Question: Please answer all the questions 14. value: 3.00 points TIPS A TIPS bond with a $1,000 par value was issued three years ago with a

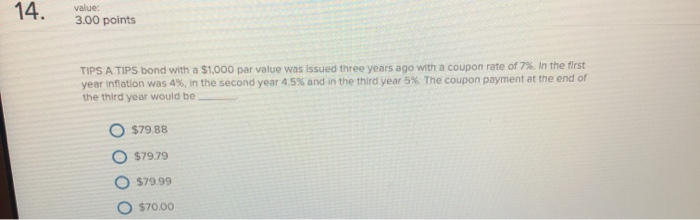

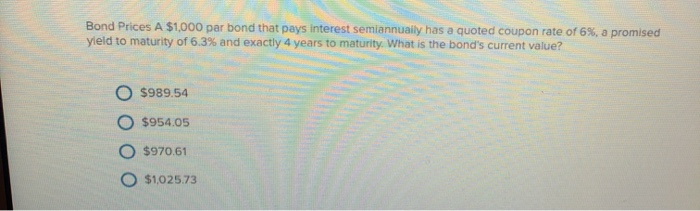

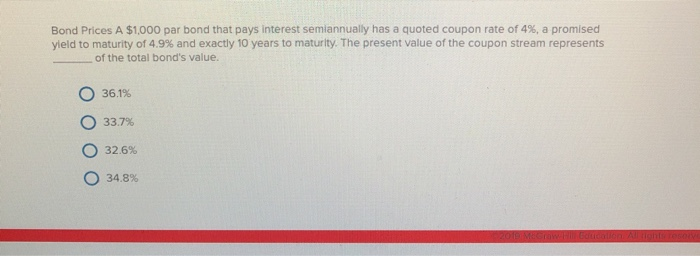

14. value: 3.00 points TIPS A TIPS bond with a $1,000 par value was issued three years ago with a coupon rate of 7 %. In the first year inflation was 4% , in the second year 4.5 % and in the third year 5 % The coupon payment at the end of the third year would be $79.88 $79.79 $79.99 O $70.00 Bond Prices A $1,000 par bond that pays interest semiannuaily has a quoted coupon rate of 6% , a promised yield to maturity of 6.3% and exactly 4 years to maturity. What is the bond's current value? $989.54 $954.05 $970.61 $1,025.73 Bond Prices A $1,000 par bond that pays interest semiannually has a quoted coupon rate of 4 % , a promised yield to maturity of 4.9% and exactly 10 years to maturity. The present value of the coupon stream represents .of the total bond's value. 36.1% 33.7% 32.6% 34.8% liohts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts