Question: please answer all the Questions 26. Projects A and B both year 1, $30,000 in year 2, S30,000 will return a cash flow of higher

please answer all the Questions

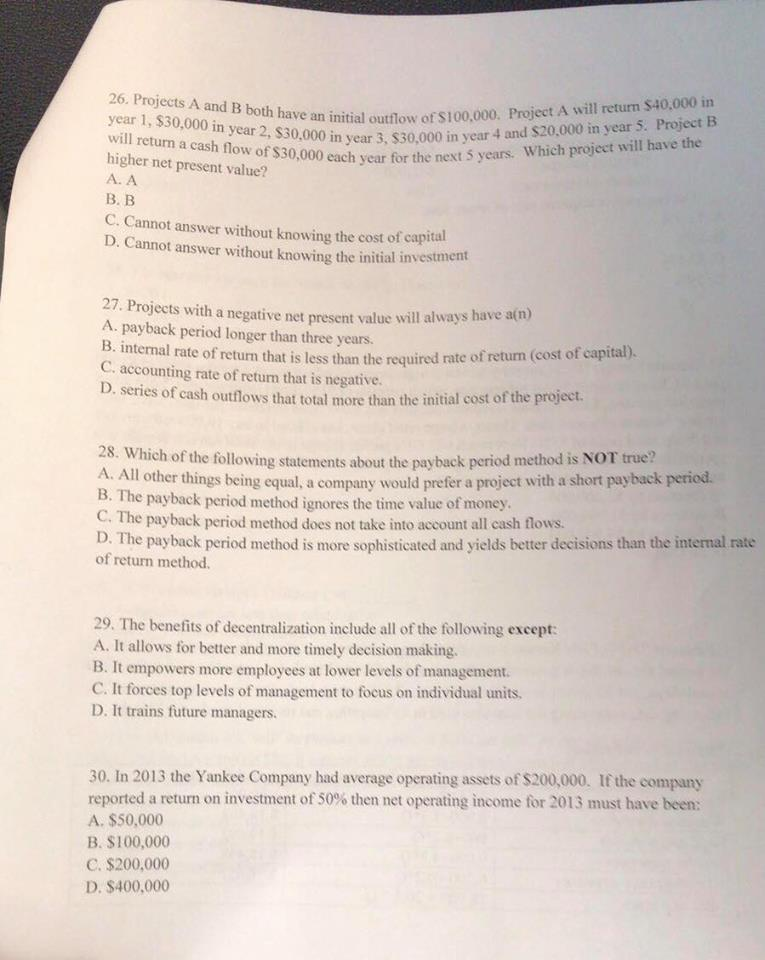

26. Projects A and B both year 1, $30,000 in year 2, S30,000 will return a cash flow of higher net present value? have an initial outflow of st00,000. Project A will return $40,000 in in year 3, s30,000 in year 4 and $20,000 in year 5. Project B outflow of 3, $3 for t 0,000 each year for the next 5 years. Which project will have the C. Cannot answer without knowing the cost of capi D. Cannot answer without knowing the initial investment ta 27. Projects A. payback period longer than three years. B. with a negative net present value will always have a(n) intenal rate of return that is less than the required rate of retun (cost of capital). C. accounting rate of return that is negative. . series of cash outflows that total more than the initial cost of the project. 28. Which of the following statements about the payback period method is NOT true? A All other things being equal, a company would prefer a project with a short payback period. B. The payback period method ignores the time value of money. C. The payback period method does not take into account all cash flows. D. The payback period method is more sophisticated and yields better decisions than the internal rate of return method. 29. The benefits of decentralization include all of the following except A. It allows for better and more timely decision making. B. It empowers more employees at lower levels of management. C. It forces top levels of management to focus on individual units D. It trains future managers 30. In 2013 the Yankee Company had average operating assets of S200,000. If the company reported a return on investment of 50% then net operating income for 2013 must have been: A. $50,000 B. $100,000 C. $200,000 D. $400,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts