Question: PLEASE ANSWER WITH EXCEL 3. Assuming we begin a project, which has the same OCFs and WACC as those in this company. You spend $4,000,000

PLEASE ANSWER WITH EXCEL

PLEASE ANSWER WITH EXCEL

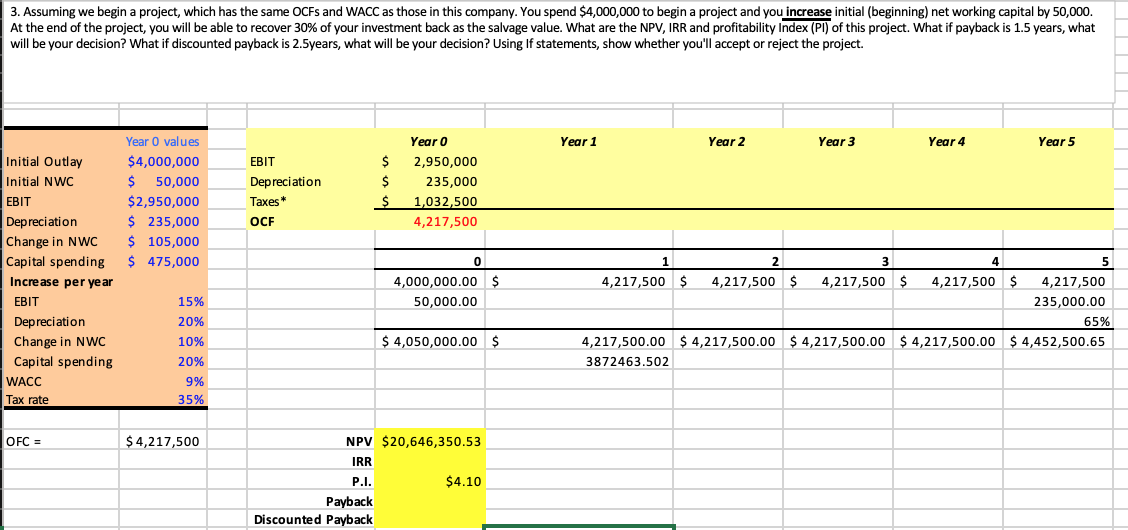

3. Assuming we begin a project, which has the same OCFs and WACC as those in this company. You spend $4,000,000 to begin a project and you increase initial (beginning) net working capital by 50,000. At the end of the project, you will be able to recover 30% of your investment back as the salvage value. What are the NPV, IRR and profitability Index (Pl) of this project. What if payback is 1.5 years, what will be your decision? What if discounted payback is 2.5years, what will be your decision? Using If statements, show whether you'll accept or reject the project. Year 1 C rear2 year4 Year 2 Year 3 year3 Year 4 Year 5 $ $ Year O values $4,000,000 $ 50,000 $2,950,000 $ 235,000 $ 105,000 $475,000 EBIT Depreciation Taxes* OCF Year 0 2,950,000 235,000 1,032,500 4,217,500 Initial Outlay Initial NWC EBIT Depreciation Change in NWC Capital spending Increase per year EBIT Depreciation Change in NWC Capital spending WACC Tax rate 0 4,000,000.00 $ 50,000.00 4,217,500 $ 4,217,500 $ 4,217,500 $ 4,217,500 $ 4,217,500 235,000.00 65% $ 4,452,500.65 $ 4,050,000.00 $ $ 4,217,500.00 $ 4,217,500.00 $ 4,217,500.00 15% 20% 10% 20% 9% 35% 4,217,500.00 3872463.502 OFC = $ 4,217,500 NPV $20,646,350.53 IRR P.I. $4.10 Payback Discounted Payback 3. Assuming we begin a project, which has the same OCFs and WACC as those in this company. You spend $4,000,000 to begin a project and you increase initial (beginning) net working capital by 50,000. At the end of the project, you will be able to recover 30% of your investment back as the salvage value. What are the NPV, IRR and profitability Index (Pl) of this project. What if payback is 1.5 years, what will be your decision? What if discounted payback is 2.5years, what will be your decision? Using If statements, show whether you'll accept or reject the project. Year 1 C rear2 year4 Year 2 Year 3 year3 Year 4 Year 5 $ $ Year O values $4,000,000 $ 50,000 $2,950,000 $ 235,000 $ 105,000 $475,000 EBIT Depreciation Taxes* OCF Year 0 2,950,000 235,000 1,032,500 4,217,500 Initial Outlay Initial NWC EBIT Depreciation Change in NWC Capital spending Increase per year EBIT Depreciation Change in NWC Capital spending WACC Tax rate 0 4,000,000.00 $ 50,000.00 4,217,500 $ 4,217,500 $ 4,217,500 $ 4,217,500 $ 4,217,500 235,000.00 65% $ 4,452,500.65 $ 4,050,000.00 $ $ 4,217,500.00 $ 4,217,500.00 $ 4,217,500.00 15% 20% 10% 20% 9% 35% 4,217,500.00 3872463.502 OFC = $ 4,217,500 NPV $20,646,350.53 IRR P.I. $4.10 Payback Discounted Payback

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts