Question: Please answer all the questions i post this third time QUESTION 1 Mr. X took a call option with a strike of $25 that is

Please answer all the questions i post this third time

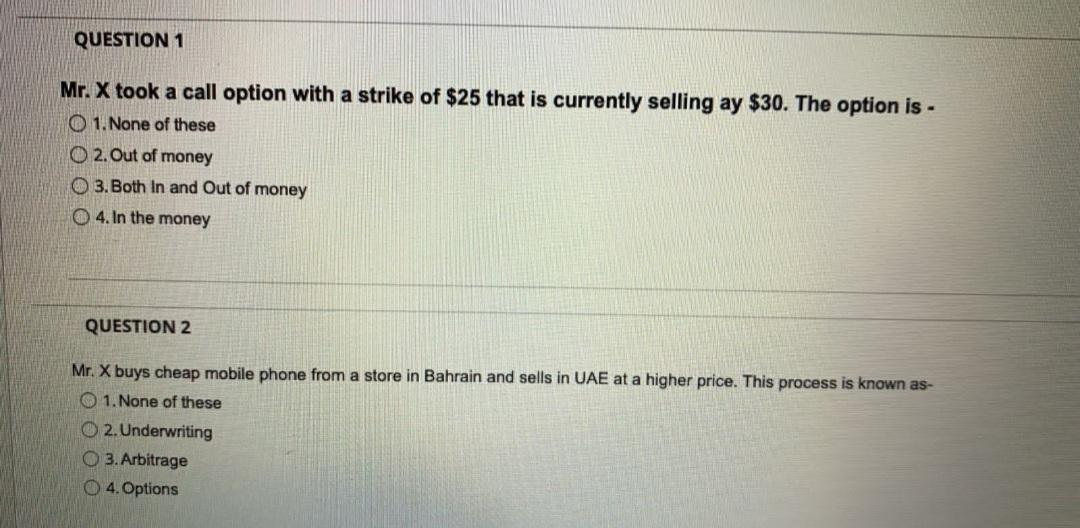

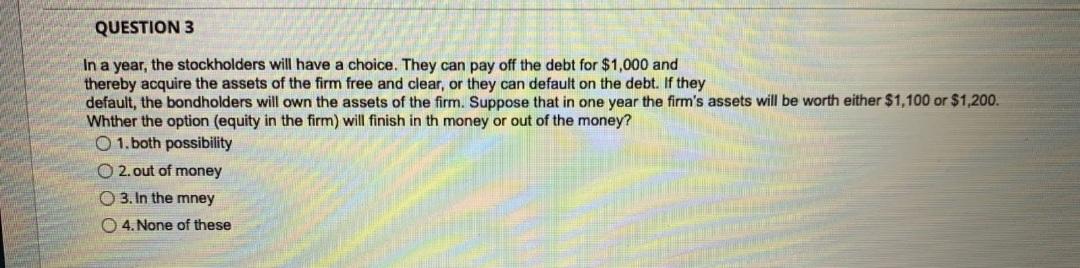

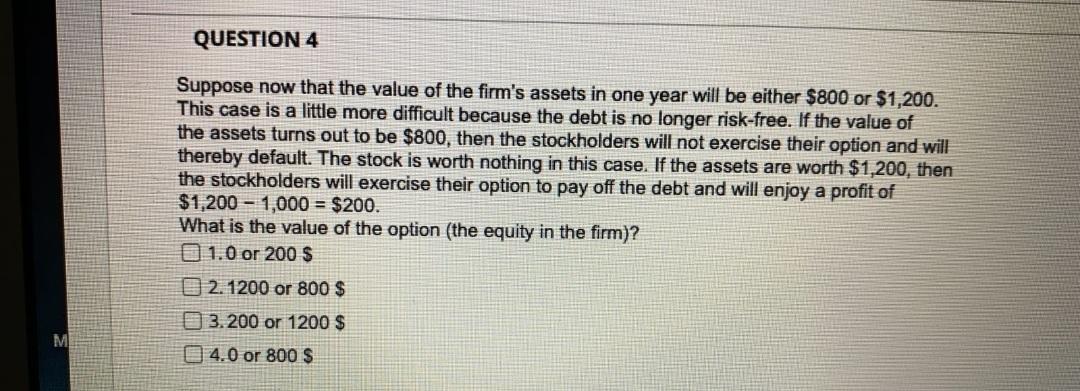

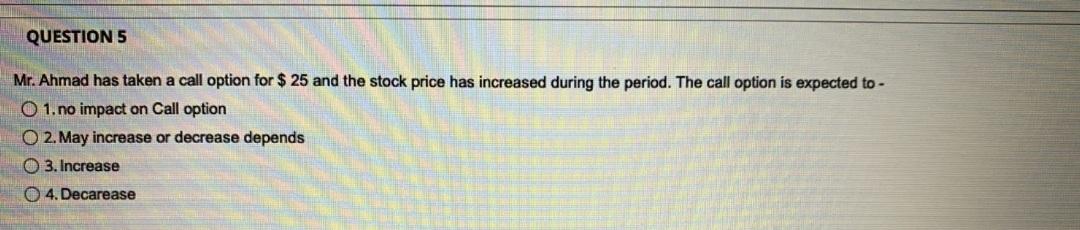

QUESTION 1 Mr. X took a call option with a strike of $25 that is currently selling ay $30. The option is - O 1. None of these O 2. Out of money 3. Both In and Out of money 4. In the money QUESTION 2 Mr. X buys cheap mobile phone from a store in Bahrain and sells in UAE at a higher price. This process is known as- O 1. None of these 2. Underwriting O 3. Arbitrage 0 4. Options QUESTION 3 In a year, the stockholders will have a choice. They can pay off the debt for $1,000 and thereby acquire the assets of the firm free and clear, or they can default on the debt. If they default, the bondholders will own the assets of the firm. Suppose that in one year the firm's assets will be worth either $1,100 or $1,200 Whther the option (equity in the firm) will finish in th money or out of the money? O 1. both possibility 0 2. out of money 03. In the mney 4. None of these QUESTION 4 Suppose now that the value of the firm's assets in one year will be either $800 or $1,200. This case is a little more difficult because the debt is no longer risk-free. If the value of the assets turns out to be $800, then the stockholders will not exercise their option and will thereby default. The stock is worth nothing in this case. If the assets are worth $1,200, then the stockholders will exercise their option to pay off the debt and will enjoy a profit of $1,200 - 1,000 = $200. What is the value of the option (the equity in the firm)? a 1.0 or 200 $ B 2. 1200 or 800 $ 3.200 or 1200 $ M 4.0 or 800 S QUESTION 5 Mr. Ahmad has taken a call option for $25 and the stock price has increased during the period. The call option is expected to - O 1. no impact on Call option 2. May increase or decrease depends 0 3. Increase 4. Decarease

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts