Question: please answer all questions Consider a world that only consists of the three stocks shown in the following table: . Calculote the tolal yalue of

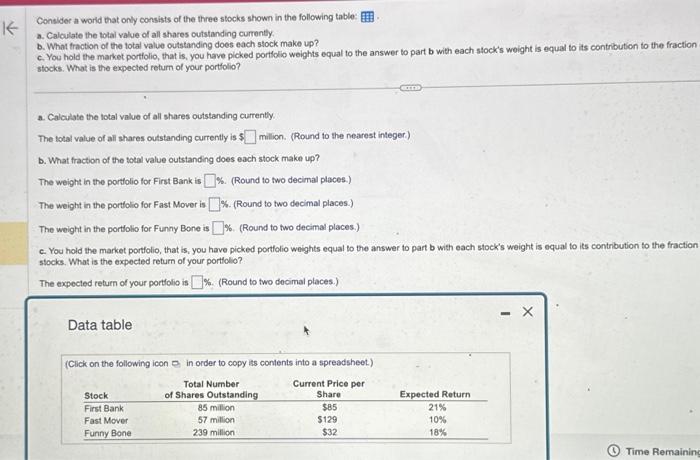

Consider a world that only consists of the three stocks shown in the following table: . Calculote the tolal yalue of all shares cutstanding currently. b. What fraction of the total value outstanding does each stock make up? c. You hold the market portiolio, that is, you have picked porticlio weights equal to the answer to part b with each stock's weight is equal to its contribution to the fraction stocks. What is the expected return of your portfolio? a. Calculate the total value of all shares outstanding currently The total value of all shares outstanding currently is $ million. (Round to the nearest integer.) b. What fraction of the total value outstanding does each stock make up? The weight in the portfolio for First Bank is \%. (Round to two decimal places.) The weight in the portfolio for Fast Mover is \%. (Round to two decimal places.) The weight in the portlolio for Funny Bone is \%. (Round to two decimal places.) c. You hold the market portolio, that is, you havo picked portfolio weights equal to the answer to part b with each stock's weight is equal to its contribution to the fraction stocks. What is the expected return of your porticlio? The expected return of your portfolio is \%. (Round to two docimal places.) Data table (Click on the following icon 8 in order to copy its contents into a spreadsheet) (1) Time Remainin

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts