Question: please answer all questions completely using multiple choice Suppose that in the coming year, you expect Exxon-Mobil stick to have a volatility of 42% and

please answer all questions completely using multiple choice

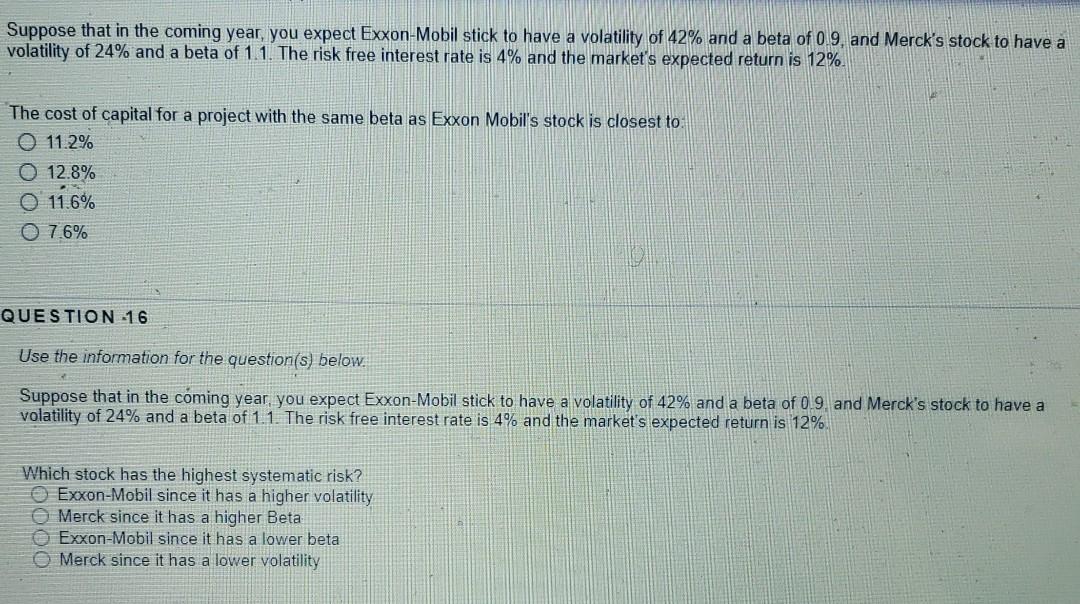

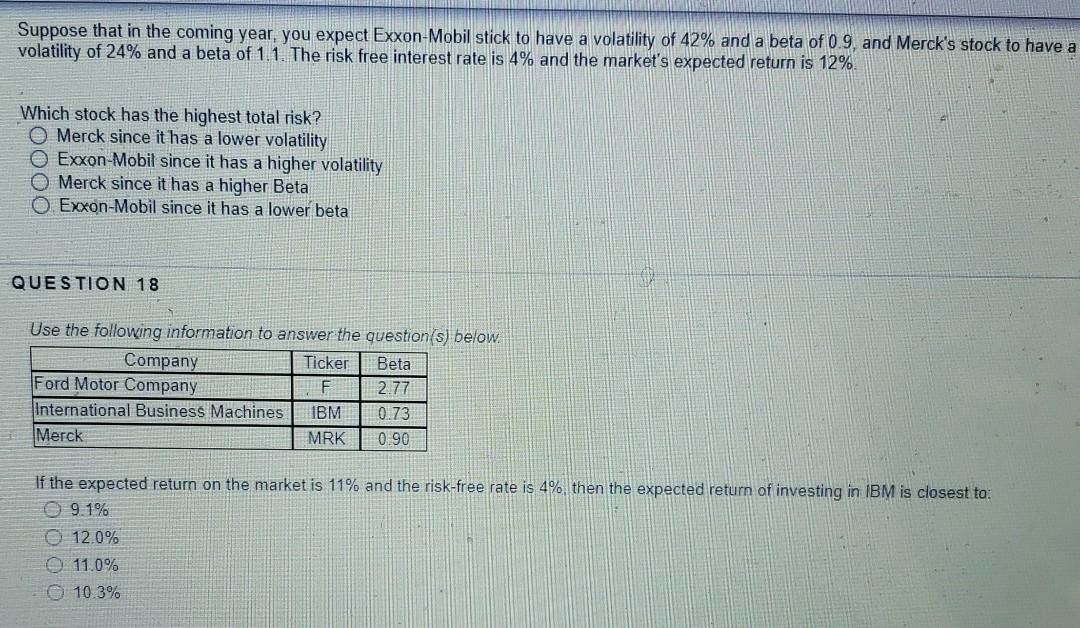

Suppose that in the coming year, you expect Exxon-Mobil stick to have a volatility of 42% and a beta of 0.9, and Merck's stock to have a volatility of 24% and a beta of 1.1. The risk free interest rate is 4% and the market's expected return is 12% The cost of capital for a project with the same beta as Exxon Mobil's stock is closest to O 11.2% O 12.8% 0 11.6% 7.6% QUESTION -16 Use the information for the question(s) below. Suppose that in the coming year, you expect Exxon-Mobil stick to have a volatility of 42% and a beta of 0.9, and Merck's stock to have a volatility of 24% and a beta of 1.1. The risk free interest rate is 4% and the market's expected return is 12% Which stock has the highest systematic risk? Exxon-Mobil since it has a higher volatility Merck since it has a higher Beta Exxon-Mobil since it has a lower beta Merck since it has a lower volatility Suppose that in the coming year, you expect Exxon-Mobil stick to have a volatility of 42% and a beta of 0.9, and Merck's stock to have a volatility of 24% and a beta of 1.1. The risk free interest rate is 4% and the market's expected return is 12% Which stock has the highest total risk? Merck since it has a lower volatility Exxon Mobil since it has a higher volatility Merck since it has a higher Beta O Exxon-Mobil since it has a lower beta QUESTION 18 Use the following information to answer the question(s) below. Company Ticker Beta Ford Motor Company F 2.77 International Business Machines IBM 0.73 Merck MRK 0.90 If the expected return on the market is 11% and the risk-free rate is 4% then the expected return of investing in IBM is closest to 09.1% 12.0% 11.0% 10.3%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts