Question: please answer all sir. Thank you 1 point Mixed forecasting refers to the use of a combination of forecasting techniques. True False Translation exposure reflects:

please answer all sir. Thank you

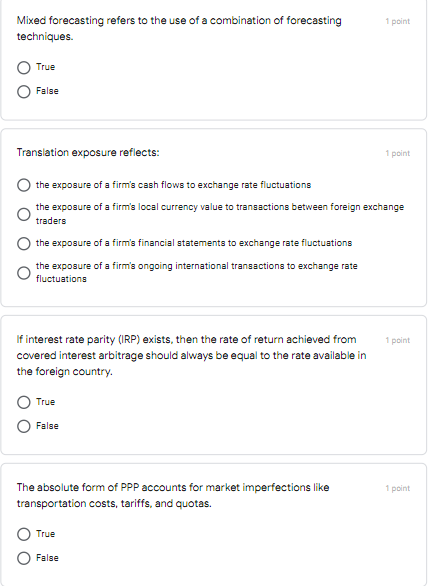

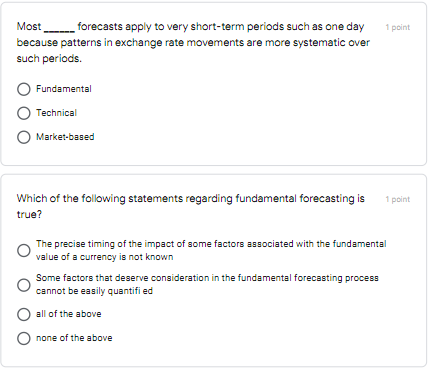

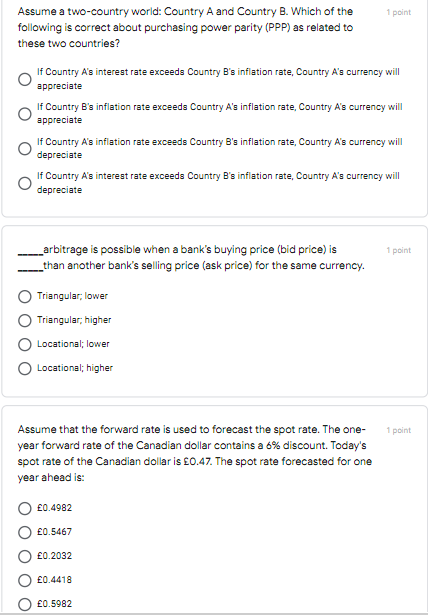

1 point Mixed forecasting refers to the use of a combination of forecasting techniques. True False Translation exposure reflects: 1 point the exposure of a firm's cash flows to exchange rate fluctuations the exposure of a firm's local currency value to transactions between foreign exchange traders the exposure of a firm's financial statements to exchange rate fluctuations the exposure of a firm's ongoing international transactions to exchange rate fluctuations 1 point If interest rate parity (IRP) exists, then the rate of return achieved from covered interest arbitrage should always be equal to the rate available in the foreign country. True False 1 point The absolute form of PPP accounts for market imperfections like transportation costs, tariffs, and quotas. True False 1 point Most _forecasts apply to very short-term periods such as one day because patterns in exchange rate movements are more systematic over such periods. Fundamental Technical Market-based 1 point Which of the following statements regarding fundamental forecasting is true? The precise timing of the impact of some factors associated with the fundamental value of a currency is not known Some factors that deserve consideration in the fundamental forecasting process cannot be easily quantified all of the above none of the above 1 point Assume a two-country world: Country A and Country B. Which of the following is correct about purchasing power parity (PPP) as related to these two countries? If Country A's interest rate exceeds Country B's inflation rate, Country A's currency will appreciate If Country B's inflation rate exceeds Country A's inflation rate, Country A's currency will appreciate If Country A's inflation rate exceeds Country B's inflation rate, Country A's currency will depreciate If Country A's interest rate exceeds Country B's inflation rate, Country A's currency will depreciate 1 point _arbitrage is possible when a bank's buying price (bid price) is _than another bank's selling price (ask price) for the same currency. Triangular; lower Triangular; higher Locational; lower Locational, higher Assume that the forward rate is used to forecast the spot rate. The one- 1 point year forward rate of the Canadian dollar contains a 6% discount. Today's spot rate of the Canadian dollar is 0.47. The spot rate forecasted for one year ahead is: 0.4982 0.5467 0.2032 0.4418 0.5982

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts