Question: please answer all thank you In this section, questions are worth 2 marks unless specified otherwise. There are 20 marks in total. Newmarket Manufacturing Inc.

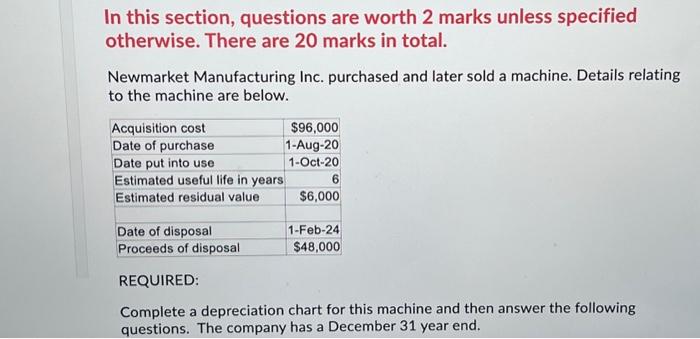

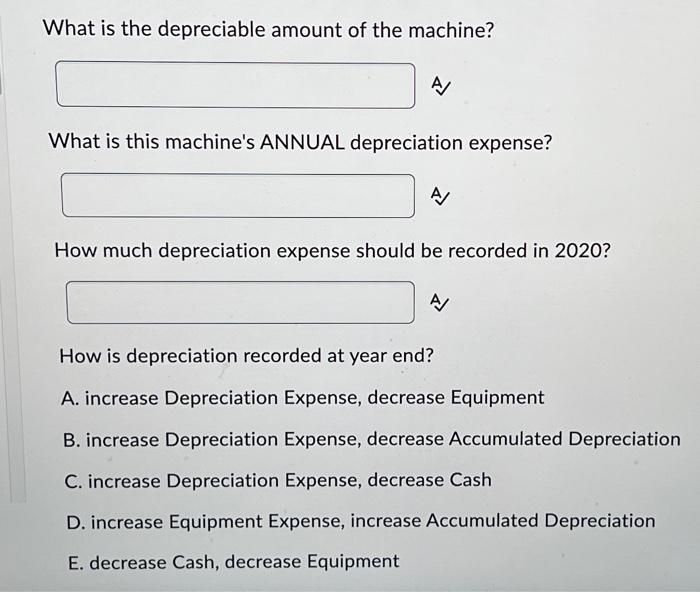

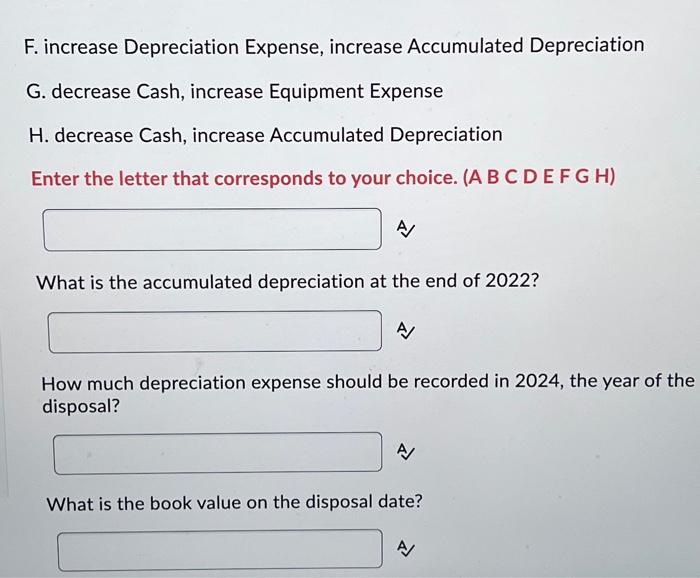

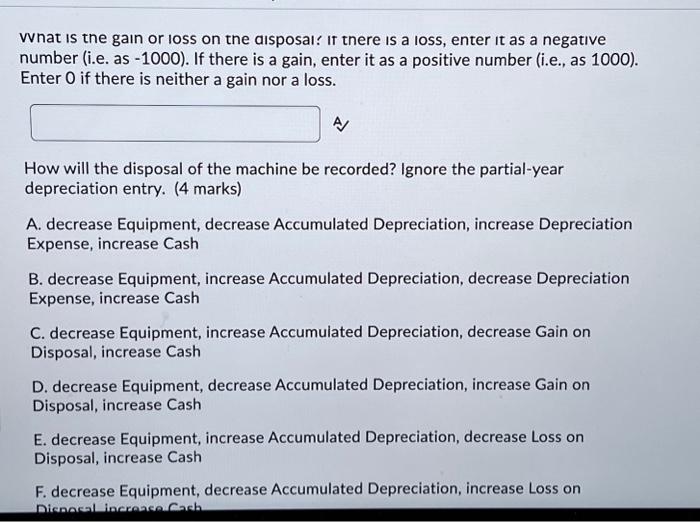

In this section, questions are worth 2 marks unless specified otherwise. There are 20 marks in total. Newmarket Manufacturing Inc. purchased and later sold a machine. Details relating to the machine are below. REQUIRED: Complete a depreciation chart for this machine and then answer the following questions. The company has a December 31 year end. What is the depreciable amount of the machine? What is this machine's ANNUAL depreciation expense? A. How much depreciation expense should be recorded in 2020? How is depreciation recorded at year end? A. increase Depreciation Expense, decrease Equipment B. increase Depreciation Expense, decrease Accumulated Depreciation C. increase Depreciation Expense, decrease Cash D. increase Equipment Expense, increase Accumulated Depreciation E. decrease Cash, decrease Equipment F. increase Depreciation Expense, increase Accumulated Depreciation G. decrease Cash, increase Equipment Expense H. decrease Cash, increase Accumulated Depreciation Enter the letter that corresponds to your choice. (A B C D E F G H) A/ What is the accumulated depreciation at the end of 2022? A How much depreciation expense should be recorded in 2024 , the year of the disposal? What is the book value on the disposal date? A Vvnat is the gain or loss on the disposai! It there is a Ioss, enter it as a negative number (i.e. as -1000). If there is a gain, enter it as a positive number (i.e., as 1000). Enter 0 if there is neither a gain nor a loss. How will the disposal of the machine be recorded? Ignore the partial-year depreciation entry. (4 marks) A. decrease Equipment, decrease Accumulated Depreciation, increase Depreciation Expense, increase Cash B. decrease Equipment, increase Accumulated Depreciation, decrease Depreciation Expense, increase Cash C. decrease Equipment, increase Accumulated Depreciation, decrease Gain on Disposal, increase Cash D. decrease Equipment, decrease Accumulated Depreciation, increase Gain on Disposal, increase Cash E. decrease Equipment, increase Accumulated Depreciation, decrease Loss on Disposal, increase Cash F. decrease Equipment, decrease Accumulated Depreciation, increase Loss on

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts