Question: Please answer all the questions (Total 30 marks) Question 2 Christie Ltd is a company with two divisions that together manufacture a single product, the

Please answer all the questions

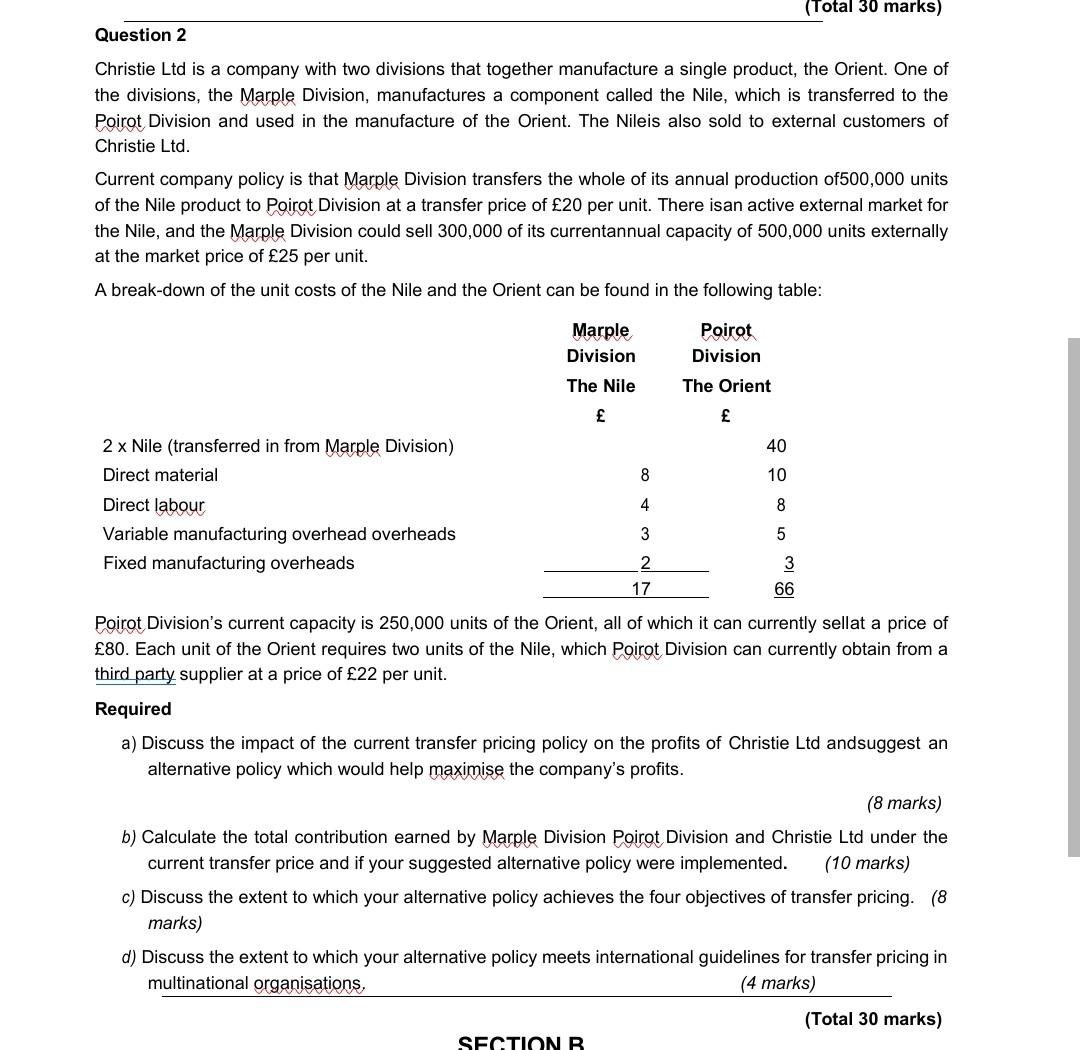

(Total 30 marks) Question 2 Christie Ltd is a company with two divisions that together manufacture a single product, the Orient. One of the divisions, the Marple Division, manufactures a component called the Nile, which is transferred to the Poirot Division and used in the manufacture of the Orient. The Nileis also sold to external customers of Christie Ltd. Current company policy is that Marple Division transfers the whole of its annual production of 500,000 units of the Nile product to Poirot Division at a transfer price of 20 per unit. There isan active external market for the Nile, and the Marple Division could sell 300,000 of its currentannual capacity of 500,000 units externally at the market price of 25 per unit. A break-down of the unit costs of the Nile and the Orient can be found in the following table: Marple Division Poirot Division The Nile The Orient 40 2 x Nile (transferred in from Marple Division) Direct material 8 10 4 8 Direct labour Variable manufacturing overhead overheads Fixed manufacturing overheads 3 5 2 17 3 66 Poirot Division's current capacity is 250,000 units of the Orient, all of which it can currently sellat a price of 80. Each unit of the Orient requires two units of the Nile, which Poirot Division can currently obtain from a third party supplier at a price of 22 per unit. Required a) Discuss the impact of the current transfer pricing policy on the profits of Christie Ltd andsuggest an alternative policy which would help maximise the company's profits. (8 marks) b) Calculate the total contribution earned by Marple Division Poirot Division and Christie Ltd under the current transfer price and if your suggested alternative policy were implemented. (10 marks) c) Discuss the extent to which your alternative policy achieves the four objectives of transfer pricing. (8 marks) d) Discuss the extent to which your alternative policy meets international guidelines for transfer pricing in multinational organisations, (4 marks) (Total 30 marks) SECTION R

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts