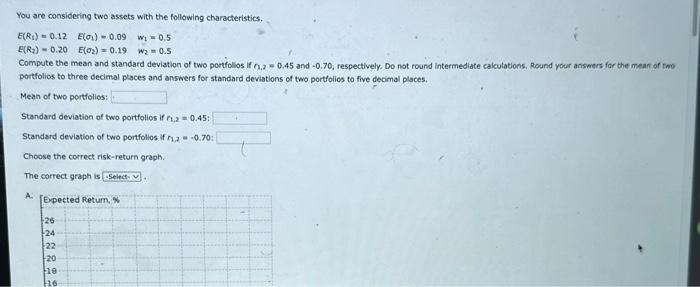

Question: PLEASE ANSWER ALL QUESTIONS You are considering two assets with the following characteristics. E(R1)=0.12E(R2)=0.20E(1)=0.09E(2)=0.19w1=0.5w2=0.5 Compute the mean and standard deviation of two portfolios if r1,2=0.45

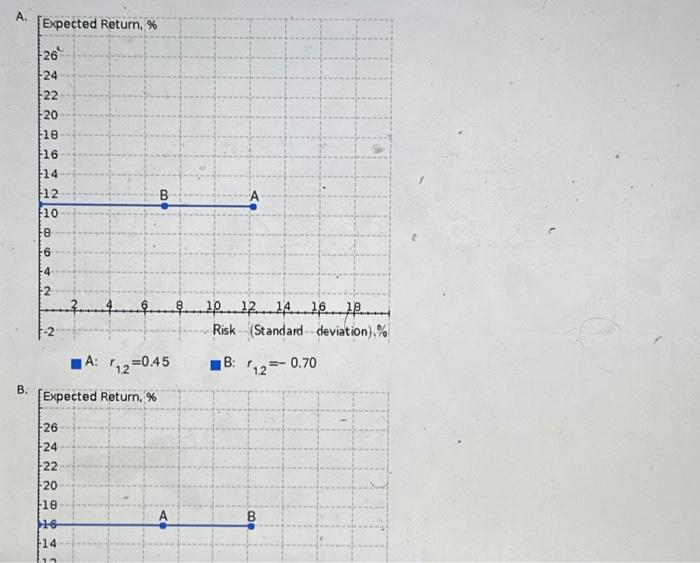

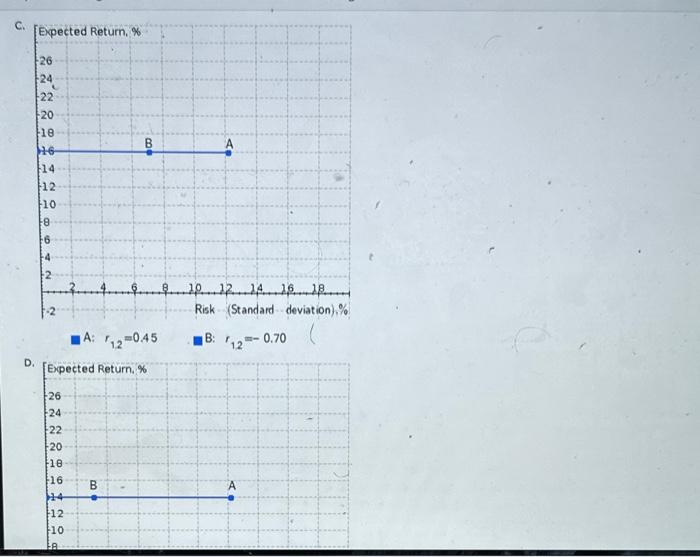

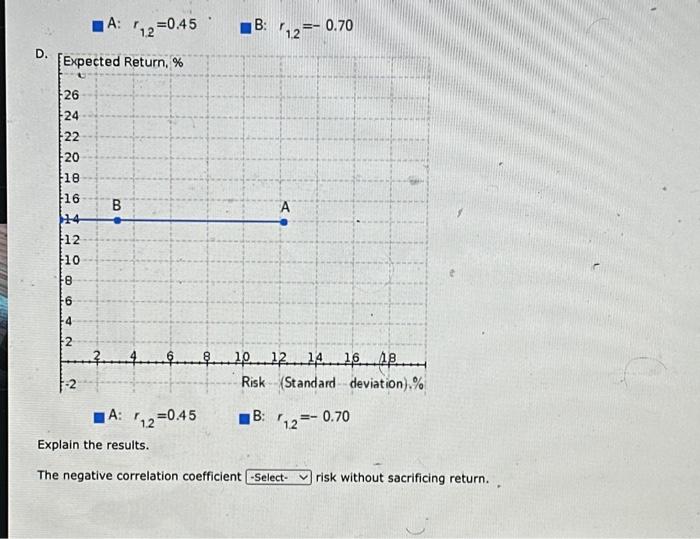

You are considering two assets with the following characteristics. E(R1)=0.12E(R2)=0.20E(1)=0.09E(2)=0.19w1=0.5w2=0.5 Compute the mean and standard deviation of two portfolios if r1,2=0.45 and =0.70, respectively. Do not round intermediate calculations. Round your answers for the mean of two portfolios to three decimal places and answers for standard deviations of two portfolios to five decimai places. Mean of two portfolios: Standard deviation of two portfolios if r1,2=0,45 : Standard deviation of two portfolios if r1,2=0.70: Choose the correct risk-return graph. The correct graph is A. r1.2=0.45 B: r12=0.70 r1.2=0.45 B: r12=0.70 A:r1,2=0.45 3: r1.2=0.70 A: r1.2=0.45 B: r1.2=0.70 Explain the results. The negative correlation coefficient risk without sacrificing return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts