Question: **PLEASE ANSWER ALL SUB-QUESTIONS AND EXPLAIN STEP BY STEP, PLEASE INCLUDE FORMULAE IN CORRECT FORMAT NOT COMPUTED VERSIONS, PLEASE INCLUDE NOMENCLATURE FOR ALL FORMULAE USED.

**PLEASE ANSWER ALL SUB-QUESTIONS AND EXPLAIN STEP BY STEP, PLEASE INCLUDE FORMULAE IN CORRECT FORMAT NOT COMPUTED VERSIONS, PLEASE INCLUDE NOMENCLATURE FOR ALL FORMULAE USED. THANK YOU FOR THE ASSISTANCE! ** PLEASE ANSWER THE ENTIRE QUESTION UNTIL THE END**

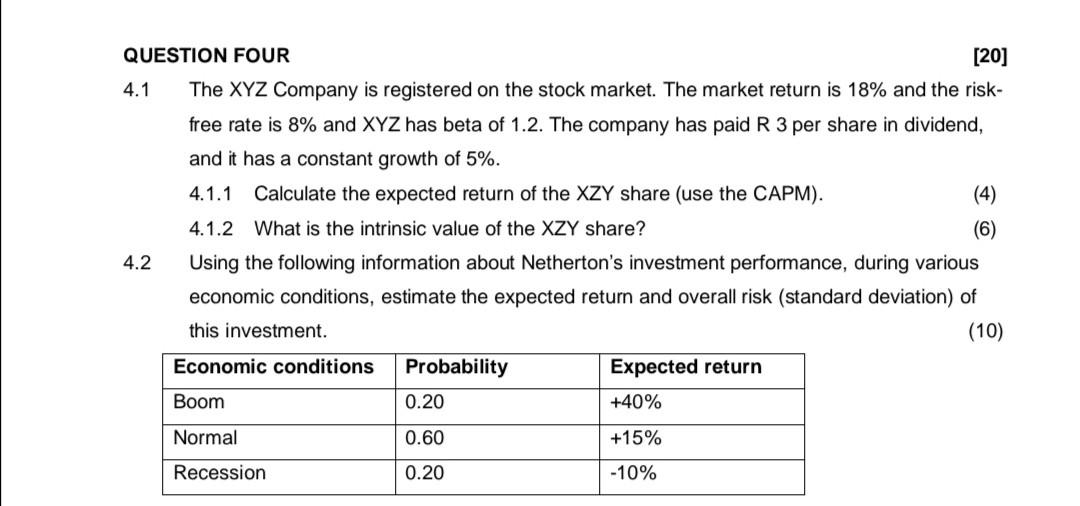

QUESTION FOUR [20] 4.1 The XYZ Company is registered on the stock market. The market return is 18% and the risk- free rate is 8% and XYZ has beta of 1.2. The company has paid R 3 per share in dividend, and it has a constant growth of 5%. 4.1.1 Calculate the expected return of the XZY share (use the CAPM). (4) 4.1.2 What is the intrinsic value of the XZY share? (6) 4.2 Using the following information about Netherton's investment performance, during various economic conditions, estimate the expected return and overall risk (standard deviation) of this investment. (10) Economic conditions Probability Expected return Boom 0.20 +40% Normal 0.60 +15% Recession 0.20 -10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts