Question: this is my second time posting this questions and please answer the 2 questions 1) Compute the stock price from the balance sheet, if the

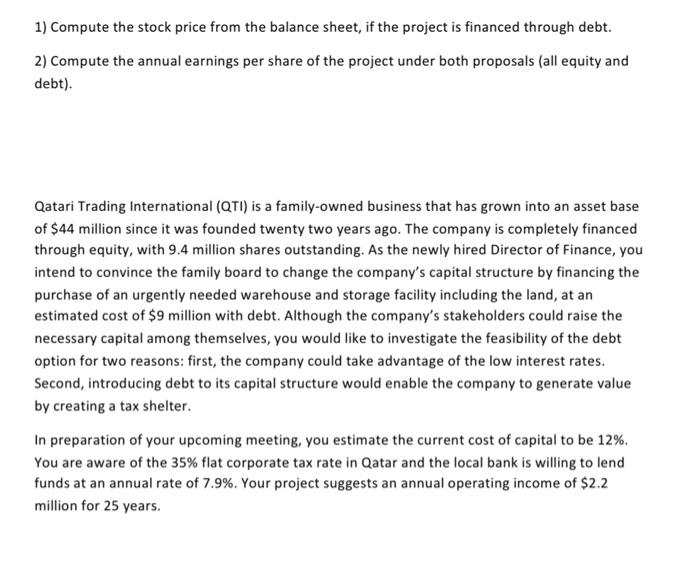

1) Compute the stock price from the balance sheet, if the project is financed through debt. 2) Compute the annual earnings per share of the project under both proposals (all equity and debt). Qatari Trading International (QTI) is a family-owned business that has grown into an asset base of $44 million since it was founded twenty two years ago. The company is completely financed through equity, with 9.4 million shares outstanding. As the newly hired Director of Finance, you intend to convince the family board to change the company's capital structure by financing the purchase of an urgently needed warehouse and storage facility including the land, at an estimated cost of $9 million with debt. Although the company's stakeholders could raise the necessary capital among themselves, you would like to investigate the feasibility of the debt option for two reasons: first, the company could take advantage of the low interest rates. Second, introducing debt to its capital structure would enable the company to generate value by creating a tax shelter. In preparation of your upcoming meeting, you estimate the current cost of capital to be 12%. You are aware of the 35% flat corporate tax rate in Qatar and the local bank is willing to lend funds at an annual rate of 7.9%. Your project suggests an annual operating income of $2.2 million for 25 years. 1) Compute the stock price from the balance sheet, if the project is financed through debt. 2) Compute the annual earnings per share of the project under both proposals (all equity and debt). Qatari Trading International (QTI) is a family-owned business that has grown into an asset base of $44 million since it was founded twenty two years ago. The company is completely financed through equity, with 9.4 million shares outstanding. As the newly hired Director of Finance, you intend to convince the family board to change the company's capital structure by financing the purchase of an urgently needed warehouse and storage facility including the land, at an estimated cost of $9 million with debt. Although the company's stakeholders could raise the necessary capital among themselves, you would like to investigate the feasibility of the debt option for two reasons: first, the company could take advantage of the low interest rates. Second, introducing debt to its capital structure would enable the company to generate value by creating a tax shelter. In preparation of your upcoming meeting, you estimate the current cost of capital to be 12%. You are aware of the 35% flat corporate tax rate in Qatar and the local bank is willing to lend funds at an annual rate of 7.9%. Your project suggests an annual operating income of $2.2 million for 25 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts