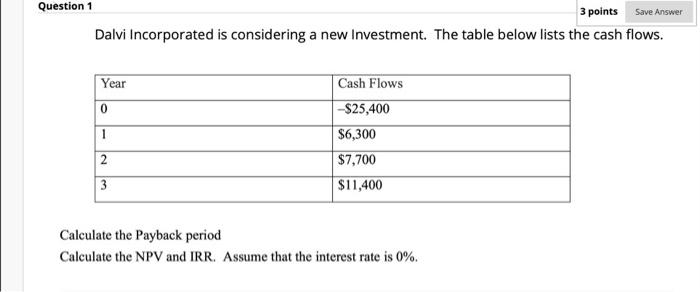

Question: Question 1 3 points Save Answer Dalvi Incorporated is considering a new Investment. The table below lists the cash flows. Year 0 Cash Flows -$25,400

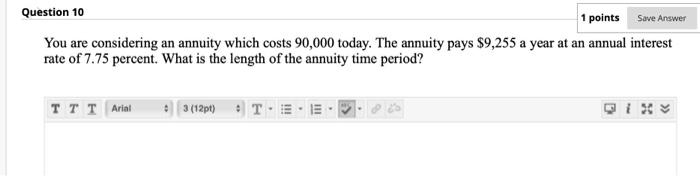

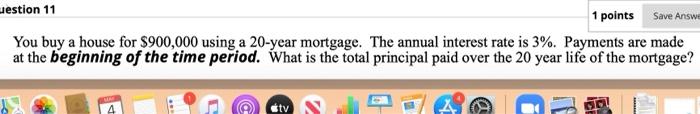

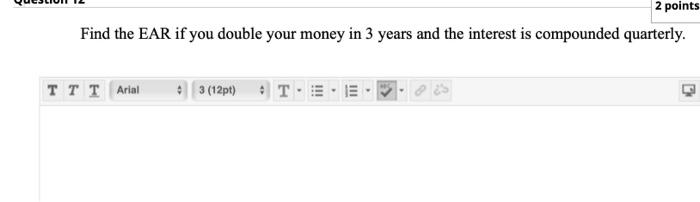

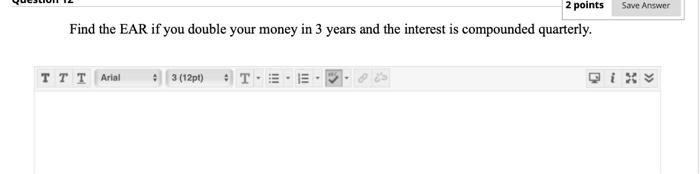

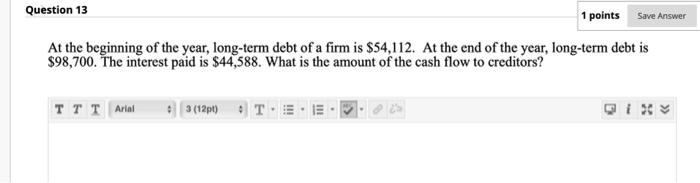

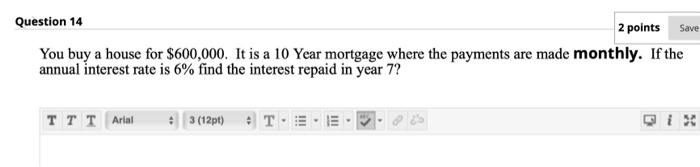

Question 1 3 points Save Answer Dalvi Incorporated is considering a new Investment. The table below lists the cash flows. Year 0 Cash Flows -$25,400 $6,300 $7,700 1 2 3 $11,400 Calculate the Payback period Calculate the NPV and IRR. Assume that the interest rate is 0%. Question 2 2 points Save Answer Find R if the Dividend in Year 1 is $3; the price of the stock is $37.87 and the dividend grows annually at 2% each year forever. TTT Arial 3 (12pt) HTE Question 3 2 points Save Answer You make monthly payments at the beginning of each month that grow at a constant rate of 0.6% each month for the next 246 months. If the first payment is $20 and the interest rate is 0.7% each month; find the PV of this growing annuity. TTT Arial 43 (12p) T. Question 4 1 points Save Answer You want to invest in a project that costs $4125. The initial (Date 0) CF of the project is $75 which will grow at 10% each year forever. If the interest rate is 12% find the NPV of this project? TTT Arial Questions 2 points Save Answer You sign a contract for annual payments of S35 each year for the next 8 years. There is a signing bonus of $40 and a balloon payment of $95. What is the value of the contract if the interest rate is 12%? Font TITAN (12pt) TTTT Paragraph - Font tam %DOO Si Mashup Save An Question 7 1 points ABC has 12 percent coupon bonds on the market with 13 years left to maturity. The bonds make annual payments and currently sell for $1257.8765. What is the market interest rate (YTM)? TTT Ariel 3(12pt) T Question 8 1 points Save Answer ABC purchased a piece of property for $2,000,000. The loan terms require monthly payments at the beginning of each month for 30 years at an annual percentage rate of 6 percent. What is the amount of each mortgage payment? TTT Arlat 3 (12pt) T Save Answer Question 9 1 points The FV of an annuity where payments are made at the beginning of the year is $6,456 and the FV of an annuity where payments are made at the end of the year is $5946. If the annuity is for 5 years; find the interest rate. TTT Arint 3 (12pt) T TTTT Paragraph - Font size T'T Font fam Question 10 1 points Save Answer You are considering an annuity which costs 90,000 today. The annuity pays $9,255 a year at an annual interest rate of 7.75 percent. What is the length of the annuity time period? TTT Arial + 3(12pt) T uestion 11 1 points Save Answe You buy a house for $900,000 using a 20-year mortgage. The annual interest rate is 3%. Payments are made at the beginning of the time period. What is the total principal paid over the 20 year life of the mortgage? 2 points Find the EAR if you double your money in 3 years and the interest is compounded quarterly. TTT Arial 3 (12pt) T. Save Answer 2 points Find the EAR if you double your money in 3 years and the interest is compounded quarterly. TTT Arial 43 (12pt) . T. Question 13 1 points Save Answer At the beginning of the year, long-term debt of a firm is $54,112. At the end of the year, long-term debt is $98,700. The interest paid is $44,588. What is the amount of the cash flow to creditors? Arial 43 (121) T Save Question 14 2 points You buy a house for $600,000. It is a 10 Year mortgage where the payments are made monthly. If the annual interest rate is 6% find the interest repaid in year 7? TTT Artal 3 (12pt) T

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts