Question: Please answer all questions Problems (80 Points- You must show your calculations to receive full credit) 11, Tanya is in the 15% tax bracket. She

Please answer all questions

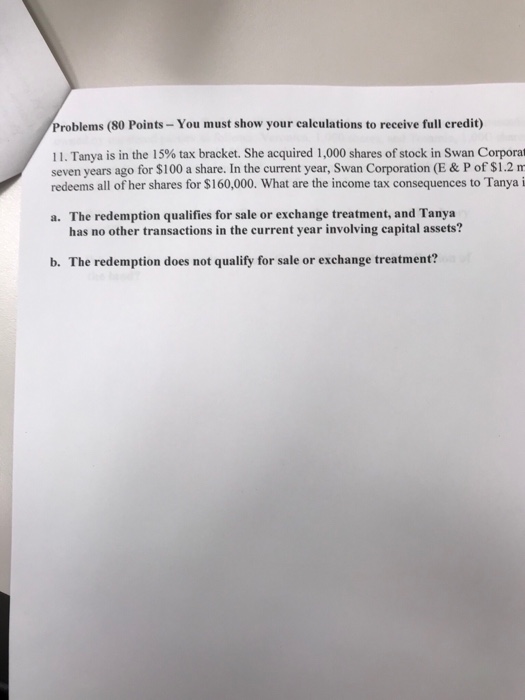

Please answer all questions Problems (80 Points- You must show your calculations to receive full credit) 11, Tanya is in the 15% tax bracket. She acquired 1,000 shares of stock in Swan Corpora seven years ago for $100 a share. In the current year, Swan Corporation (E & P of $1.2 m redeems all of her shares for $160,000. What are the income tax consequences to Tanya i a. The redemption qualifies for sale or exchange treatment, and Tanya has no other transactions in the current year involving capital assets? b. The redemption does not qualify for sale or exchange treatment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts