Question: please answer all the question to get a like button and a subscribe button ASAP! Pena Company is considering an investment of $29,480 that provides

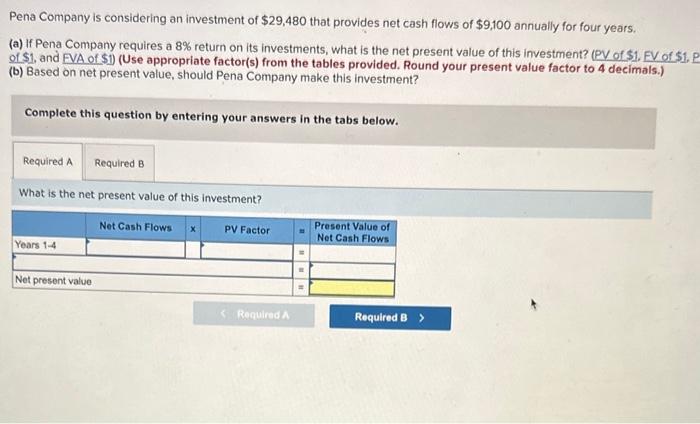

Pena Company is considering an investment of $29,480 that provides net cash flows of $9,100 annually for four years. (a) If Pena Company requires a 8% return on its investments, what is the net present value of this investment? (PV of $1. EV of $. of \$1, and EVA of \$1) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.) (b) Based on net present value, should Pena Company make this investment? Complete this question by entering your answers in the tabs below. What is the net present value of this investment? Pena Company is considering an investment of $29,480 that provides net cash flows of $9,100 annually for four years. (a) If Pena Company requires a 8% return on its investments, what is the net present value of this investment? (PV of $1. EV of $1, PV of \$1, and EVA of \$1) (Use appropriate factor(5) from the tables provided. Round your present value factor to 4 decimals.) (b) Based on net present value, should Pena Company make this investment? Complete this question by entering your answers in the tabs below. Based on net present value, should Pena Company make this investment? Based on net present value, should Pena Company make this investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts