Question: Please answer all questions or don't anwaser! THANK YOU! Problem 11.24 The Imaginary Products Co. currently has debt with a market value of $300 million

Please answer all questions or don't anwaser! THANK YOU!

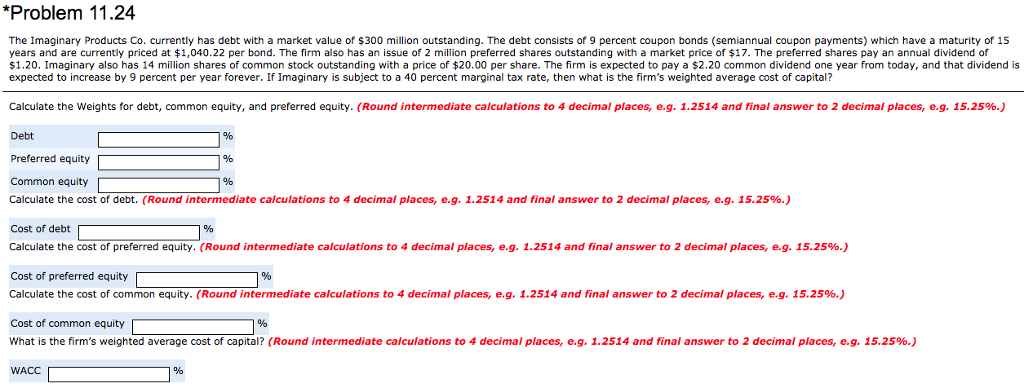

Problem 11.24 The Imaginary Products Co. currently has debt with a market value of $300 million outstanding. The debt consists of 9 percent coupon bonds (semiannual coupon payments) which have a maturity of 15 years and are currently priced at $1,040.22 per bond. The firm also has an issue of 2 million preferred shares outstanding with a market price of $17. The preferred shares pay an annual dividend of $1.20. Imaginary also has 14 million shares of common stock outstanding with a price of $20.00 per share. The firm is expected to pay a $2.20 common dividend one year from today, and that dividend is expected to increase by 9 percent per year forever. If Imaginary is subject to a 40 percent marginal tax rate, then what is the firm's weighted average cost of capital? calculate the weights for debt, common equity and preferred equity Round intermediate calculations to 4 dec a Pla es, e 9-1.2514 and fi lan ve t 2 decima places e 9-15 2596 Debt Preferred equity Common equity Calculate the cost of debt. (Round intermediate calculations to 4 decimal places, e.g. 1.2514 and final answer to 2 decimal places, e.g. 15.25%.) Cost of debt Calculate the cost of preferred equity. (Round intermediate calculations to 4 decimal places, eg. 1.2514 and final answer to 2 decimal places, e.g. 15.25%.) Cost of preferred equity [ Calculate the cost of common equity Round intermediate calculations to 4 decimal places, e g 1.2514 and final answer to 2 decimal places, e g. 15.25% .) cost of common equity What is the firm's weighted average cost of capital? (Round intermediate calculations to 4 decimal places, e.g. 1.2514 and final answer to 2 decimal places, eg, 15.25%.) WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts