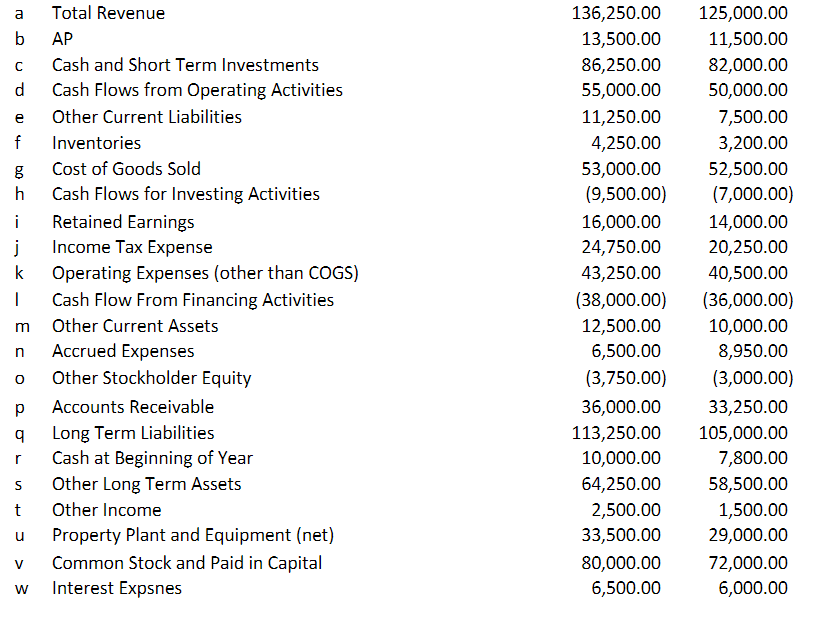

Question: PLEASE ANSWER ALL RATIOS! THANK YOU. begin{tabular}{llrr} a & Total Revenue & 136,250.00 & 125,000.00 b & AP & 13,500.00 & 11,500.00 c

PLEASE ANSWER ALL RATIOS! THANK YOU.

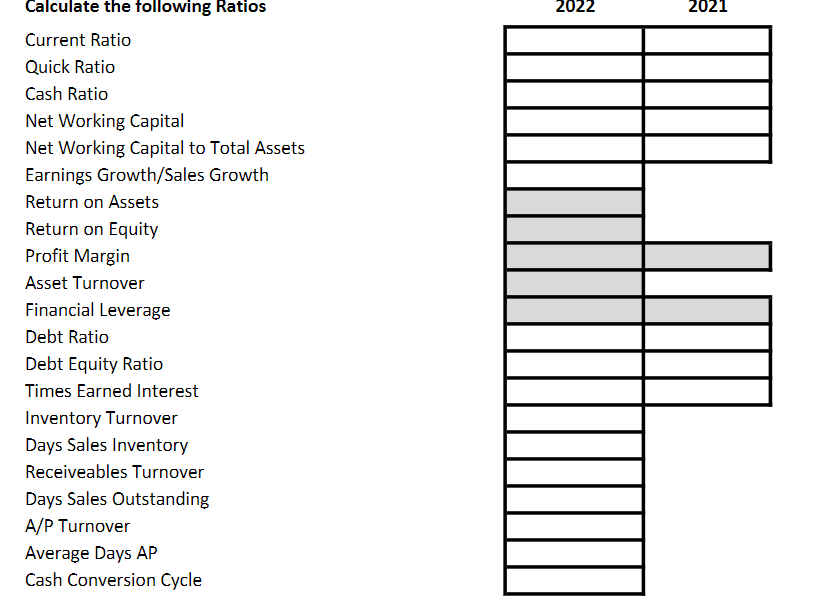

\begin{tabular}{llrr} a & Total Revenue & 136,250.00 & 125,000.00 \\ b & AP & 13,500.00 & 11,500.00 \\ c & Cash and Short Term Investments & 86,250.00 & 82,000.00 \\ d & Cash Flows from Operating Activities & 55,000.00 & 50,000.00 \\ e & Other Current Liabilities & 11,250.00 & 7,500.00 \\ f & Inventories & 4,250.00 & 3,200.00 \\ g & Cost of Goods Sold & 53,000.00 & 52,500.00 \\ h & Cash Flows for Investing Activities & (9,500.00) & (7,000.00) \\ i & Retained Earnings & 16,000.00 & 14,000.00 \\ j & Income Tax Expense & 24,750.00 & 20,250.00 \\ k & Operating Expenses (other than COGS) & 43,250.00 & 40,500.00 \\ I & Cash Flow From Financing Activities & (38,000.00) & (36,000.00) \\ m & Other Current Assets & 12,500.00 & 10,000.00 \\ n & Accrued Expenses & 6,500.00 & 8,950.00 \\ o & Other Stockholder Equity & (3,750.00) & (3,000.00) \\ p & Accounts Receivable & 36,000.00 & 33,250.00 \\ q & Long Term Liabilities & 113,250.00 & 105,000.00 \\ r & Cash at Beginning of Year & 10,000.00 & 7,800.00 \\ s & Other Long Term Assets & 64,250.00 & 58,500.00 \\ t & Other Income & 2,500.00 & 1,500.00 \\ u & Property Plant and Equipment (net) & 33,500.00 & 29,000.00 \\ v & Common Stock and Paid in Capital & 80,000.00 & 72,000.00 \\ w Interest Expsnes & 6,500.00 & 6,000.00 \end{tabular} Calculate the following Ratios Current Ratio Quick Ratio Cash Ratio Net Working Capital Net Working Capital to Total Assets Earnings Growth/Sales Growth Return on Assets Return on Equity Profit Margin Asset Turnover Financial Leverage Debt Ratio Debt Equity Ratio Times Earned Interest Inventory Turnover Days Sales Inventory Receiveables Turnover Days Sales Outstanding A/P Turnover Average Days AP Cash Conversion Cycle 2022 2021 \begin{tabular}{|l|l|} \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts