Question: Please answer all questions. will thumbs up if right! 32. The market price of a $1000 par value, semi-annual payment bond is $956.76. If this

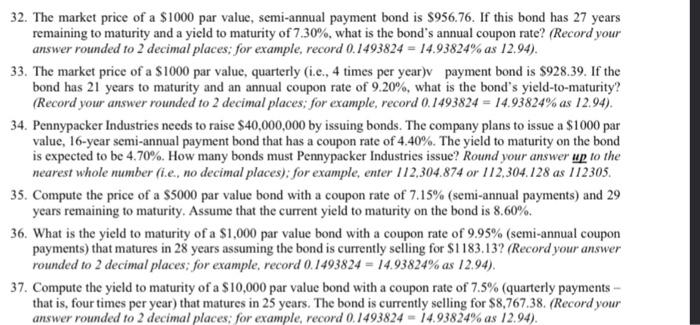

32. The market price of a $1000 par value, semi-annual payment bond is $956.76. If this bond has 27 years remaining to maturity and a yield to maturity of 7.30%, what is the bond's annual coupon rate? (Record your answer rounded to 2 decimal places; for example, record 0.1493824=14.93824% as 12.94 ). 33. The market price of a $1000 par value, quarterly (i.e., 4 times per year)v payment bond is $928.39. If the bond has 21 years to maturity and an annual coupon rate of 9.20%, what is the bond's yield-to-maturity? (Record your answer rounded to 2 decimal places; for example, record 0.1493824=14.93824% as 12.94 ). 34. Pennypacker Industries needs to raise $40,000,000 by issuing bonds. The company plans to issue a $1000 par value, 16-year semi-annual payment bond that has a coupon rate of 4.40%. The yield to maturity on the bond is expected to be 4.70%. How many bonds must Pennypacker Industries issue? Round your answer 1p to the nearest whole number (i.e, no decimal places); for example, enter 112,304.874 or 112,304.128 as 112305 . 35. Compute the price of a $5000 par value bond with a coupon rate of 7.15% (semi-annual payments) and 29 years remaining to maturity. Assume that the current yield to maturity on the bond is 8.60%. 36. What is the yield to maturity of a $1,000 par value bond with a coupon rate of 9.95% (semi-annual coupon payments) that matures in 28 years assuming the bond is currently selling for $1183.13 ? (Record your answer rounded to 2 decimal places; for example, record 0.1493824=14.93824% as 12.94 ). 37. Compute the yield to maturity of a $10,000 par value bond with a coupon rate of 7.5% (quarterly payments that is, four times per year) that matures in 25 years. The bond is currently selling for $8,767.38. (Record your answer rounded to 2 decimal places; for example, record 0.1493824=14.93824% as 12.94 )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts