Question: Please answer all the question QUESTION 3 Majlis Agama Islam Melaka has awarded a contract Mobeen Ltd to build a mosque at Taman Perdana, Melaka.

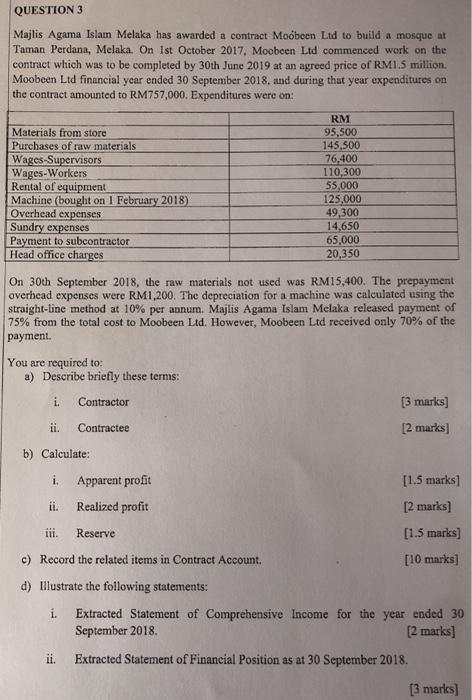

QUESTION 3 Majlis Agama Islam Melaka has awarded a contract Mobeen Ltd to build a mosque at Taman Perdana, Melaka. On 1st October 2017, Moobeen Ltd commenced work on the contract which was to be completed by 30th June 2019 at an agreed price of RM1.5 million. Moobeen Ltd financial year ended 30 September 2018, and during that year expenditures on the contract amounted to RM757,000. Expenditures were on: RM Materials from store 95,500 Purchases of raw materials 145,500 Wages-Supervisors 76,400 Wages-Workers 110,300 Rental of equipment 55.000 Machine (bought on 1 February 2018) 125.000 Overhead expenses 49,300 Sundry expenses 14,650 Payment to subcontractor 65.000 Head office charges 20,350 On 30th September 2018, the raw materials not used was RM15,400. The prepayment overhead expenses were RM1,200. The depreciation for a machine was calculated using the straight-line method at 10% per annum. Majlis Agama Islam Melaka released payment of 75% from the total cost to Moobeen Ltd. However, Moobeen Ltd received only 70% of the payment You are required to: a) Describe briefly these terms: i. Contractor [3 marks] ii. Contractee [2 marks b) Calculate: i. Apparent profit [1.5 marks Realized profit [2 marks] ili. Reserve [1.5 marks] c) Record the related items in Contract Account [10 marks] d) Illustrate the following statements: i. Extracted Statement of Comprehensive Income for the year ended 30 September 2018 [2 marks] ii. Extracted Statement of Financial Position as at 30 September 2018. [3 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts