Question: please answer all questions completely using multiple choice. Company Ford Motor Company International Business Machines Merck Ticker F IBM MRK Beta 2.77 0.73 0.90 If

please answer all questions completely using multiple choice.

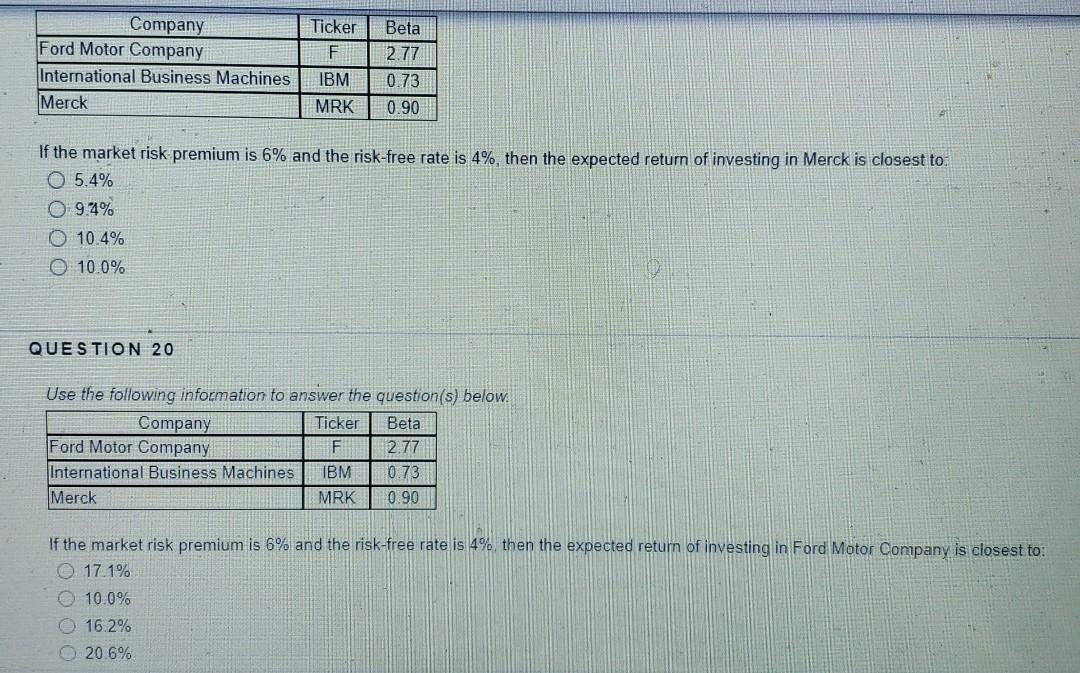

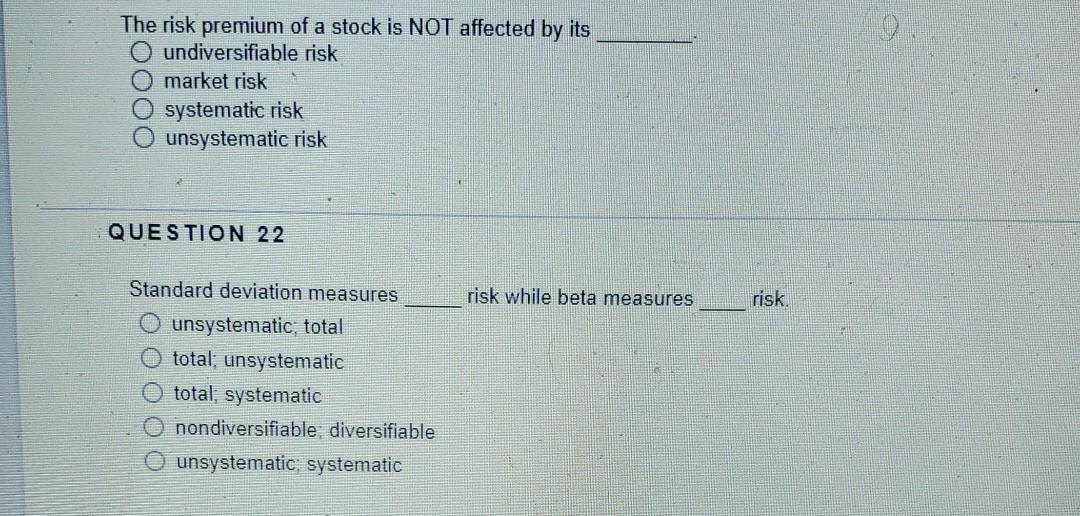

Company Ford Motor Company International Business Machines Merck Ticker F IBM MRK Beta 2.77 0.73 0.90 If the market risk premium is 6% and the risk-free rate is 4%, then the expected return of investing in Merck is closest to O 5.4% 9.4% 10.4% O 10.0% QUESTION 20 Use the following information to answer the question(s) below Company Ticker Beta Ford Motor Company F 2.77 International Business Machines IBM 0.73 Merck MRK 0.90 If the market risk premium is 6% and the risk-free rate is 4% then the expected return of investing in Ford Motor Company is closest to: O 17.1% O 10.0% 16.2% 20.6% The risk premium of a stock is NOT affected by its O undiversifiable risk market risk O systematic risk unsystematic risk QUESTION 22 risk while beta measures risk Standard deviation measures unsystematic, total total: unsystematic total, systematic O nondiversifiable diversifiable unsystematic systematic

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts