Question: please answer ALL six Questions. d Chapter 4 1. What is the Fisher effect? How does it affect the nominal rate of interest? 2. If

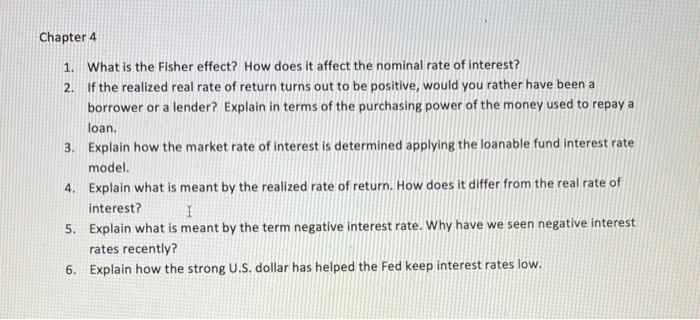

Chapter 4 1. What is the Fisher effect? How does it affect the nominal rate of interest? 2. If the realized real rate of return turns out to be positive, would you rather have been a borrower or a lender? Explain in terms of the purchasing power of the money used to repay a loan. 3. Explain how the market rate of interest is determined applying the loanable fund interest rate model. 4. Explain what is meant by the realized rate of return. How does it differ from the real rate of interest? 1 5. Explain what is meant by the term negative interest rate. Why have we seen negative interest rates recently? 6. Explain how the strong U.S. dollar has helped the Fed keep interest rates low

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts