the son claim on his 2021 Form 1040? A $4,200 B 0 D 4,300 E None of the above 1,000 14. Norris Noble is single with 2021 Medicare wages of $140,000 and net self employment income of $100,000. What is the total amount of Norris' additional Medicare tax for the year? A $1,520 B 360 0 D 900 E None of the above 15. Albert Able is a former resident of Richmond, Virginia, but has lived in Ohio for the past three years. Albert is 100% supported by the three individuals listed below, all of whom reside in Richmond. Albert's brother Franklin (provided 44% of Albert's support) Albert's son Charles (provided 8% of Albert's support) Unrelated friend, Patrick (provided 48% of Albert's support) Under a multiple support agreement, who would be eligible to claim Albert as a dependent? Franklin only B Charles only C Patrick only D Franklin or Patrick E E None of the above 16. On August 4, 2021, calendar year taxpayer Ben Baker acquires and places in service in his sole proprietorship a machine at a cost of $70,000. Assume that the machine has a useful life of 15 years and a salvage value of $10,000. Assume also that the machine is a MACRS 7 year asset, that Ben does not claim an IRC 179 deduction or bonus depreciation, and that Ben purchases no other depreciable assets during the year. What depreciation deduction will Ben claim on his 2023 (third year) Form 1040, Schedule C? $10,490 B 3,500 C 10,720 D E None of the above 5,750 17. Joan Johnson is married to a nonresident alien who files federal income tax returns using a a June 30 fiscal year. Joan provides 60% of the cost of maintaining a household in which a qualifying child of Joan resides for all twelve months of calendar year 2021. Assuming that Joan seeks to incur the lowest possible income tax liability, what 2021 Form 1040 filing status will Joan use? A Single B Married joint Married separate D Head of household E None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts