Question: please answer all questions Chapter 1: Managerial Accounting and Cost Concepts The below data is for a manufacturing company that makes a single product. The

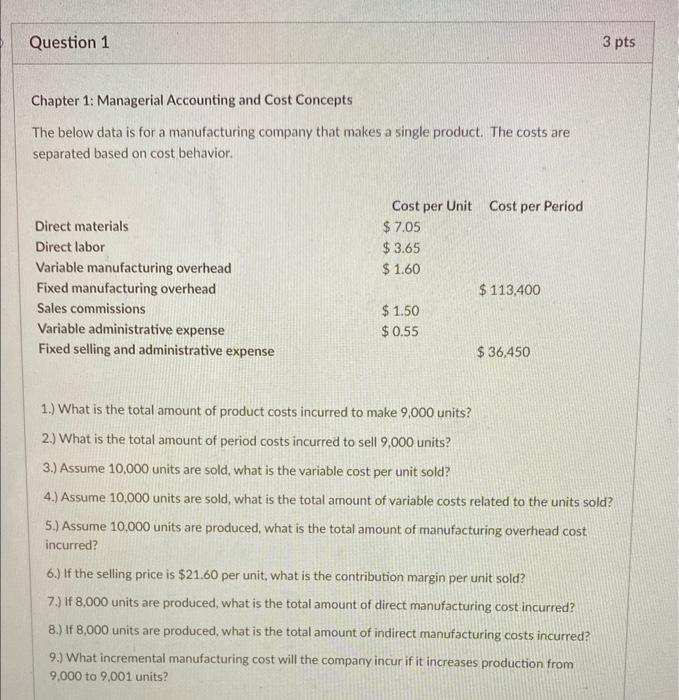

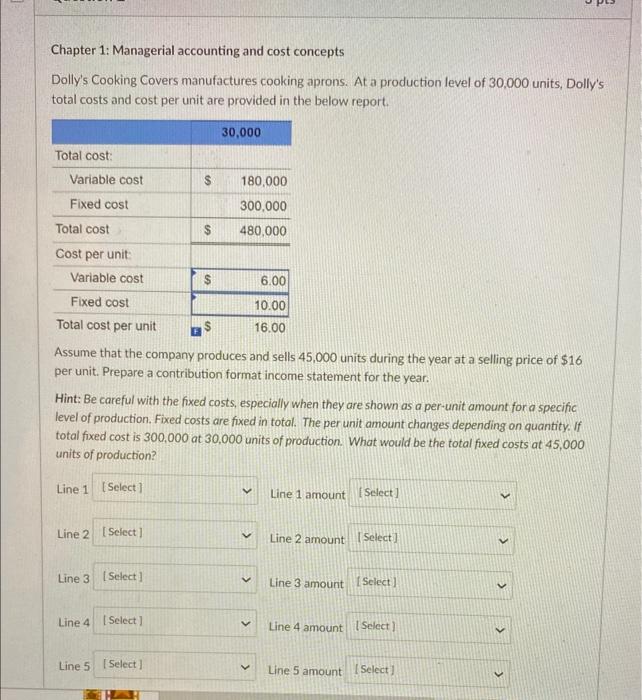

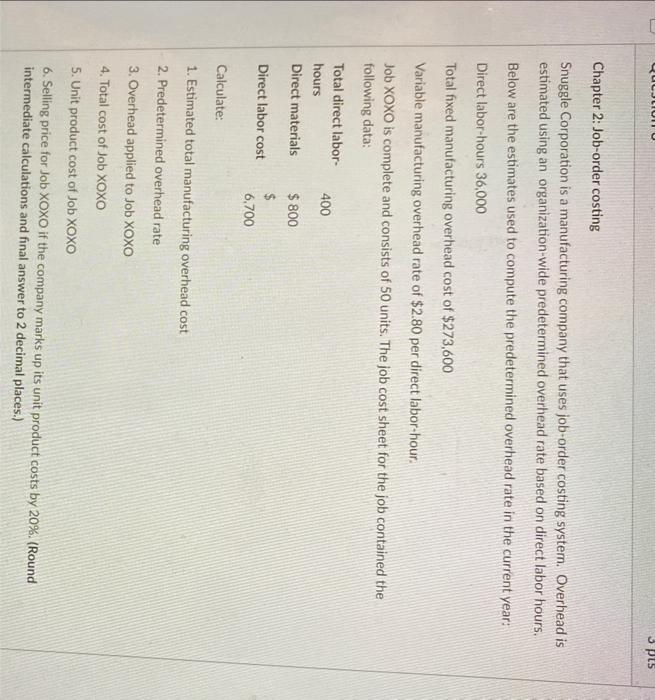

Chapter 1: Managerial Accounting and Cost Concepts The below data is for a manufacturing company that makes a single product. The costs are separated based on cost behavior. 1.) What is the total amount of product costs incurred to make 9,000 units? 2.) What is the total amount of period costs incurred to sell 9,000 units? 3.) Assume 10,000 units are sold, what is the variable cost per unit sold? 4.) Assume 10,000 units are sold, what is the total amount of variable costs related to the units sold? 5.) Assume 10,000 units are produced, what is the total amount of manufacturing overhead cost incurred? 6.) If the selling price is $21.60 per unit, what is the contribution margin per unit sold? 7.) If 8,000 units are produced, what is the total amount of direct manufacturing cost incurred? 8.) If 8,000 units are produced, what is the total amount of indirect manufacturing costs incurred? 9.) What incremental manufacturing cost will the company incur if it increases production from 9,000 to 9,001 units? Chapter 1: Managerial accounting and cost concepts Dolly's Cooking Covers manufactures cooking aprons. At a production level of 30,000 units, Dolly's total costs and cost per unit are provided in the below report. Assume that the company produces and sells 45,000 units during the year at a selling price of $16 per unit. Prepare a contribution format income statement for the year. Hint: Be careful with the fixed costs, especially when they are shown as a per-unit amount for a specific level of production. Fixed costs are fixed in total. The per unit amount changes depending on quantity. If total fixed cost is 300,000 at 30,000 units of production. What would be the total fixed costs at 45,000 units of production? Line 1 Line 1 amount Line 2 Line 2 amount Line 3 Line 3 amount Line 4 Line 4 amount Line 5 Line 5 amount Chapter 2: Job-order costing Snuggle Corporation is a manufacturing company that uses job-order costing system. Overhead is estimated using an organization-wide predetermined overhead rate based on direct labor hours. Below are the estimates used to compute the predetermined overhead rate in the current year: Direct labor-hours 36,000 Total fixed manufacturing overhead cost of $273,600 Variable manufacturing overhead rate of $2.80 per direct labor-hour. Job XOXO is complete and consists of 50 units. The job cost sheet for the job contained the following data: Calculate: 1. Estimated total manufacturing overhead cost 2. Predetermined overhead rate 3. Overhead applied to Job XOXO 4. Total cost of Job XOXO 5. Unit product cost of Job XOXO 6. Selling price for Job XOXO if the company marks up its unit product costs by 20%. (Round intermediate calculations and final answer to 2 decimal places.) Chapter 2: Job-order costing Furrybaugh, a manufacturer of cat products, recently completed Job KingKatBed. Below is data regarding the job. $19,500 direct material, $12,400 direct labor, 800 machine hours, and 550 labor hours. Furrybaugh uses a single plant-wide overhead rate based on labor hours. The overhead rate is $10 per labor hour. Job KingKatBed consisted of 1,000 units. What is cost per unit for Job KingKatBed? What is the total cost for job KingKatBed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts