Question: please answer all questions All answers rounded to the nearest $10 18. Chris Crone (age 67) is married, but will file as married separate. Assume

please answer all questions

All answers rounded to the nearest $10

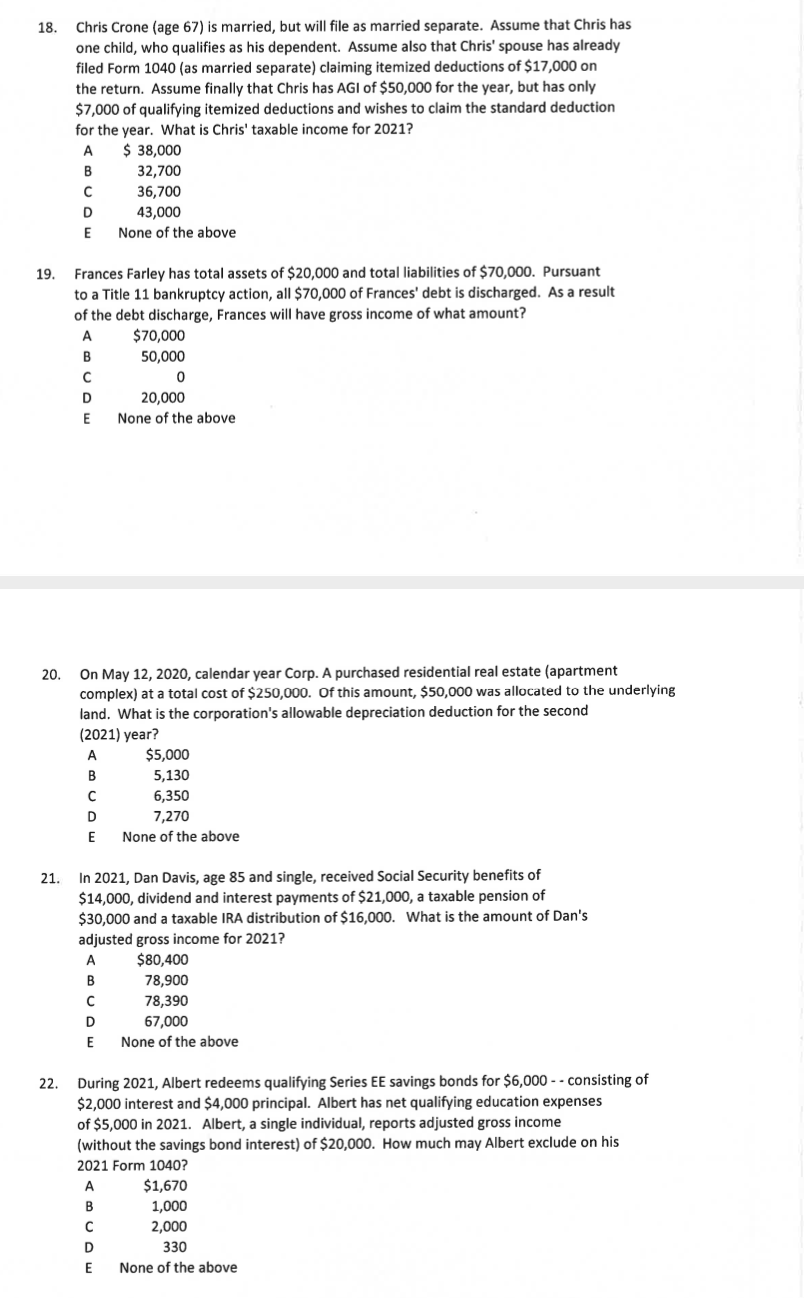

18. Chris Crone (age 67) is married, but will file as married separate. Assume that Chris has one child, who qualifies as his dependent. Assume also that Chris' spouse has already filed Form 1040 (as married separate) claiming itemized deductions of $17,000 on the return. Assume finally that Chris has AGI of $50,000 for the year, but has only $7,000 of qualifying itemized deductions and wishes to claim the standard deduction for the year. What is Chris' taxable income for 2021? $ 38,000 B 32,700 36,700 D 43,000 E None of the above 19. Frances Farley has total assets of $20,000 and total liabilities of $70,000. Pursuant to a Title 11 bankruptcy action, all $ 70,000 of Frances' debt is discharged. As a result of the debt discharge, Frances will have gross income of what amount? A $70,000 B 50,000 0 D D 20,000 E E None of the above 20. On May 12, 2020, calendar year Corp. A purchased residential real estate (apartment complex) at a total cost of $250,000. Of this amount, $50,000 was allocated to the underlying land. What is the corporation's allowable depreciation deduction for the second (2021) year? A $5,000 B 5,130 6,350 D 7,270 E None of the above 21. In 2021, Dan Davis, age 85 and single, received Social Security benefits of $14,000, dividend and interest payments of $21,000, a taxable pension of $30,000 and a taxable IRA distribution of $16,000. What is the amount of Dan's a adjusted gross income for 2021? A $80,400 B B 78,900 78,390 D 67,000 E None of the above 22. During 2021, Albert redeems qualifying Series EE savings bonds for $6,000 -- consisting of $2,000 interest and $4,000 principal. Albert has net qualifying education expenses of $5,000 in 2021. Albert, a single individual, reports adjusted gross income (without the savings bond interest) of $20,000. How much may Albert exclude on his 2021 Form 1040? A $1,670 B 1,000 C 2,000 D 330 E None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts