Question: please answer all the questions. 1. The current spot price (So) of an asset is $228 and the interest rate (r) = 6.75% per annum

please answer all the questions.

please answer all the questions.

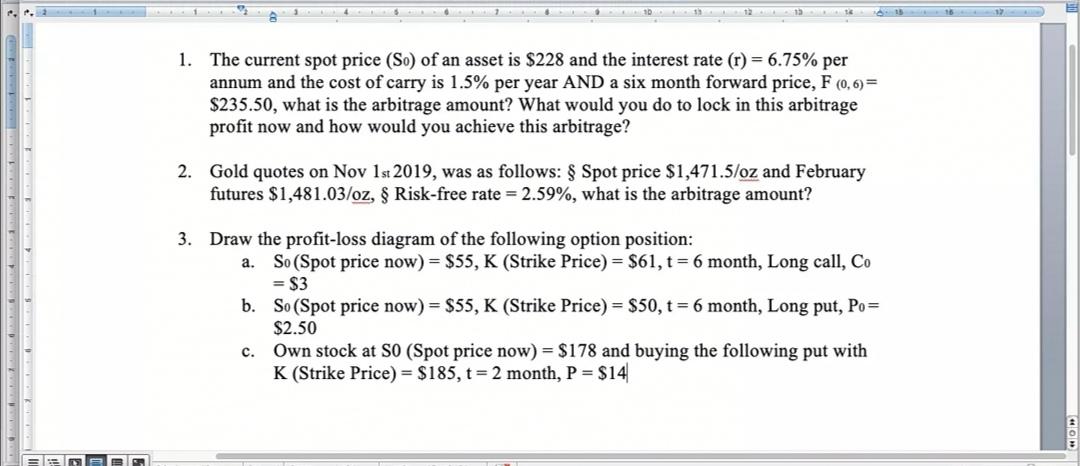

1. The current spot price (So) of an asset is $228 and the interest rate (r) = 6.75% per annum and the cost of carry is 1.5% per year AND a six month forward price, F (0,6)= $235.50, what is the arbitrage amount? What would you do to lock in this arbitrage profit now and how would you achieve this arbitrage? 2. Gold quotes on Nov 1st 2019, was as follows: $ Spot price $1,471.5/oz and February futures $1,481.03/oz, Risk-free rate = 2.59%, what is the arbitrage amount? 3. Draw the profit-loss diagram of the following option position: a. So (Spot price now) = $55, K (Strike Price) = $61, t = 6 month, Long call, Co = $3 b. So (Spot price now) = $55, K (Strike Price) = $50, t = 6 month, Long put, Po= $2.50 Own stock at SO (Spot price now) = $178 and buying the following put with K (Strike Price) = $185, t = 2 month, P = $14 c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts