Question: please answer all questions or dont answer at all 36. The in the balance sheet are listed in the order in which they must be

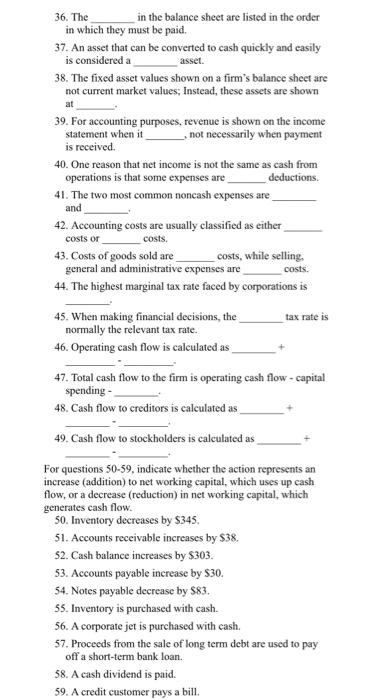

36. The in the balance sheet are listed in the order in which they must be paid. 37. An asset that can be converted to cash quickly and casily is considered a asset. 38. The fixed asset values shown on a firm's balance sheet are not current market values; Instead, these assets are shown at 39. For accounting purposes, revenue is shown on the income statement when it , not necessarily when payment is received. 40. One reason that net income is not the same as cash from operations is that some expenses are deductions. 41. The two most common noncash expenses are and 42. Accounting costs are usually classified as either costs or costs. 43. Costs of goods sold are costs, while selling. general and administrative expenses are costs. 44. The highest marginal tax rate faced by corporations is 45. When making financial decisions, the tax rate is normally the relevant tax rate. 46. Operating cash flow is calculated as 47. Total cash flow to the firm is operating cash flow - capital spending - 48. Cash flow to creditors is calculated as 49. Cash flow to stockholders is calculated as For questions 50-59, indicate whether the action represents an increase (addition) to net working capital, which uses up cash flow, or a decrease (reduction) in net working capital, which generates cash flow. 50. Inventory decreases by $345. 51. Accounts receivable increases by $38. 52. Cash balance increases by $303. 53. Accounts payable increase by $30. 54. Notes payable decrease by $83. 55. Inventory is purchased with cash. 56. A corporate jet is purchased with cash. 57. Proceeds from the sale of long term debt are used to pay off a short-term bank loan. 58. A cash dividend is paid. 59. A credit customer pays a bill

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts