Question: please answer all questions and state answer clearly. Question 33 (2.5 points) When the appraiser estimates the total rent revenue that the income producing property

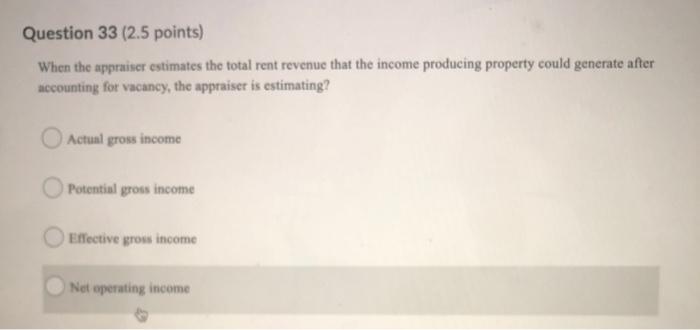

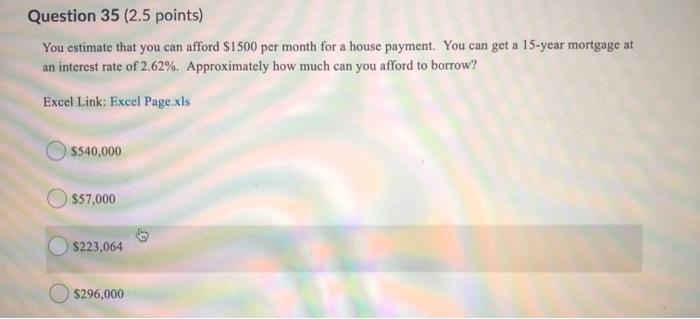

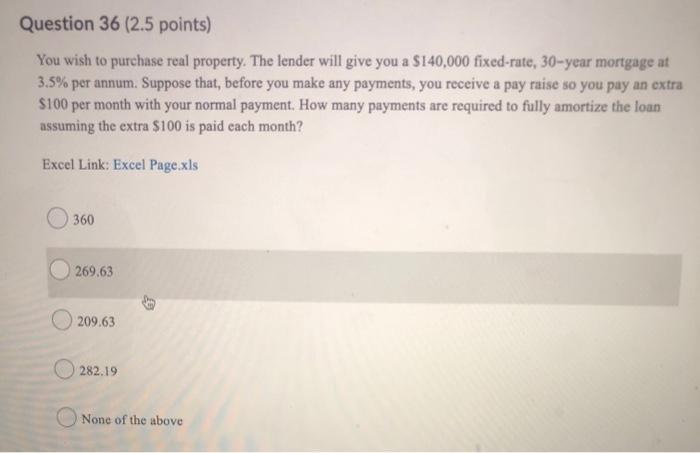

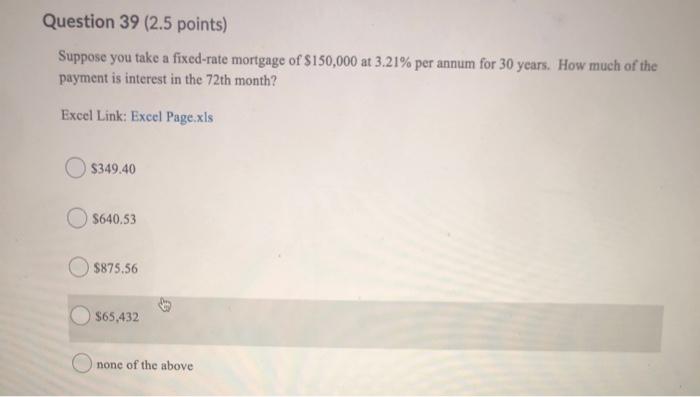

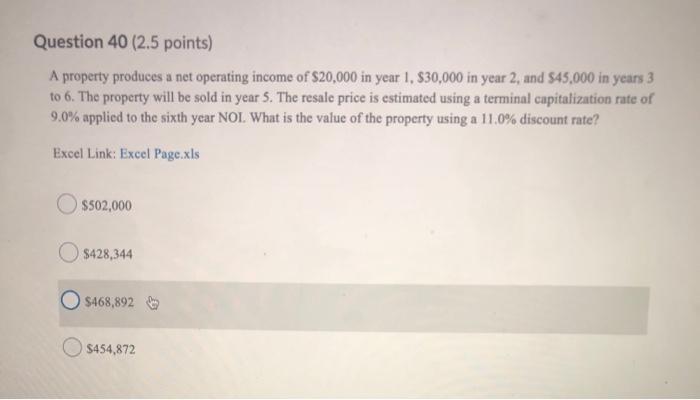

Question 33 (2.5 points) When the appraiser estimates the total rent revenue that the income producing property could generate after accounting for vacancy, the appraiser is estimating? Actual gross income Potential gross income Effective gross income Net operating income Question 35 (2.5 points) You estimate that you can afford $1500 per month for a house payment. You can get a 15-year mortgage at an interest rate of 2.62%. Approximately how much can you afford to borrow? Excel Link: Excel Page xls $540,000 $57,000 $223,064 $296,000 Question 36 (2.5 points) You wish to purchase real property. The lender will give you a $140,000 fixed-rate, 30-year mortgage at 3.5% per annum. Suppose that, before you make any payments, you receive a pay raise so you pay an extra $100 per month with your normal payment. How many payments are required to fully amortize the loan assuming the extra $100 is paid each month? Excel Link: Excel Page.xls 360 269.63 209.63 282.19 None of the above Question 39 (2.5 points) Suppose you take a fixed-rate mortgage of $150,000 at 3.21% per annum for 30 years. How much of the payment is interest in the 72th month? Excel Link: Excel Page.xls $349.40 S640.53 $875.56 $65,432 none of the above Question 40 (2.5 points) A property produces a net operating income of $20,000 in year 1, $30,000 in year 2, and 545,000 in years 3 to 6. The property will be sold in year 5. The resale price is estimated using a terminal capitalization rate of 9.0% applied to the sixth year NOL. What is the value of the property using a 11.0% discount rate? Excel Link: Excel Page.xls O $502,000 S428,344 $468,892 $454,872

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts