Question: please answer all the questions. the data for question 1 is in the second picture. Homework Exercise Module 2 Evaluating Trading Costs Imagine that you

please answer all the questions. the data for question 1 is in the second picture.

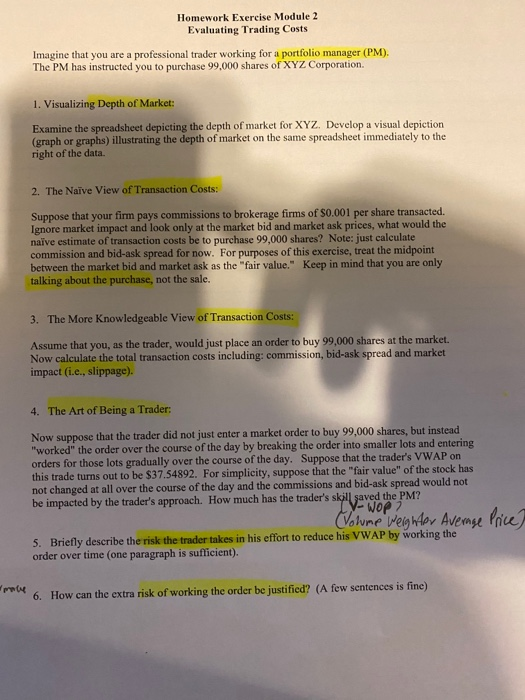

Homework Exercise Module 2 Evaluating Trading Costs Imagine that you are a professional trader working for a portfolio manager (PM). The PM has instructed you to purchase 99.000 shares of XYZ Corporation. 1. Visualizing Depth of Market: Examine the spreadsheet depicting the depth of market for XYZ. Develop a visual depiction (graph or graphs) illustrating the depth of market on the same spreadsheet immediately to the right of the data 2. The Naive View of Transaction Costs: Suppose that your firm pays commissions to brokerage firms of $0.001 per share transacted. Ignore market impact and look only at the market bid and market ask prices, what would the naive estimate of transaction costs be to purchase 99,000 shares? Note: just calculate commission and bid-ask spread for now. For purposes of this exercise, treat the midpoint between the market bid and market ask as the "fair value. Keep in mind that you are only talking about the purchase, not the sale. 3. The More Knowledgeable View of Transaction Costs: Assume that you, as the trader, would just place an order to buy 99,000 shares at the market. Now calculate the total transaction costs including: commission, bid-ask spread and market impact (i.e., slippage). 4. The Art of Being a Trader: Now suppose that the trader did not just enter a market order to buy 99,000 shares, but instead "worked" the order over the course of the day by breaking the order into smaller lots and entering orders for those lots gradually over the course of the day. Suppose that the trader's VWAP on this trade turns out to be $37.54892. For simplicity, suppose that the "fair value of the stock has not changed at all over the course of the day and the commissions and bid-ask spread would not be impacted by the trader's approach. How much has the trader's skill saved the PM? LY-WOP 7 (Volume weighter Average Price] 5. Briefly describe the risk the trader takes in his effort to reduce his VWAP by working the order over time (one paragraph is sufficient). 6. How can the extra risk of working the order be justified? (A few sentences is fine) DIY ? Merge Center Format Painter Clipboard Font Alignment GH 8 Bid 9 Bid 10 Bid 11 Bid 12 Bid 13 Bid 14 Bid 15 Bid S 37.37 $ 37.29 $ 37.43 $ 37.35 $ 37.39 $ 37.36 $ 37.41 $ 37 38 $ 37.40 $ 37.34 S 37.46 $ 37.42 $ 37.45 $ 37.48 $ 37.33 $ 37.44 $ 37.30 $ 37.47 $ 37.32 $ 37.50 $ 37.31 $ 37.51 $ 37.49 18200 16200 15000 14300 14200 12100 12000 11600 10000 9000 9000 8900 8500 8500 8000 8000 6500 6200 6000 4000 3000 2800 2200 24 Bid 25 Bid 26 Bid 27 Market Bid NIAMANSARA 29 Far Value $ 37.52 31 Market Ask 33 Ask 34 Ask 35 Ask 36 Ask 37 Ask 38 Ask 39 Ask 40 Ask 41 Ask 42 Ask 43 Ask 44 Ask 45 Ask 46 Ask 47 Ask 48 Ask 49 Ask 50 Ask 51 Ask 52 Ask 53 Ask 37.53 37 66 37.68 37.57 37.55 37.58 37.75 37 54 3759 37.67 37.56 376 37.7 37 64 37.63 37.72 37.69 37.74 37.76 37.61 37.71 37.62 37.73 37.77 1000 1200 2000 2200 2500 2500 3000 3100 31200 3200 3400 3500 4000 5300 5400 5800 5000 6500 6500 7100 8000 9000 9000 9000 Homework Exercise Module 2 Evaluating Trading Costs Imagine that you are a professional trader working for a portfolio manager (PM). The PM has instructed you to purchase 99.000 shares of XYZ Corporation. 1. Visualizing Depth of Market: Examine the spreadsheet depicting the depth of market for XYZ. Develop a visual depiction (graph or graphs) illustrating the depth of market on the same spreadsheet immediately to the right of the data 2. The Naive View of Transaction Costs: Suppose that your firm pays commissions to brokerage firms of $0.001 per share transacted. Ignore market impact and look only at the market bid and market ask prices, what would the naive estimate of transaction costs be to purchase 99,000 shares? Note: just calculate commission and bid-ask spread for now. For purposes of this exercise, treat the midpoint between the market bid and market ask as the "fair value. Keep in mind that you are only talking about the purchase, not the sale. 3. The More Knowledgeable View of Transaction Costs: Assume that you, as the trader, would just place an order to buy 99,000 shares at the market. Now calculate the total transaction costs including: commission, bid-ask spread and market impact (i.e., slippage). 4. The Art of Being a Trader: Now suppose that the trader did not just enter a market order to buy 99,000 shares, but instead "worked" the order over the course of the day by breaking the order into smaller lots and entering orders for those lots gradually over the course of the day. Suppose that the trader's VWAP on this trade turns out to be $37.54892. For simplicity, suppose that the "fair value of the stock has not changed at all over the course of the day and the commissions and bid-ask spread would not be impacted by the trader's approach. How much has the trader's skill saved the PM? LY-WOP 7 (Volume weighter Average Price] 5. Briefly describe the risk the trader takes in his effort to reduce his VWAP by working the order over time (one paragraph is sufficient). 6. How can the extra risk of working the order be justified? (A few sentences is fine) DIY ? Merge Center Format Painter Clipboard Font Alignment GH 8 Bid 9 Bid 10 Bid 11 Bid 12 Bid 13 Bid 14 Bid 15 Bid S 37.37 $ 37.29 $ 37.43 $ 37.35 $ 37.39 $ 37.36 $ 37.41 $ 37 38 $ 37.40 $ 37.34 S 37.46 $ 37.42 $ 37.45 $ 37.48 $ 37.33 $ 37.44 $ 37.30 $ 37.47 $ 37.32 $ 37.50 $ 37.31 $ 37.51 $ 37.49 18200 16200 15000 14300 14200 12100 12000 11600 10000 9000 9000 8900 8500 8500 8000 8000 6500 6200 6000 4000 3000 2800 2200 24 Bid 25 Bid 26 Bid 27 Market Bid NIAMANSARA 29 Far Value $ 37.52 31 Market Ask 33 Ask 34 Ask 35 Ask 36 Ask 37 Ask 38 Ask 39 Ask 40 Ask 41 Ask 42 Ask 43 Ask 44 Ask 45 Ask 46 Ask 47 Ask 48 Ask 49 Ask 50 Ask 51 Ask 52 Ask 53 Ask 37.53 37 66 37.68 37.57 37.55 37.58 37.75 37 54 3759 37.67 37.56 376 37.7 37 64 37.63 37.72 37.69 37.74 37.76 37.61 37.71 37.62 37.73 37.77 1000 1200 2000 2200 2500 2500 3000 3100 31200 3200 3400 3500 4000 5300 5400 5800 5000 6500 6500 7100 8000 9000 9000 9000