Question: Please Answer all questions everything needed to answer is in the picture. Thank you Please Answer all questions. all information needed to answer questions are

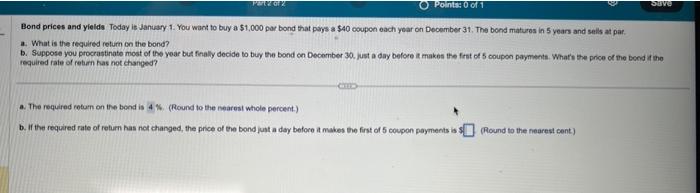

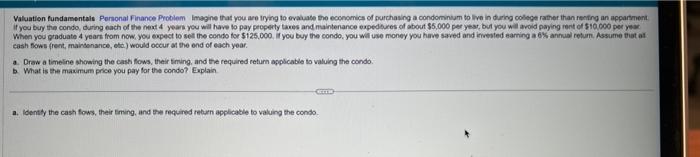

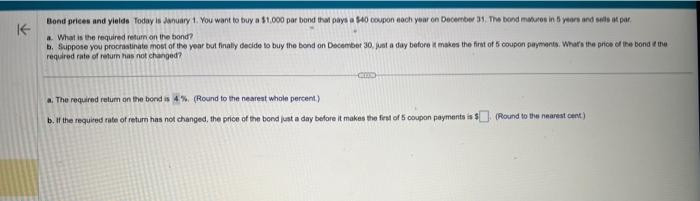

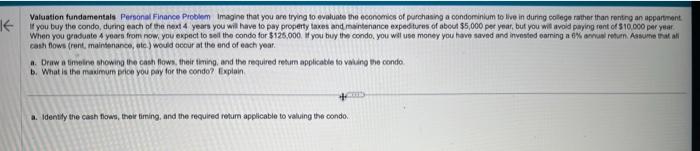

Bond prices and ylelds Today it danuary 1. You want to buy a $1,000 por bond that pays a $40 coupon each year on Deoember 31 . The bond matures in 5 years and sells at par. a. What is the tequired return on the bond? b. Suppose you procrastinate most of the year but fenaly decide to buy the bond cn December 30 . just a day before it makes the fint of 5 coupon payments. Whate the price of the boed it the required rale of retien has not changed? a. The required rotum on the bend is 4% (Round to the nearesi whicie percent.) b. If the required rate of return has net thanged, the price of the bond just a doy before t makes the first of 5 coupon payments is 3 . (Round to the nearest cent) Valuation fundamentale Pononal Finance Problem Imagine that you are irying to evaluate the economics of purchasing a condominum to live in dering colege rather than renting an apparsient If you buy the condo, during each of the next 4 years you will have to pay propety takes and maintenance expedsures of about 35,000 per yest, bul you will aroid paying rent ef 510.000 per year When you graduate 4 years from now, you expect to set the condo tor $125,000. fyou buy the condo, you wit use money you have sared and invested eaming a b\% annual rehum. Assume thet af cash fows (rent, maincenance, etc) would occur at the end of each year. a. Draw a timeine showing the cash flows, their timing, and the required return acplicable to valuing the condo. b. What is the maxmum price you pay for the condo? Eaplan a. Idently the cash fows, their timing, and the required return applicable to valuing the conso. Eond priees and yieids. Today is Jahuary 1. You want to buy a 11,000 par bond that pays a 340 coupon noch year on Deceented 31 , The bond makures in 5 years and sells at par. a. What is the required return on the bond? b. Suppose you procrastinate most of the year but finaty decide to buy the bond on Decenbet 30 , fust a day before it makes the first of 5 coupon payments. Whars the price of ifen bond it thei required rate of return has not changed? a. The required retum on the bond is 4%. (Round to the nearest whole percent) b. If the requied rate of return has not changed, the price of the bond just a day belore it makes the fers of 5 coupon payments is $ (Round to the nearest cent) casth fows (runt, maintenance, atc.) wovid becur at the end of each year. a. Driw a timeirie showing the cash flows. their timing. and tho requited resim applicable to vatimg the conde b. What is the masimum price you pay for the condo? Ixpiain. Bond prices and ylelds Today it danuary 1. You want to buy a $1,000 por bond that pays a $40 coupon each year on Deoember 31 . The bond matures in 5 years and sells at par. a. What is the tequired return on the bond? b. Suppose you procrastinate most of the year but fenaly decide to buy the bond cn December 30 . just a day before it makes the fint of 5 coupon payments. Whate the price of the boed it the required rale of retien has not changed? a. The required rotum on the bend is 4% (Round to the nearesi whicie percent.) b. If the required rate of return has net thanged, the price of the bond just a doy before t makes the first of 5 coupon payments is 3 . (Round to the nearest cent) Valuation fundamentale Pononal Finance Problem Imagine that you are irying to evaluate the economics of purchasing a condominum to live in dering colege rather than renting an apparsient If you buy the condo, during each of the next 4 years you will have to pay propety takes and maintenance expedsures of about 35,000 per yest, bul you will aroid paying rent ef 510.000 per year When you graduate 4 years from now, you expect to set the condo tor $125,000. fyou buy the condo, you wit use money you have sared and invested eaming a b\% annual rehum. Assume thet af cash fows (rent, maincenance, etc) would occur at the end of each year. a. Draw a timeine showing the cash flows, their timing, and the required return acplicable to valuing the condo. b. What is the maxmum price you pay for the condo? Eaplan a. Idently the cash fows, their timing, and the required return applicable to valuing the conso. Eond priees and yieids. Today is Jahuary 1. You want to buy a 11,000 par bond that pays a 340 coupon noch year on Deceented 31 , The bond makures in 5 years and sells at par. a. What is the required return on the bond? b. Suppose you procrastinate most of the year but finaty decide to buy the bond on Decenbet 30 , fust a day before it makes the first of 5 coupon payments. Whars the price of ifen bond it thei required rate of return has not changed? a. The required retum on the bond is 4%. (Round to the nearest whole percent) b. If the requied rate of return has not changed, the price of the bond just a day belore it makes the fers of 5 coupon payments is $ (Round to the nearest cent) casth fows (runt, maintenance, atc.) wovid becur at the end of each year. a. Driw a timeirie showing the cash flows. their timing. and tho requited resim applicable to vatimg the conde b. What is the masimum price you pay for the condo? Ixpiain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts