Question: PLEASE ANSWER ALL QUESTIONS FOR THUMBS UP QUESTION 1 3 points Save Answer A $1 million jumbo CD is quoting a 3.5% annual interest rate

PLEASE ANSWER ALL QUESTIONS FOR THUMBS UP

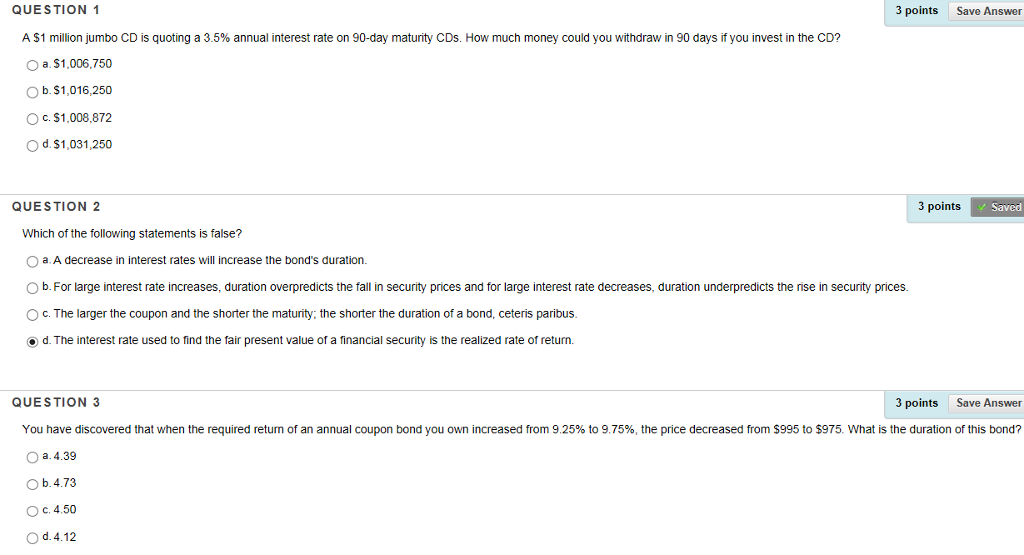

QUESTION 1 3 points Save Answer A $1 million jumbo CD is quoting a 3.5% annual interest rate on 90-day maturity CDs. How much money could you withdraw in 90 days if you invest in the CD? 0 a. $1,006,750 O b. $1,016,250 O c. $1,008,872 O d. S1,031,250 QUESTION 2 3 points saved Which of the following statements is false? O a. A decrease in interest rates will increase the bond's duration O b. For large interest rate increases, duration overpredicts the fall in security prices and for large interest rate decreases, duration underpredicts the rise in security prices. O c. The larger the coupon and the shorter the maturity, the shorter the duration of a bond, ceteris paribus o d. The interest rate used to find the fair present value of a financial security is the realized rate of return. QUESTION 3 3 points Save Answer You have discovered that when the required return of an annual coupon bond you own increased from 9.25% to 9.75%, the price decreased from $995 to $975 what is the duration of this bond? O a. 4.39 b, 4.73 O c. 4.50 O d.4.12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts