Question: please answer all questions im checking my homework 2a. you have 8000$ to invest. MCD is selling at 100$ per share. You want to buy

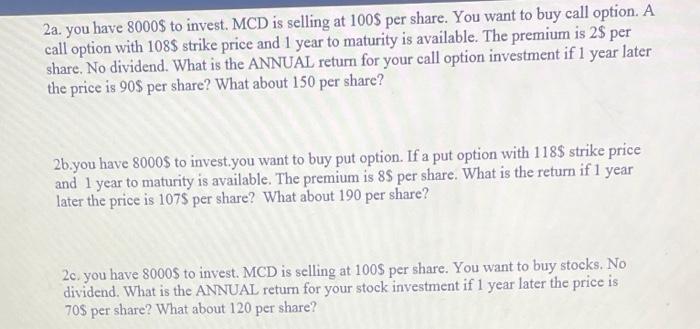

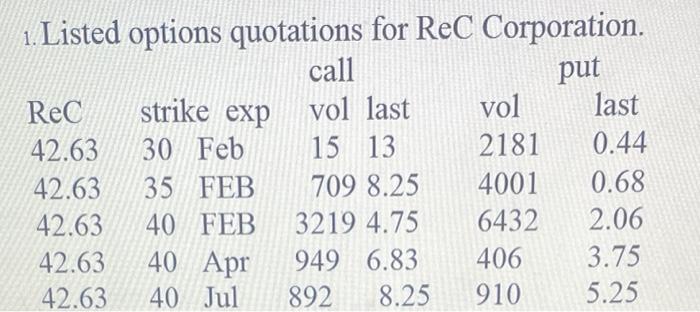

2a. you have 8000$ to invest. MCD is selling at 100$ per share. You want to buy call option. A call option with 108$ strike price and 1 year to maturity is available. The premium is 2$ per share. No dividend. What is the ANNUAL return for your call option investment if 1 year later the price is 90$ per share? What about 150 per share? 2 b.you have 80005 to invest.you want to buy put option. If a put option with 118$ strike price and 1 year to maturity is available. The premium is 85 per share. What is the return if 1 year later the price is 1075 per share? What about 190 per share? 2c you have 80005 to invest. MCD is selling at 100S per share. You want to buy stocks. No dividend. What is the ANNUAL return for your stock investment if 1 year later the price is 70 s per share? What about 120 per share? 1.Listed options quotations for ReC Corporation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts