Question: please answer all questions!! please state if its in millions!!!!! do not just write decimals Q4-06 are based on the following information In the year

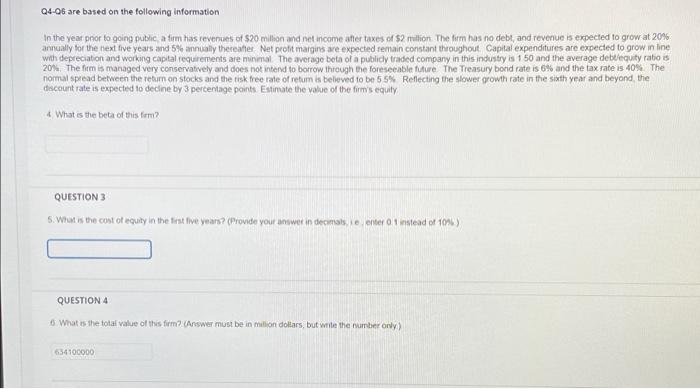

Q4-06 are based on the following information In the year prior to going public, a firm has revenues of $20 million and net income after taxes of $2 million. The firm has no debt, and revenue is expected to grow at 20% annually for the next five years and 5% annually thereafter. Net profit margins are expected remain constant throughout Capital expenditures are expected to grow in line with depreciation and working capital requirements are minimal. The average beta of a publicly traded company in this industry is 150 and the average debt/equity ratio is 20%. The firm is managed very conservatively and does not intend to borrow through the foreseeable future. The Treasury bond rate is 6% and the tax rate is 40%. The normal spread between the return on stocks and the risk free rate of retum is believed to be 5.5% Reflecting the slower growth rate in the sixth year and beyond, the discount rate is expected to decline by 3 percentage points. Estimate the value of the firm's equity 4 What is the beta of this firm? QUESTION 3 5. What is the cost of equity in the first five years? (Provide your answer in decimals, ie, enter 0.1 instead of 10%) QUESTION 4 6. What is the total value of this firm? (Answer must be in million dollars, but write the number only) 634100000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts