Question: please answer all questions. will upvote!! Q 12 - 16) A county engineer is considering two mutually exclusive alternatives as part of a bridge improvement

please answer all questions. will upvote!!

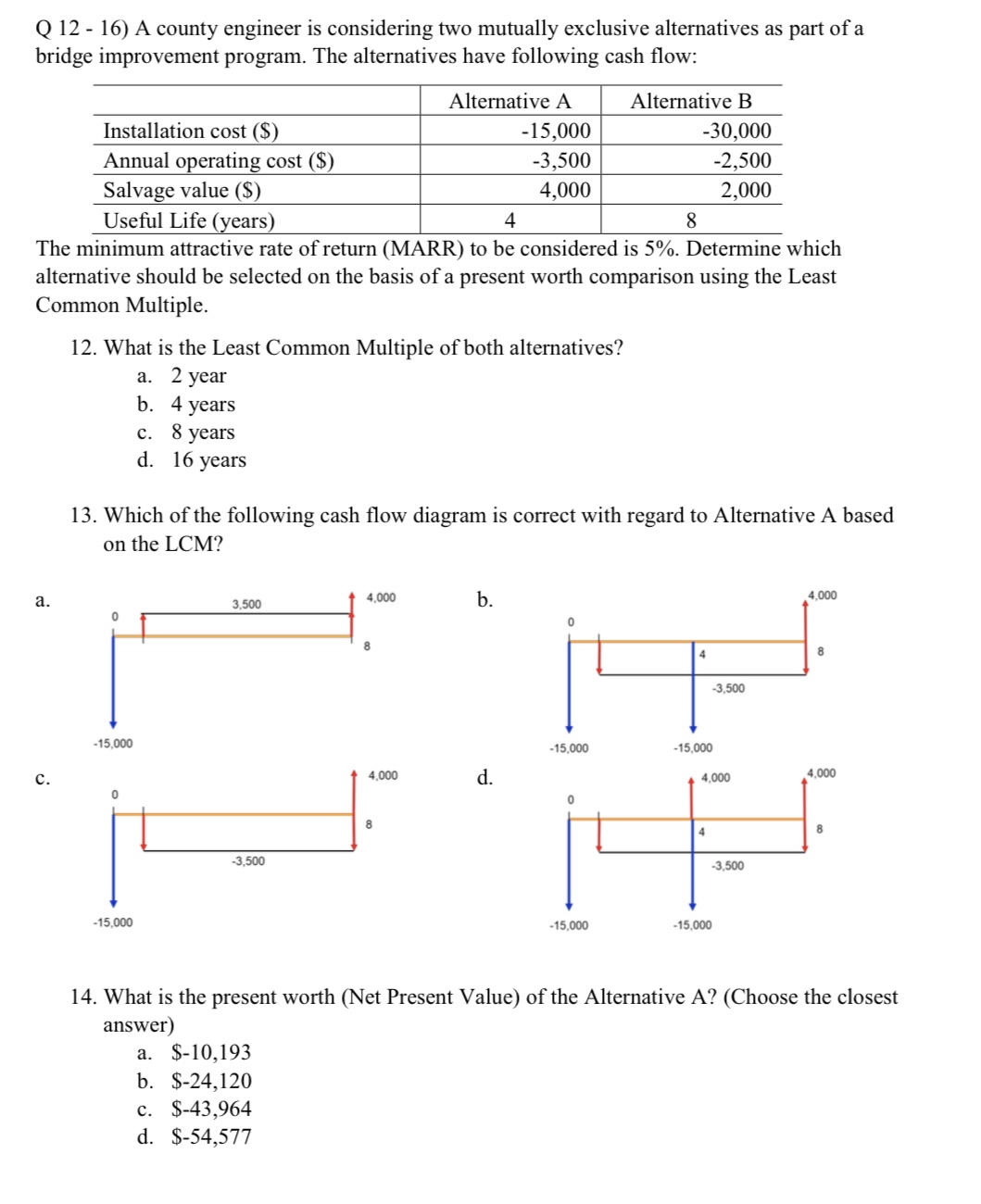

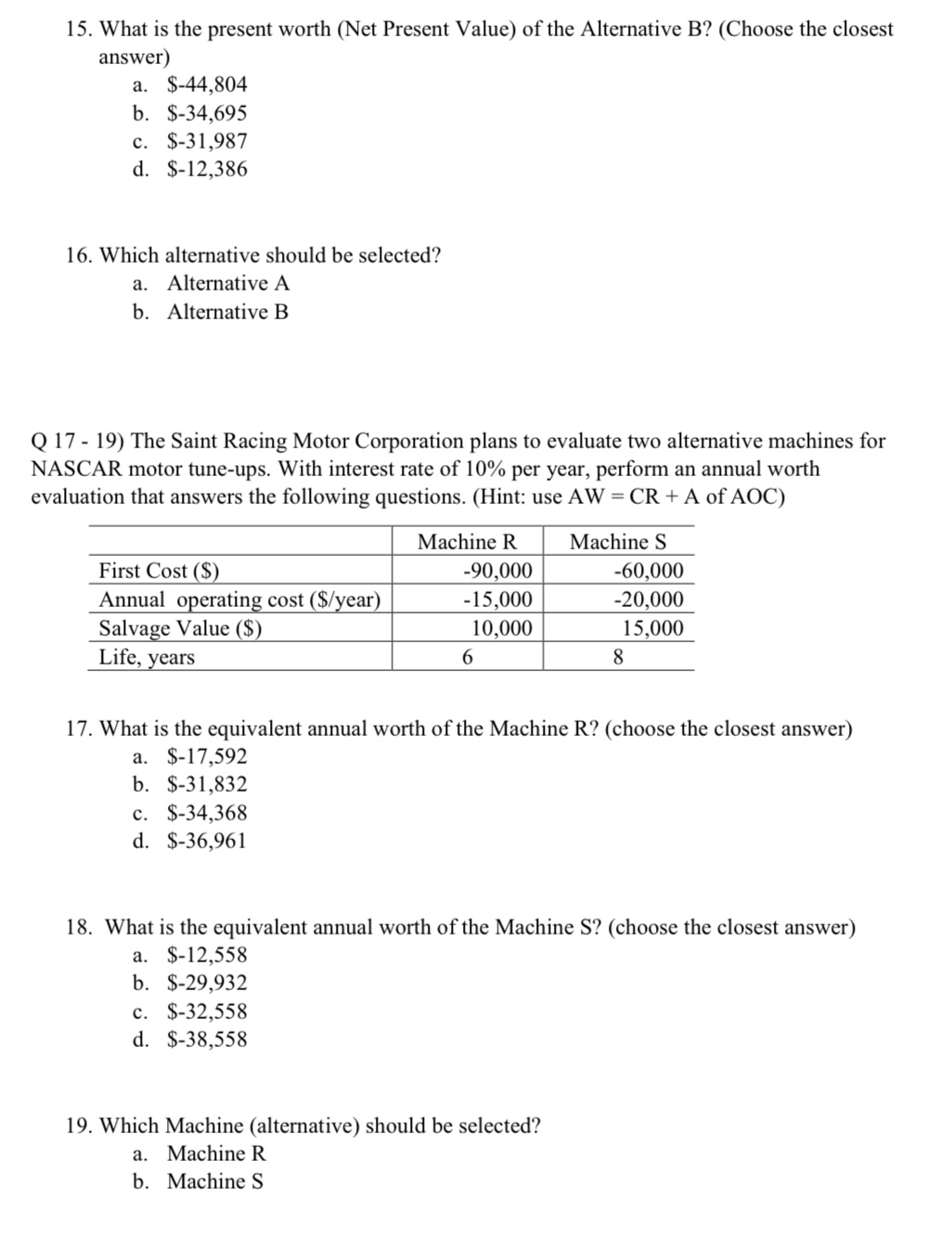

Q 12 - 16) A county engineer is considering two mutually exclusive alternatives as part of a bridge improvement program. The alternatives have following cash flow: The minimum attractive rate of return (MARR) to be considered is 5%. Determine which alternative should be selected on the basis of a present worth comparison using the Least Common Multiple. 12. What is the Least Common Multiple of both alternatives? a. 2 year b. 4 years c. 8 years d. 16 years 13. Which of the following cash flow diagram is correct with regard to Alternative A based on the LCM? a. c. b. d. 14. What is the present worth (Net Present Value) of the Alternative A? (Choose the closest answer) a. $10,193 b. $24,120 c. $43,964 d. $54,577 15. What is the present worth (Net Present Value) of the Alternative B? (Choose the closest answer) a. $44,804 b. $34,695 c. $31,987 d. $12,386 16. Which alternative should be selected? a. Alternative A b. Alternative B Q 17 - 19) The Saint Racing Motor Corporation plans to evaluate two alternative machines for NASCAR motor tune-ups. With interest rate of 10% per year, perform an annual worth evaluation that answers the following questions. (Hint: use AW=CR+A of AOC ) 17. What is the equivalent annual worth of the Machine R? (choose the closest answer) a. $17,592 b. $31,832 c. $34,368 d. $36,961 18. What is the equivalent annual worth of the Machine S? (choose the closest answer) a. $12,558 b. $29,932 c. $32,558 d. $38,558 19. Which Machine (alternative) should be selected? a. Machine R b. Machine S

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts