Question: PLEASE ANSWER ALL THE QUESTIONS Another method to deal with the unequal life problem of projects is the equivalent annual annuity (EAA) method. In this

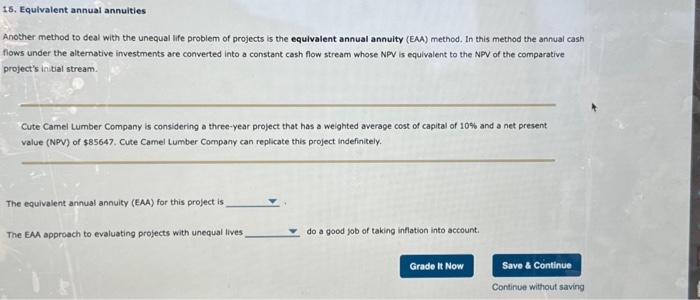

Another method to deal with the unequal life problem of projects is the equivalent annual annuity (EAA) method. In this method the annual cash flows under the alternative investments are converted into a constant cash flow stream whose NPV is equivalent to the NPV of the comparative project's initial stream. Cute Camel Lumber Company is considering a three-year project that has a weighted average cost of capital of 10% and a net present value (NPV) of $85647, Cute Camel Lumber Company can replicate this project indefinitely. The equivalent annual annuity (EAA) for this project is The EAA approach to evaluating projects with unequal lives do a good job of taking inflation into account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts