Question: please answer all these questions 3. Consider a hedge fund that has an annual fee structure of 1.6 percent base management fee plus a 20

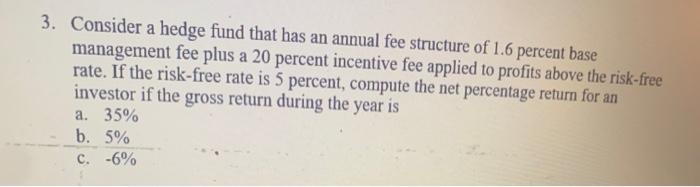

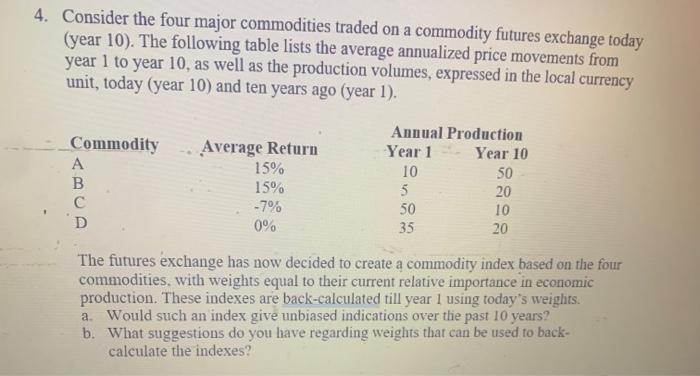

3. Consider a hedge fund that has an annual fee structure of 1.6 percent base management fee plus a 20 percent incentive fee applied to profits above the risk-free rate. If the risk-free rate is 5 percent, compute the net percentage return for an investor if the gross return during the year is a. 35% b. 5% c. 6% 4. Consider the four major commodities traded on a commodity futures exchange today (year 10). The following table lists the average annualized price movements from year 1 to year 10 , as well as the production volumes, expressed in the local currency unit, today (year 10) and ten years ago (year 1). The futures exchange has now decided to create a commodity index based on the four commodities, with weights equal to their current relative importance in economic production. These indexes are back-calculated till year 1 using today's weights. a. Would such an index give unbiased indications over thie past 10 years? b. What suggestions do you have regarding weights that can be used to backcalculate the indexes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts