Question: Please answer all the question section a, b and c Below are extracted data from the income statement of ABBA Sdn Bhd over a number

Please answer all the question section a, b and c

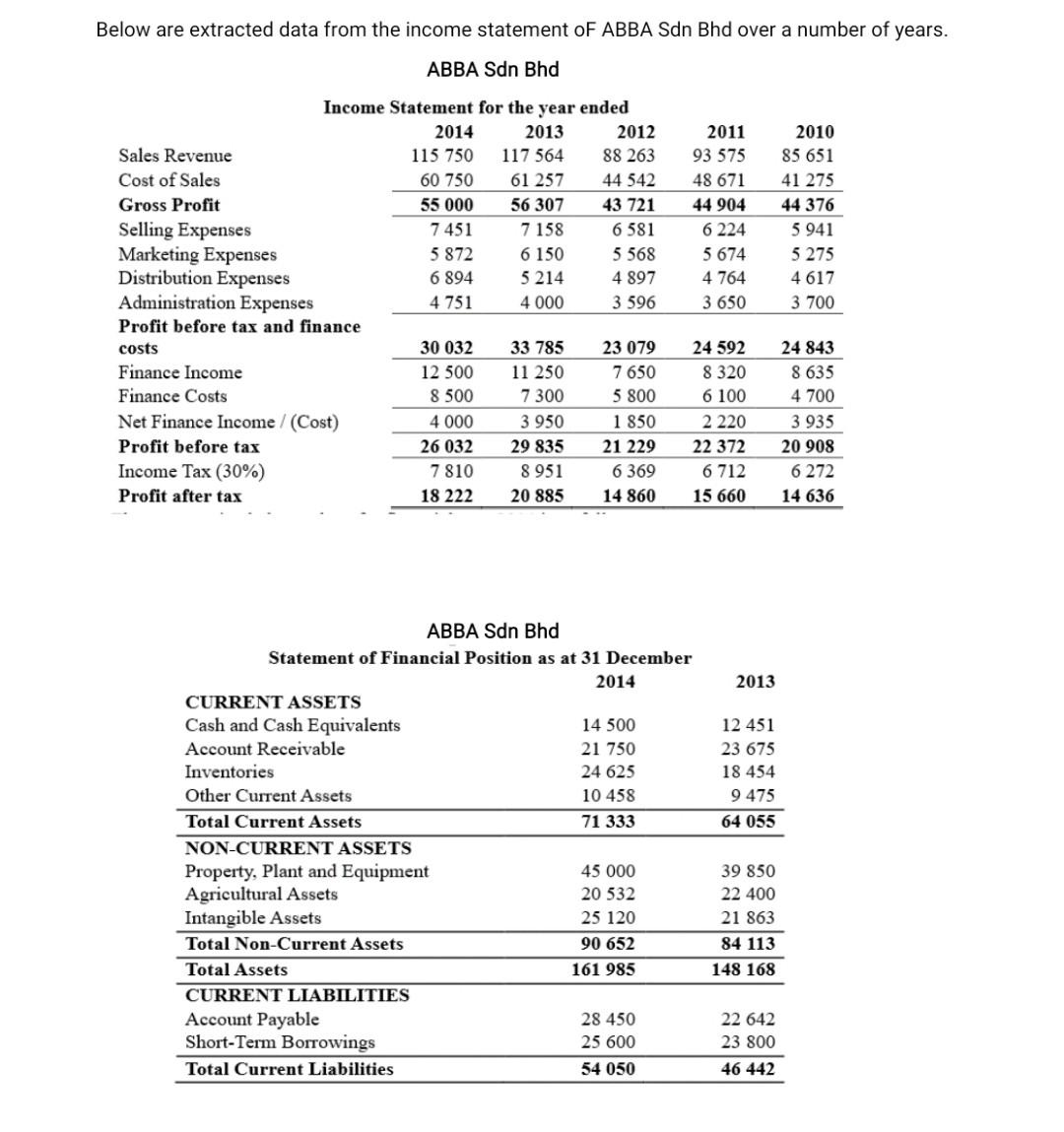

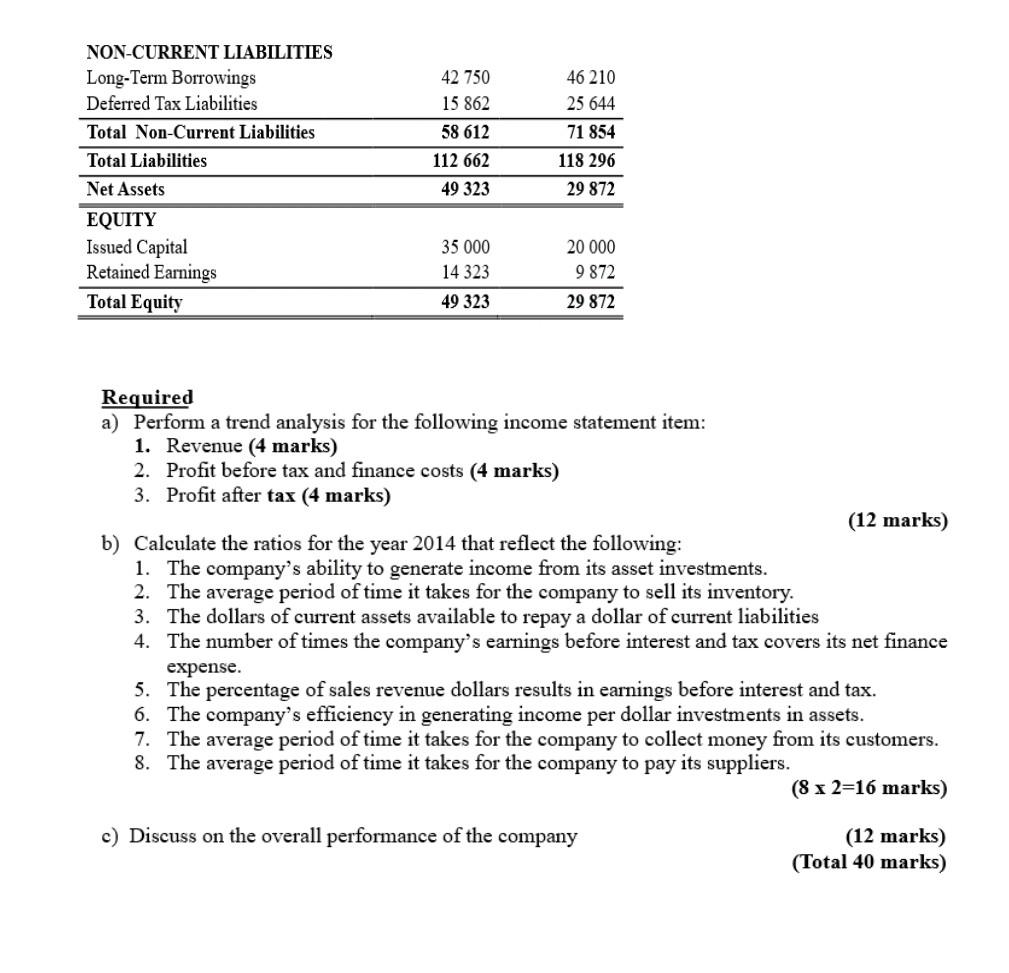

Below are extracted data from the income statement of ABBA Sdn Bhd over a number of years. ABBA Sdn Bhd Income Statement for the year ended 2014 2013 2012 115 750 117 564 88 263 2011 2010 Sales Revenue 85 651 93 575 48 671 Cost of Sales 60 750 61 257 44 542 41 275 Gross Profit 55 000 56 307 44 904 44 376 43 721 6 581 7451 7158 6 224 5 941 5 872 6 150 5 674 5 275 Selling Expenses Marketing Expenses Distribution Expenses Administration Expenses Profit before tax and finance 5 568 4 897 6 894 5214 4 764 4 617 4 751 4 000 3 596 3 650 3 700 costs 30 032 33 785 23 079 24 843 Finance Income 12 500 11 250 7 650 24 592 8 320 6 100 8 635 Finance Costs 8 500 7 300 5 800 4 700 4 000 1 850 2 220 3 935 26 032 3 950 29 835 8 951 21 229 22 372 Net Finance Income /(Cost) Profit before tax Income Tax (30%) Profit after tax 20 908 7810 6 369 6 712 6272 18 222 20 885 14 860 15 660 14 636 ABBA Sdn Bhd Statement of Financial Position as at 31 December 2014 2013 14 500 12 451 CURRENT ASSETS Cash and Cash Equivalents Account Receivable Inventories Other Current Assets 21 750 23 675 24 625 18 454 10 458 9 475 Total Current Assets 71 333 64 055 NON-CURRENT ASSETS Property, Plant and Equipment Agricultural Assets Intangible Assets Total Non-Current Assets 45 000 20 532 25 120 39 850 22 400 21 863 90 652 84 113 Total Assets 161 985 148 168 CURRENT LIABILITIES 28 450 Account Payable Short-Term Borrowings 22 642 23 800 25 600 Total Current Liabilities 54 050 46 442 NON-CURRENT LIABILITIES 42 750 46 210 Long-Term Borrowings Deferred Tax Liabilities 15 862 25 644 Total Non-Current Liabilities 58 612 71 854 Total Liabilities 112 662 118 296 Net Assets 49 323 29 872 35 000 20 000 EQUITY Issued Capital Retained Earnings Total Equity 14 323 9 872 49 323 29 872 Required a) Perform a trend analysis for the following income statement item: 1. Revenue (4 marks) 2. Profit before tax and finance costs (4 marks) 3. Profit after tax (4 marks) (12 marks) b) Calculate the ratios for the year 2014 that reflect the following: 1. The company's ability to generate income from its asset investments. 2. The average period of time it takes for the company to sell its inventory. 3. The dollars of current assets available to repay a dollar of current liabilities 4. The number of times the company's earnings before interest and tax covers its net finance expense. 5. The percentage of sales revenue dollars results in earnings before interest and tax. 6. The company's efficiency in generating income per dollar investments in assets. 7. The average period of time it takes for the company to collect money from its customers. 8. The average period of time it takes for the company to pay its suppliers. (8 x 2=16 marks) c) Discuss on the overall performance of the company (12 marks) (Total 40 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts