Question: PLEASE ANSWER ALL QUESTIONS USING HP12C FINANCIAL CALCULATOR AND EXPLAIN. WILL LIKE. THANK YOU A 15 year, $1,000 par value bond has a 6% coupon

PLEASE ANSWER ALL QUESTIONS USING HP12C FINANCIAL CALCULATOR AND EXPLAIN. WILL LIKE. THANK YOU

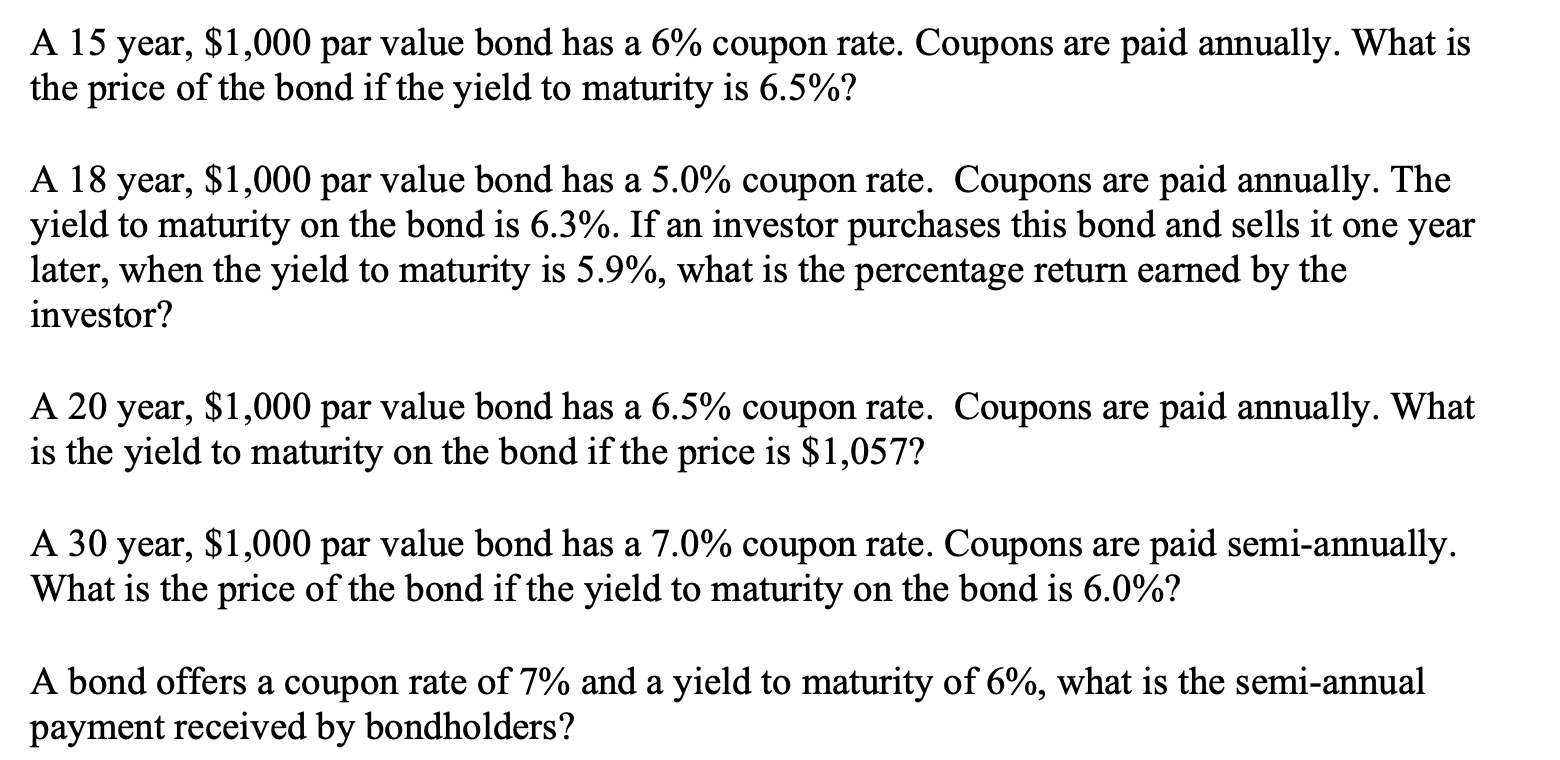

A 15 year, $1,000 par value bond has a 6% coupon rate. Coupons are paid annually. What is the price of the bond if the yield to maturity is 6.5% ? A 18 year, $1,000 par value bond has a 5.0\% coupon rate. Coupons are paid annually. The yield to maturity on the bond is 6.3%. If an investor purchases this bond and sells it one year later, when the yield to maturity is 5.9%, what is the percentage return earned by the investor? A 20 year, $1,000 par value bond has a 6.5% coupon rate. Coupons are paid annually. What is the yield to maturity on the bond if the price is $1,057 ? A 30 year, $1,000 par value bond has a 7.0% coupon rate. Coupons are paid semi-annually. What is the price of the bond if the yield to maturity on the bond is 6.0% ? A bond offers a coupon rate of 7% and a yield to maturity of 6%, what is the semi-annual payment received by bondholders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts