Question: please answer all the questions immediately thankyou 30 * When two or more sole proprietors form a partnership, the following are correct, except (1 Point)

please answer all the questions immediately thankyou

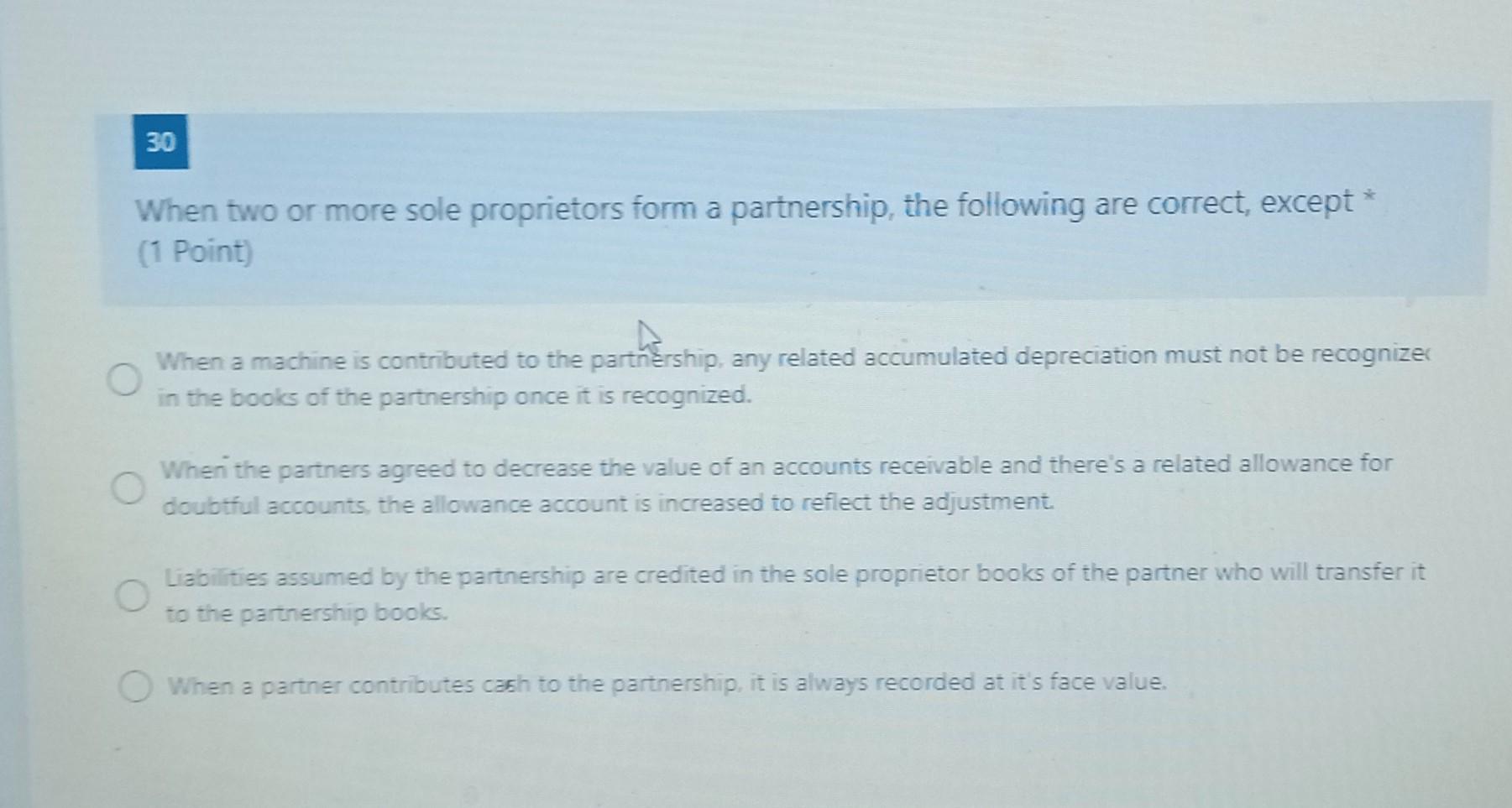

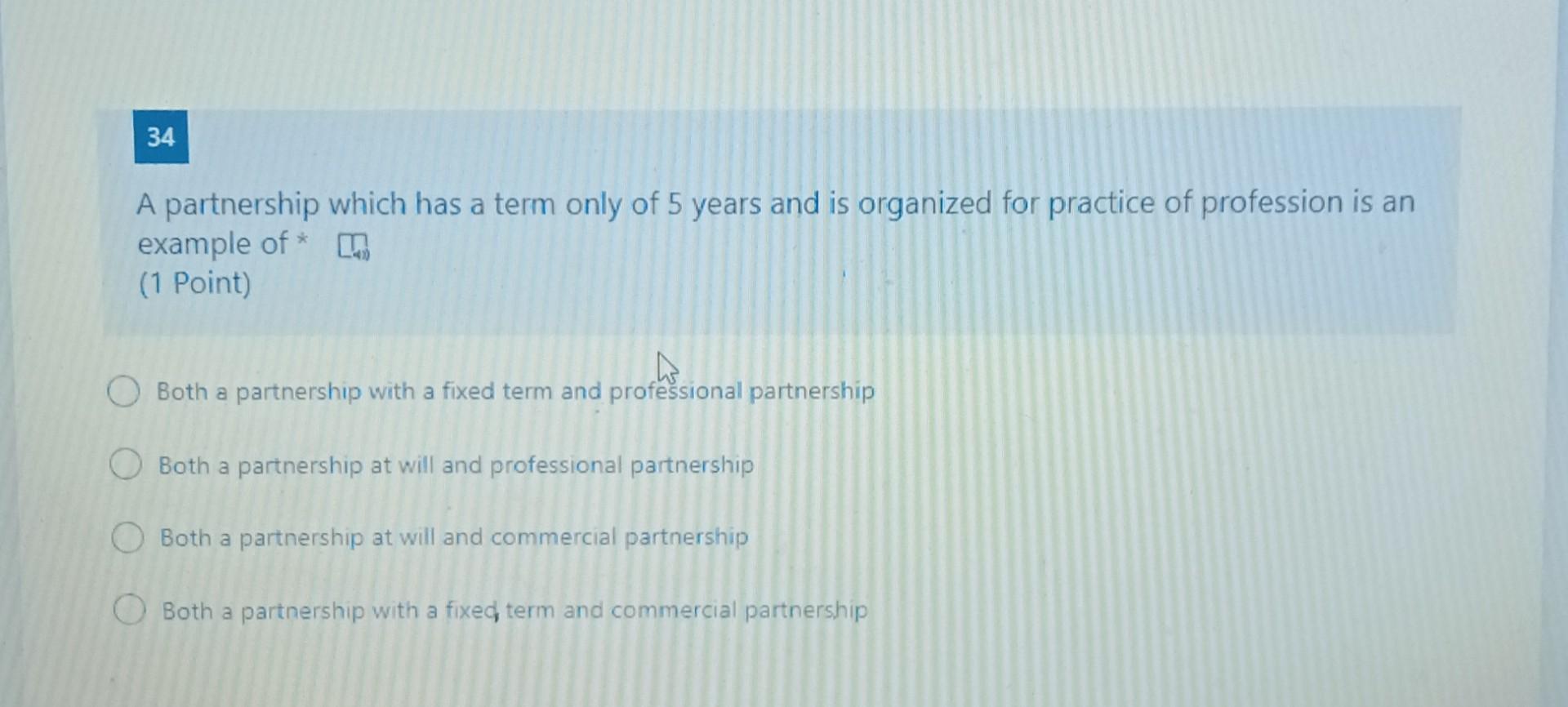

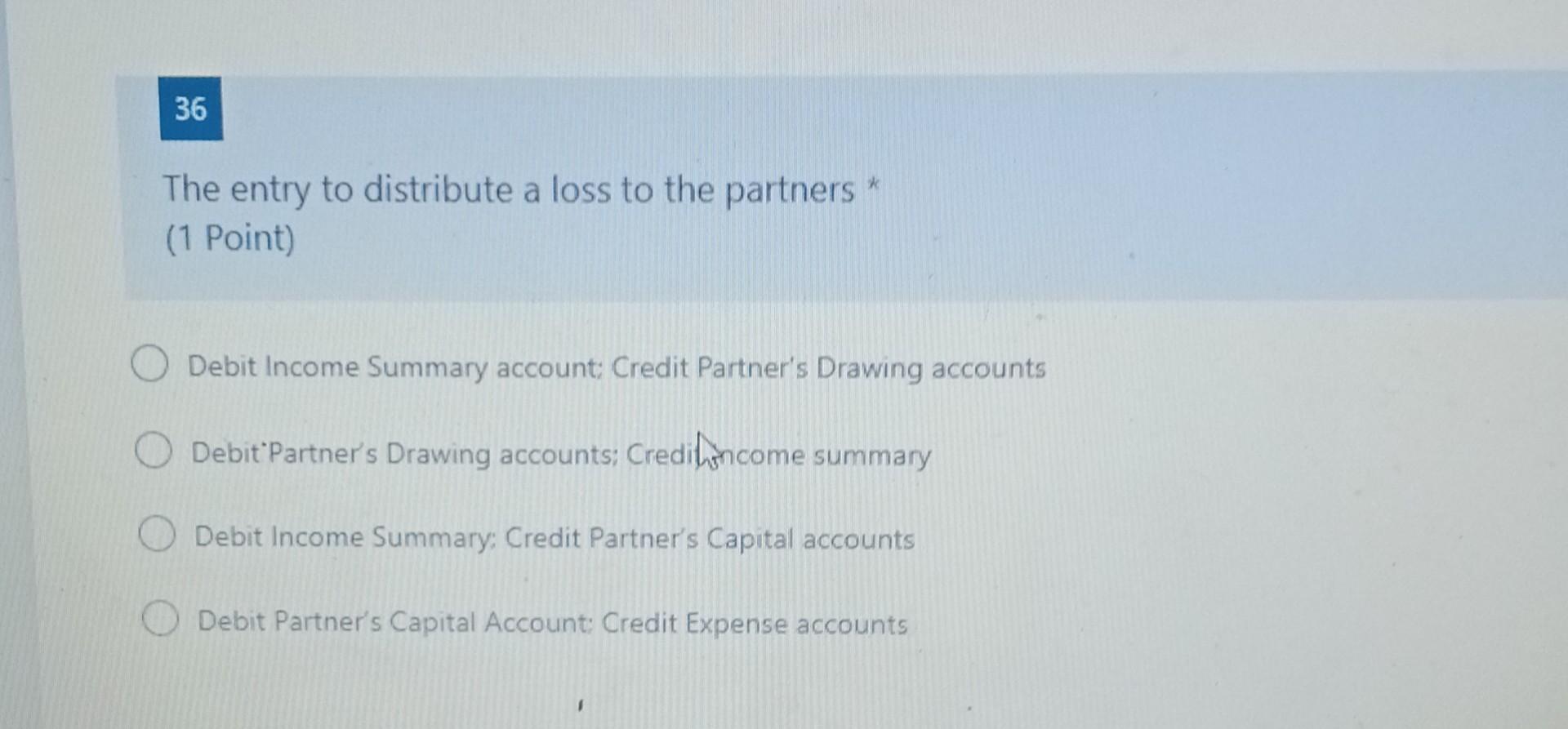

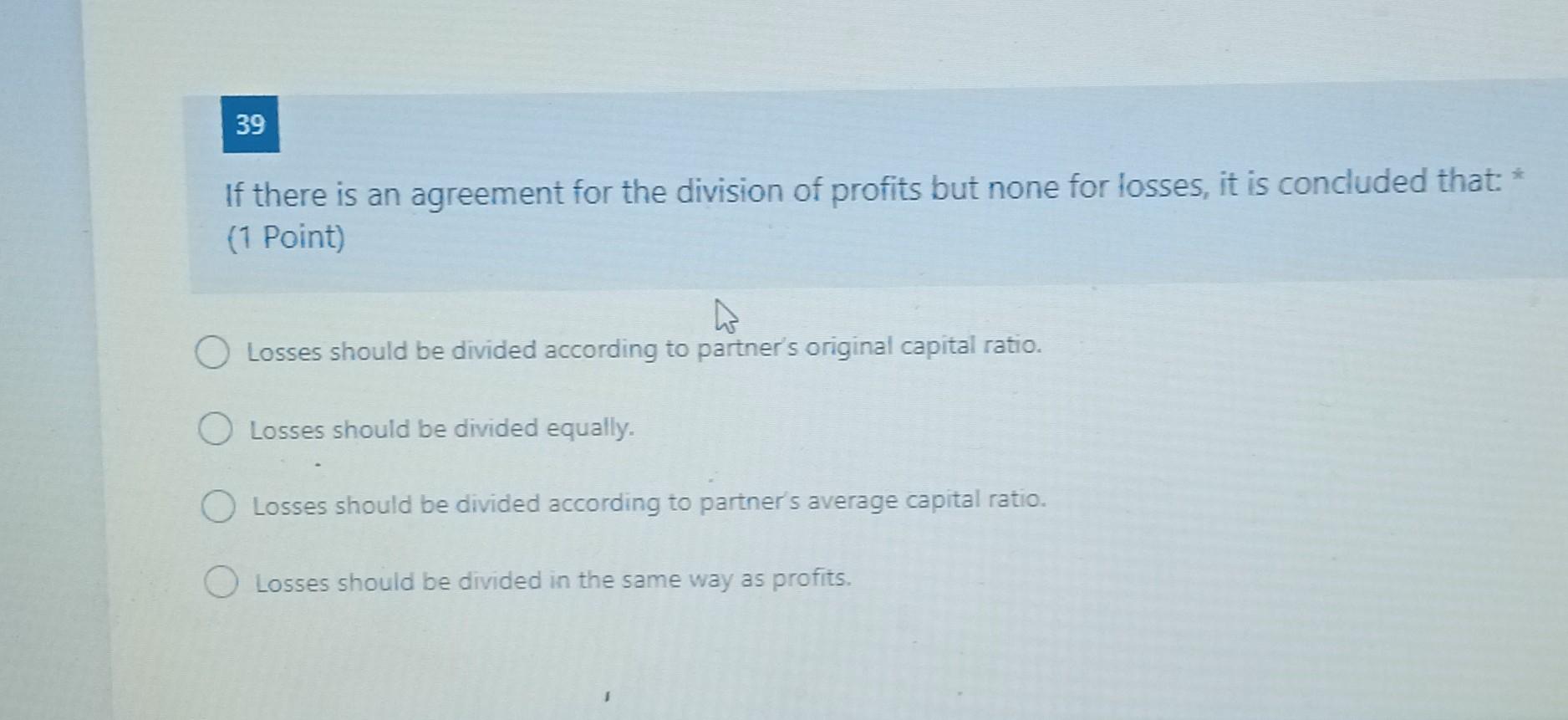

30 * When two or more sole proprietors form a partnership, the following are correct, except (1 Point) o When a machine is contributed to the partnership, any related accumulated depreciation must not be recognized in the books of the partnership once it is recognized. When the partners agreed to decrease the value of an accounts receivable and there's a related allowance for doubtful accounts the allowance account is increased to reflect the adjustment. o Liabilities assumed by the partnership are credited in the sole proprietor books of the partner who will transfer it to the partnership books. O When a partner contributes cash to the partnership, it is always recorded at it's face value 34 A partnership which has a term only of 5 years and is organized for practice of profession is an example of* m (1 Point) O Both a partnership with a fixed term and professional partnership O Both a partnership at will and professional partnership O Both a partnership at will and commercial partnership Both a partnership with a fixed term and commercial partnership 36 The entry to distribute a loss to the partners * (1 Point) O Debit Income Summary account: Credit Partner's Drawing accounts Debit'Partner's Drawing accounts; Credincome summary Debit Income Summary: Credit Partner's Capital accounts Debit Partner's Capital Account: Credit Expense accounts 39 If there is an agreement for the division of profits but none for losses, it is concluded that: (1 Point) W Losses should be divided according to partner's original capital ratio. Losses should be divided equally. Losses should be divided according to partner's average capital ratio. Losses should be divided in the same way as profits. 41 -)) If profit is not enough to cover the salary and allowances, * (1 Point) h O both will not be provided anymore both would still be provided in full and any excess would be a negative remainder allocated to the partners base on their agreement. Can be provided only in full if the partnership resulted to a loss O Can be provided only in full if the partnership resulted to a profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts