Question: please answer all questions with complete workings Question 1: During a meeting with your companys CFO, he makes the following statement: I realize that you

please answer all questions with complete workings

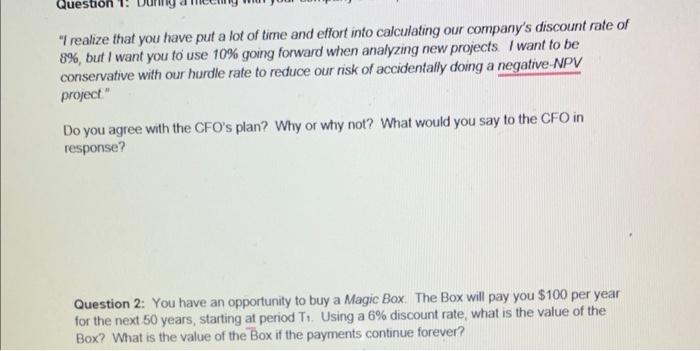

Question 1: During a meeting with your companys CFO, he makes the following statement:

I realize that you have put a lot of time and effort into calculating our companys discount rate of 8%, but I want you to use 10% going forward when analyzing new projects. I want to be conservative with our hurdle rate to reduce our risk of accidentally doing a negative-NPV project.

Do you agree with the CFOs plan? Why or why not? What would you say to the CFO in response?

Question 2: You have an opportunity to buy a Magic Box. The Box will pay you $100 per year for the next 50 years, starting at period T1. Using a 6% discount rate, what is the value of the Box? What is the value of the Box if the payments continue forever?

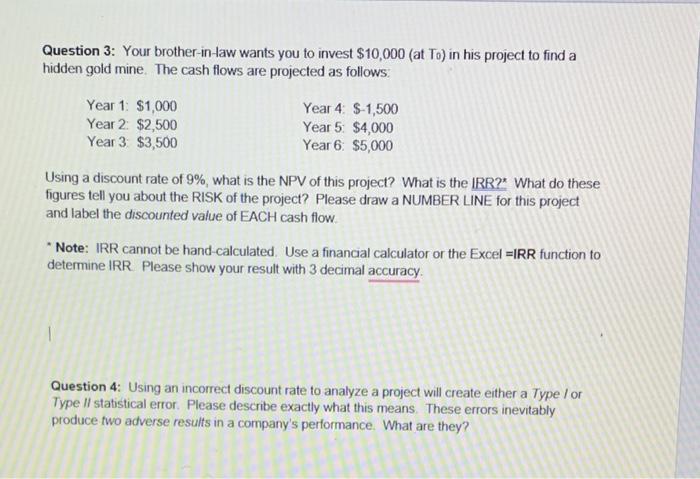

Question 3: Your brother-in-law wants you to invest $10,000 (at T0) in his project to find a hidden gold mine. The cash flows are projected as follows:

Year 1: $1,000 Year 4: $-1,500

Year 2: $2,500 Year 5: $4,000

Year 3: $3,500 Year 6: $5,000

Using a discount rate of 9%, what is the NPV of this project? What is the IRR?* What do these figures tell you about the RISK of the project? Please draw a NUMBER LINE for this project and label the discounted value of EACH cash flow.

* Note: IRR cannot be hand-calculated. Use a financial calculator or the Excel =IRR function to determine IRR. Please show your result with 3 decimal accuracy.

Question 4: Using an incorrect discount rate to analyze a project will create either a Type I or Type IIstatistical error. Please describe exactly what this means. These errors inevitably produce two adverse results in a companys performance. What are they?

b. From Question 4, please describe exactly how the adverse effects of statistical errors are created.

"I realize that you have put a lot of time and effort into calculating our company's discount rate of 8%, but I want you to use 10% going forward when analyzing new projects. I want to be conservative with our hurdle rate to reduce our risk of accidentally doing a negative-NPV project" Do you agree with the CFO's plan? Why or wiy not? What would you say to the CFO in response? Question 2: You have an opportunity to buy a Magic Box. The Box will pay you $100 per year for the next 50 years, starting at period T1. Using a 6% discount rate, what is the value of the Box? What is the value of the Box if the payments continue forever? Question 3: Your brother-in-law wants you to invest $10,000 (at T0 ) in his project to find a hidden gold mine. The cash flows are projected as follows. Using a discount rate of 9%, what is the NPV of this project? What is the IRR?* What do these figures tell you about the RISK of the project? Please draw a NUMBER LINE for this project and label the discounted value of EACH cash flow - Note: IRR cannot be hand-calculated. Use a financial calculator or the Excel =IRR function to determine IRR. Please show your result with 3 decimal accuracy. Question 4: Using an incorrect discount rate to analyze a project will create either a Type / or Type 11 statistical error. Please describe exactly what this means. These errors inevitably produce fwo adverse results in a company's performance. What are they? Extra Credit 2: From Question 4, please describe exactly how the adverse effects of statistical errors are created

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts