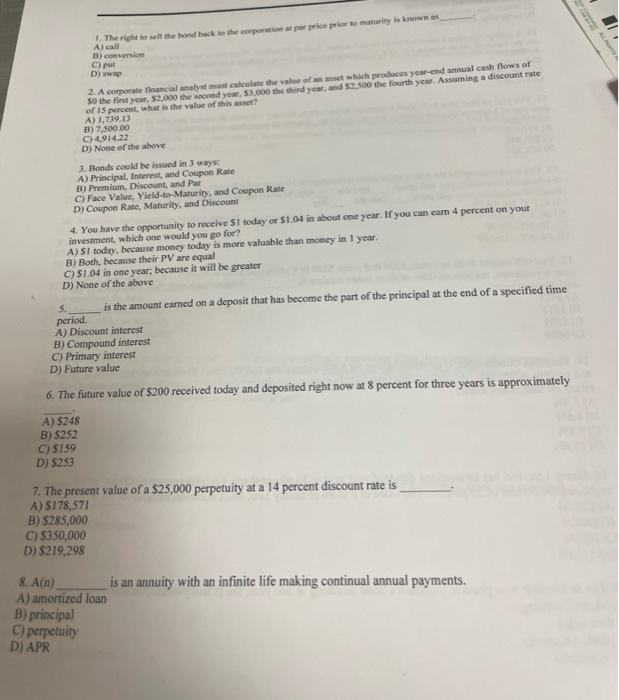

Question: Please answer all, thank you :) A) call B) conversicen c) pur. D) swap 2. A comporate financial anabys must calcolate the raloe of as

A) call B) conversicen c) pur. D) swap 2. A comporate financial anabys must calcolate the raloe of as asset which prodaces year-end ansual each flows of So the fint year, $2.000 the sceond year. $3.000 the thind year, and 52.500 the fourth year. Assuming a discount rate of 15 percent, what is the value of this aveet? A) 1.739.13 B) 7,500.00 C) 4,914,22 D) Noae of the above: 3. Bonds could be issued in 3 ways: A) Principal, Interest, and Coupon Rate B) Premium, Discocint, and Par C) Face Value, Yield-to-Maturity, and Coupon Rate D) Coupon Rate, Maturity, and Discount 4. You bave the opportunity to receive $1 today or $1.04 in about one year. If you can earn 4 percent on your investment, which one woald you go for? A) 51 today, because moncy today is more valuable than money in 1 year. B) Both, because their PV are equal C) SI.04 in one year, because it will be greater D) None of the above S. is the amount earned on a deposit that has become the part of the principal at the end of a specified time period. A) Discount interest B) Compound interest C) Primary interest D) Future value 6. The future value of $200 received today and deposited right now at 8 percent for three years is approximately A) 5248 B) $252 C) 5159 D) $253 7. The present value of a $25,000 perpetuity at a 14 percent discount rate is A) 5178.571 B) $285,000 C) 5350,000 D) 5219,298 8. A(n) is an annuity with an infinite life making continual annual payments. A) amortized loan B) principal C) perpetuity D) APR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts