Question: Please answer all the question if not don't submit it. THANKS!!! Chapter 11 Name: Content learning Worksheet - Answer the question and provide the page

Please answer all the question if not don't submit it. THANKS!!!

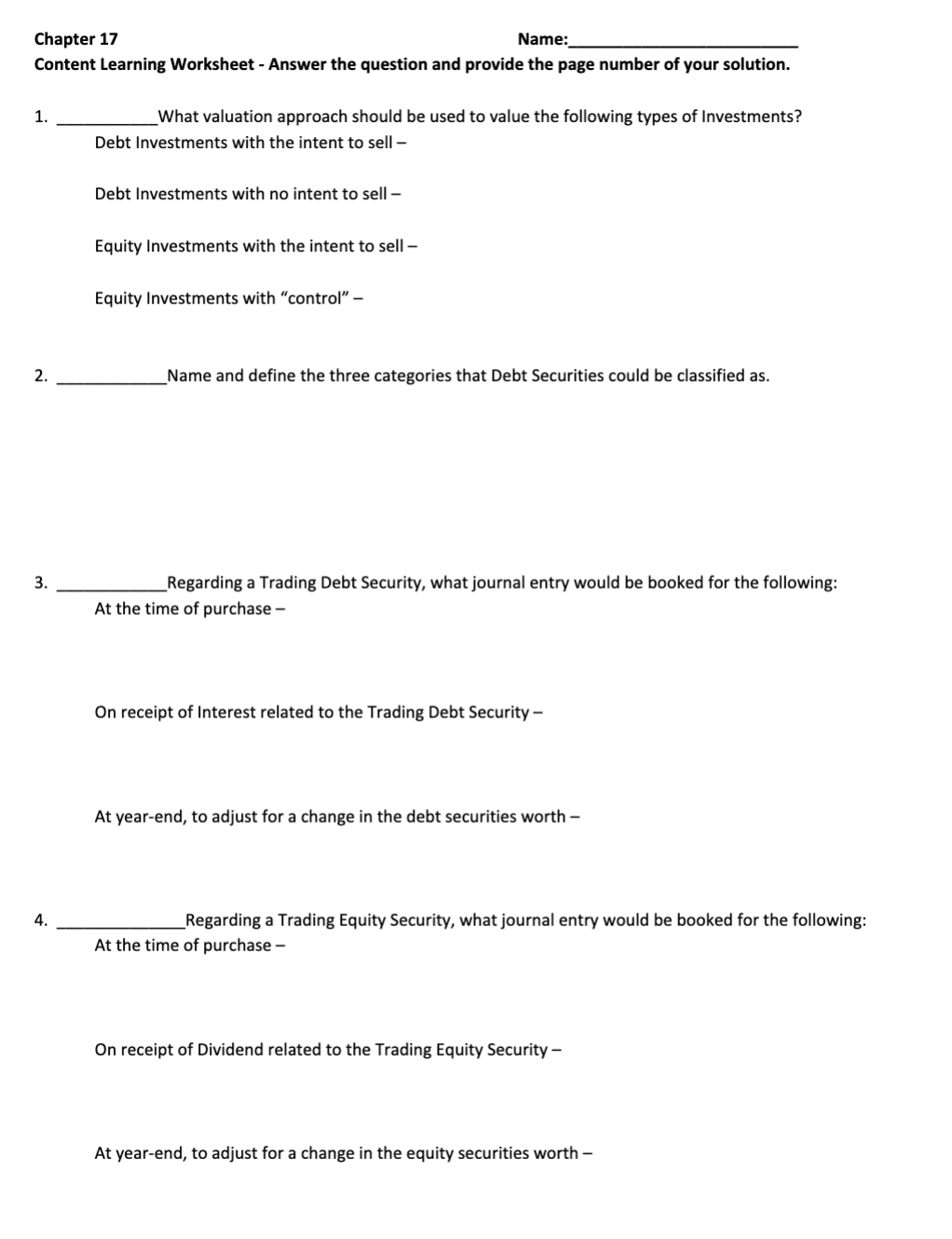

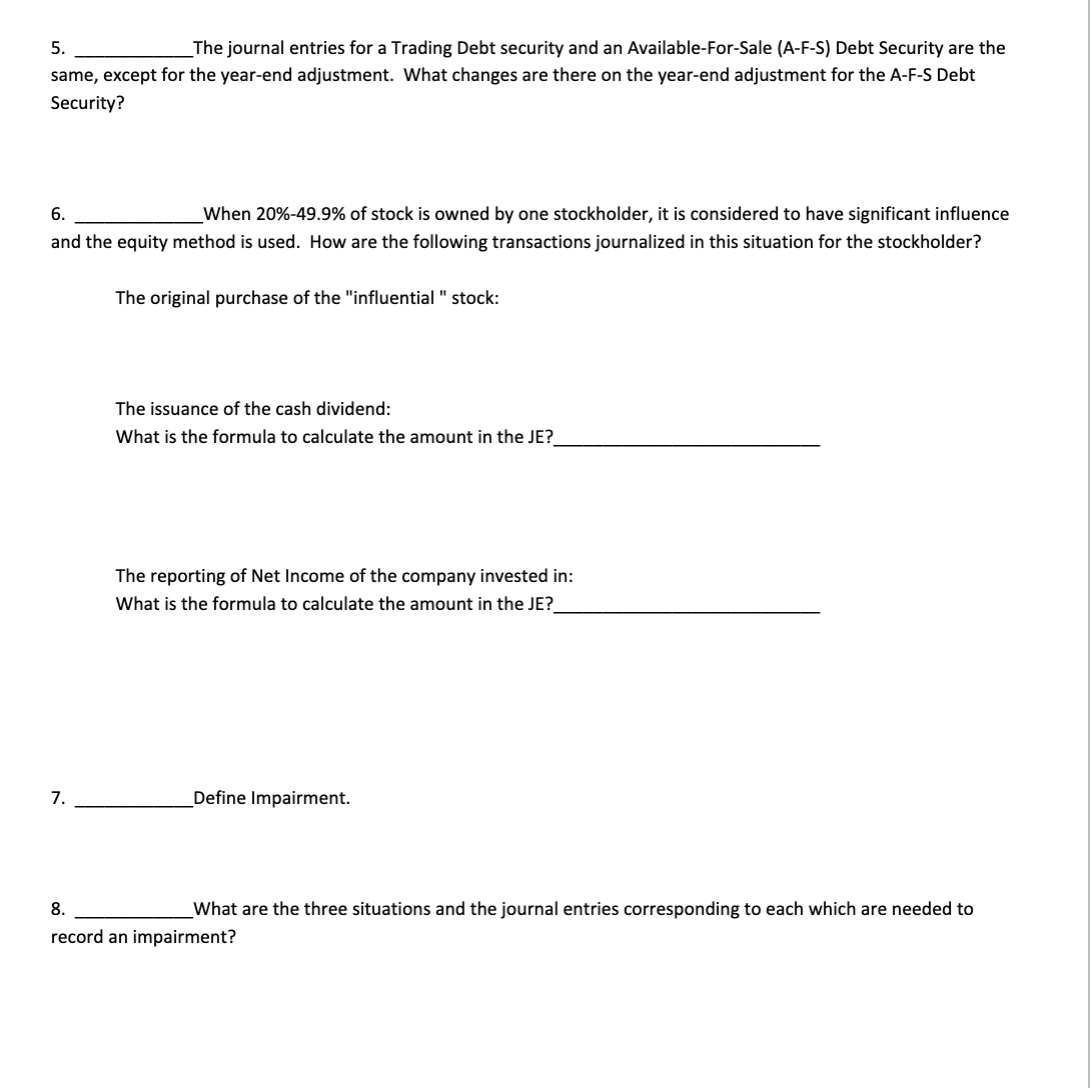

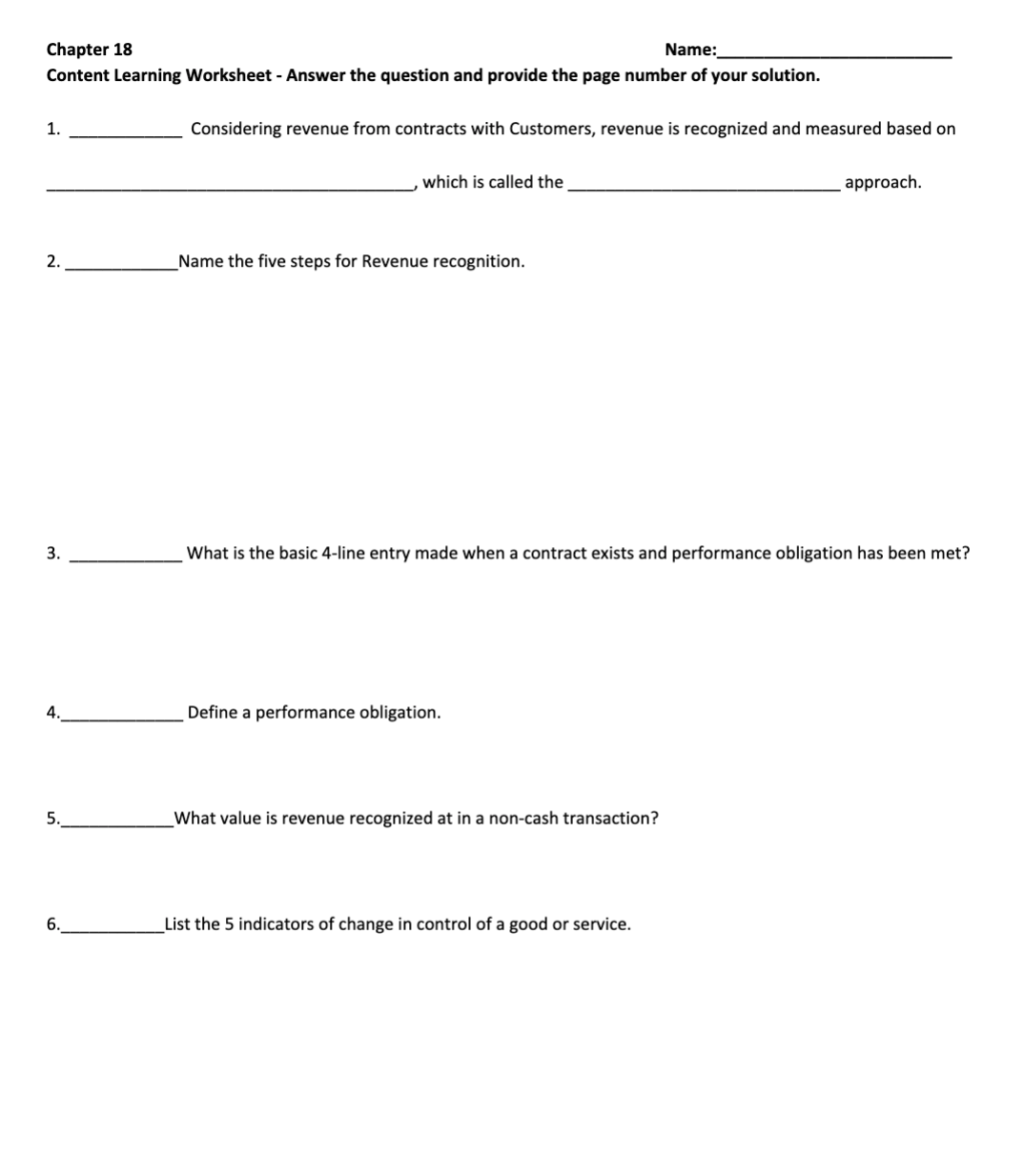

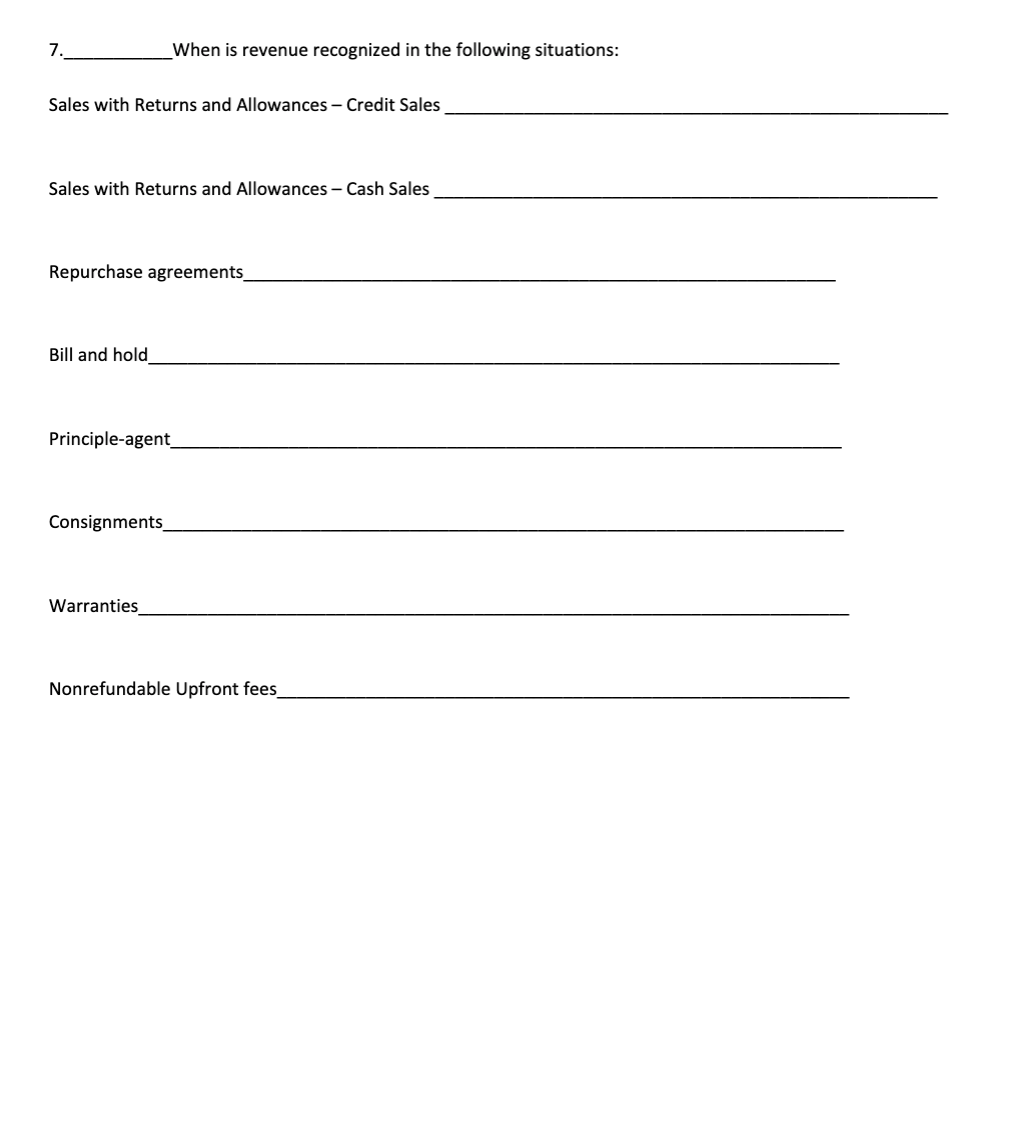

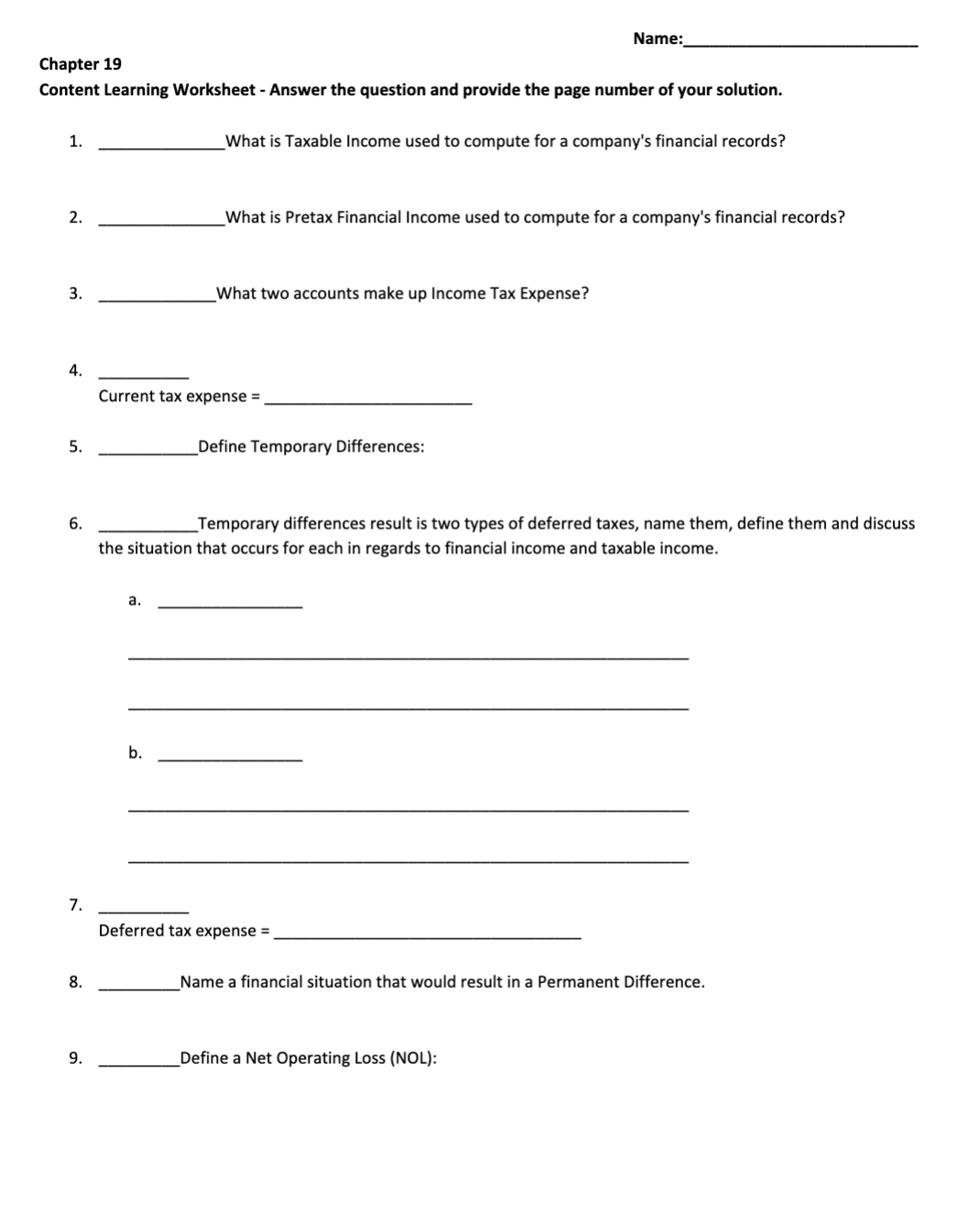

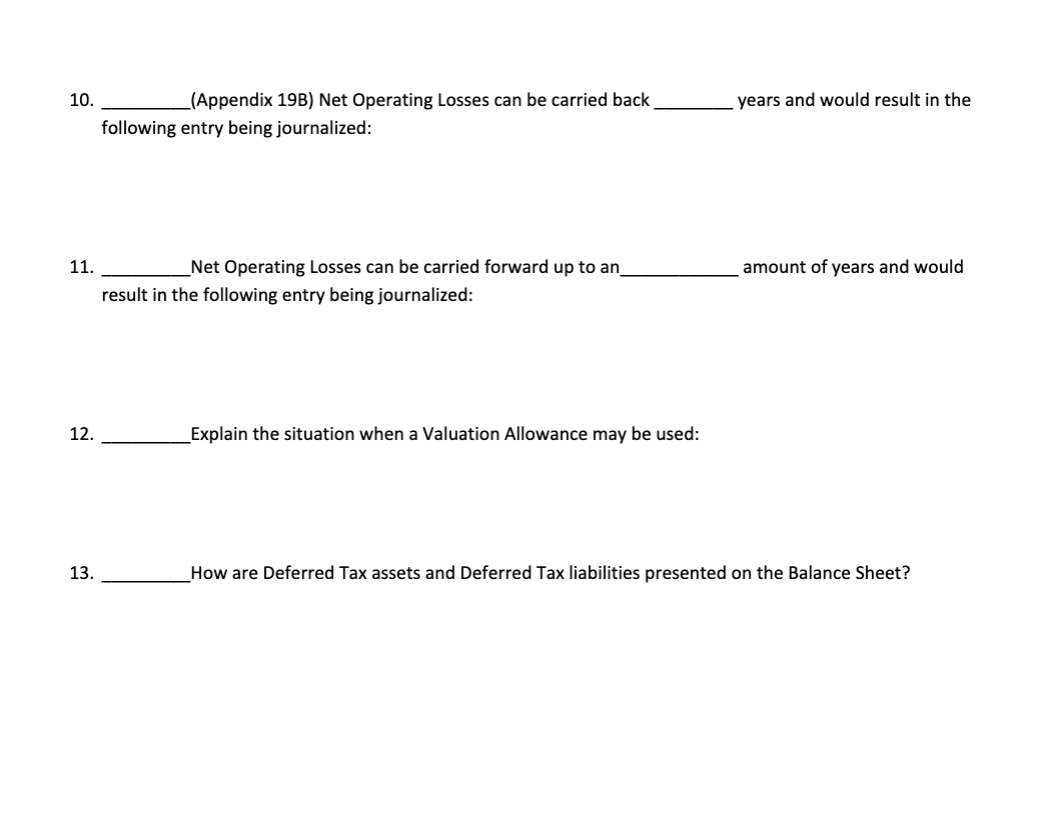

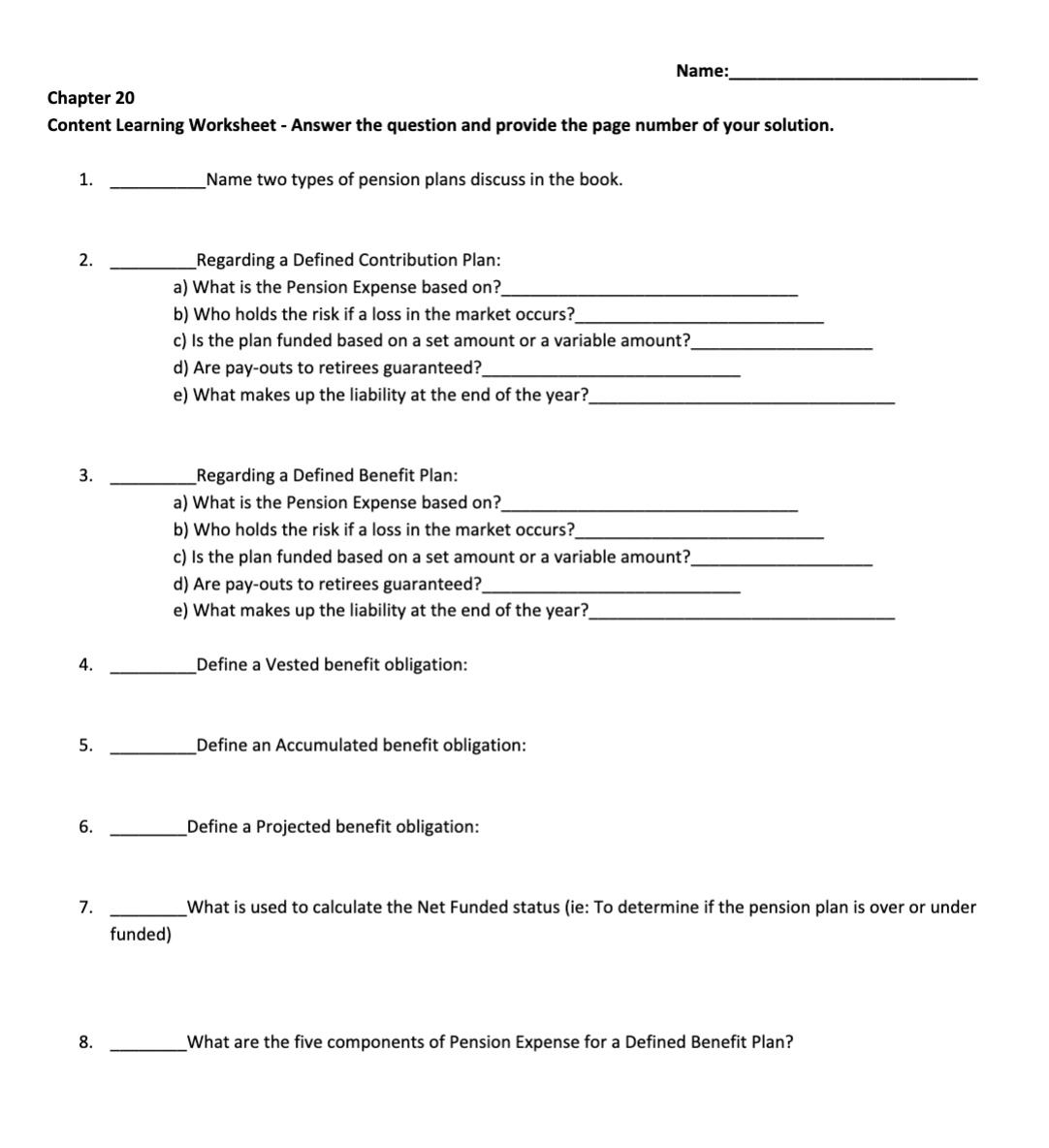

Chapter 11 Name: Content learning Worksheet - Answer the question and provide the page number of your solution. 1. What valuation approach should he used to value the following types of Investments? Debt Investments with the intent to sell - Debt Investments with no intent to sell - Equity Investments with the intent to sell - Equity Investments with "control\" - 2. Name and dene the three categories that Debt Securities could be classied as. 3. Regarding a Trading Debt Security, what journal entry would be booked for the following: At the time of purchase On receipt of Interest related to the Trading Debt Security At year-end, to adjust for a change in the debt securities worth 4. Regarding a Trading Equity Security, what journal entry would be booked for the following: At the time of purchase On receipt of Dividend related to the Trading Equity Security At year-end, to adjust for a change in the equity securities worth 5. The journal entries for a Trading Debt security and an Available-For-Sale (A-F-S) Debt Security are the same, except for the year-end adjustment. What changes are there on the year-end adjustment for the A-F-S Debt Security? 6. When 20%-49.9% of stock is owned by one stockholder, it is considered to have significant influence and the equity method is used. How are the following transactions journalized in this situation for the stockholder? The original purchase of the "influential " stock: The issuance of the cash dividend: What is the formula to calculate the amount in the JE?_ The reporting of Net Income of the company invested in: What is the formula to calculate the amount in the JE?_ 7. Define Impairment. 3. What are the three situations and the journal entries corresponding to each which are needed to record an impairment?Chapter 18 Name:_ Content Learning Worksheet - Answer the question and provide the page number of your solution. 1. Considering revenue from contracts with Customers, revenue is recognized and measured based on which is called the approach. 2. Name the five steps for Revenue recognition. 3. What is the basic 4-line entry made when a contract exists and performance obligation has been met? Define a performance obligation. 5 What value is revenue recognized at in a non-cash transaction? 6. List the 5 indicators of change in control of a good or service.7. When is revenue recognized in the following situations: Sales with Returns and Allowances Credit Sales Sales with Returns and Allowances Cash Sales Repurchase agreements Bill and hold Principle-agent Consignments Warranties Nonrefundable Upfront fees Name: Chapter 19 Content Learning Worksheet - Answer the question and provide the page number of your solution. 1. What is Taxable Income used to compute for a company's financial records? 2. What is Pretax Financial Income used to compute for a company's financial records? 3. What two accounts make up Income Tax Expense? 4. Current tax expense = 5. Define Temporary Differences: 6. Temporary differences result is two types of deferred taxes, name them, define them and discuss the situation that occurs for each in regards to financial income and taxable income. a. 7. Deferred tax expense = 8. Name a financial situation that would result in a Permanent Difference. 9. Define a Net Operating Loss (NOL):10. (Appendix 193] Net Operating Losses can be carried back years and would result in the following entry being joumalized: 11. Net Operating Losses can be carried forward up to an amount of years and would result in the following entryr heingjournalized: 12. Explain the situation when a Valuation Allowance may be used: 13. How are Deferred Tax assets and Deferred Tax liabilities presented on the Balance Sheet? Name: Chapter 20 Content Learning Worksheet - Answer the question and provide the page number of your solution. 1. Name two types of pension plans discuss in the book. 2. Regarding a Defined Contribution Plan: a) What is the Pension Expense based on? b) Who holds the risk if a loss in the market occurs? c) Is the plan funded based on a set amount or a variable amount? d) Are pay-outs to retirees guaranteed?_ e) What makes up the liability at the end of the year?_ 3. Regarding a Defined Benefit Plan: a) What is the Pension Expense based on? b) Who holds the risk if a loss in the market occurs?_ c) Is the plan funded based on a set amount or a variable amount? d) Are pay-outs to retirees guaranteed?. e) What makes up the liability at the end of the year?_ 4. Define a Vested benefit obligation: 5. Define an Accumulated benefit obligation: 6. Define a Projected benefit obligation: 7. What is used to calculate the Net Funded status (ie: To determine if the pension plan is over or under funded) 8. What are the five components of Pension Expense for a Defined Benefit Plan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts