Question: Please answer all the questions. No explaination needed. Thank you in advance. Psa 3-7 Calculate Federal Income Tax Withholding Using the Percentage Method (2020/2021 Form

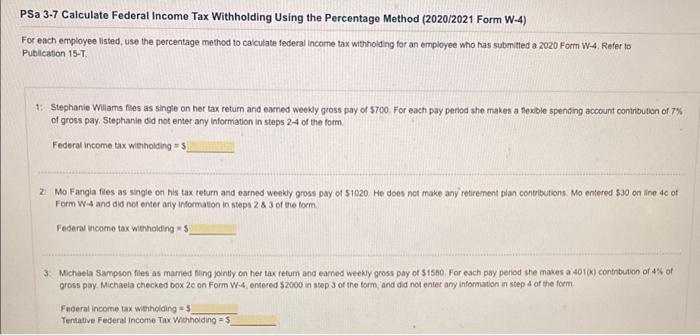

Psa 3-7 Calculate Federal Income Tax Withholding Using the Percentage Method (2020/2021 Form W-4) For each employee listed, use the percentage method to calculato federal income tax withholding for an employee who has submitted a 2020 Form W-4. Refer to Publication 15-T 1: Stephanie Williams files as single on her tax return and emned weekly gross pay of $700. For each pay period she makes a flexible spending account contribution of 7% of gross pay, Stephanie did not enter any information in steps 24 of the form Federal income tax withholding 3 2 Mo Fangia files as single on his tax return and earned weekly gross pay of S1020 He does not make any retirement plan contributions Mo entered $30 on line dc of Form W. and did not enter any information in steps 2 & 3 of the form Federal income tax withholdings 3. Michaela Sampson files as mamed ting jointly on her tax retum and eamed weekly gross pay of 51580 For each pay period the makes a 401k) contribution of 45 of gross pay. Michaela checked box 2c on Form W-4, entered S2000 in step of the form and did not enter any information in step 4 or the form Federal income tax wesholding = 5 Tentative Federal Income Tax Withholding = $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts