Question: please answer all three with good explanation. Thanks The Lumber Yard is considering adding a new product line that is expected to increase annual sales

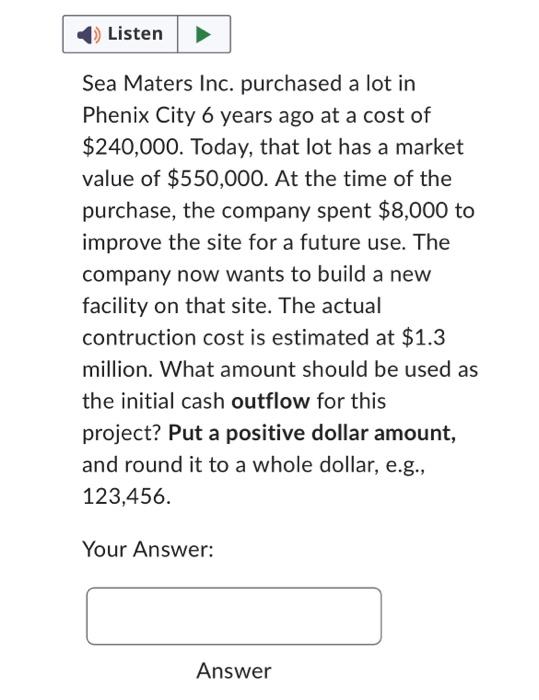

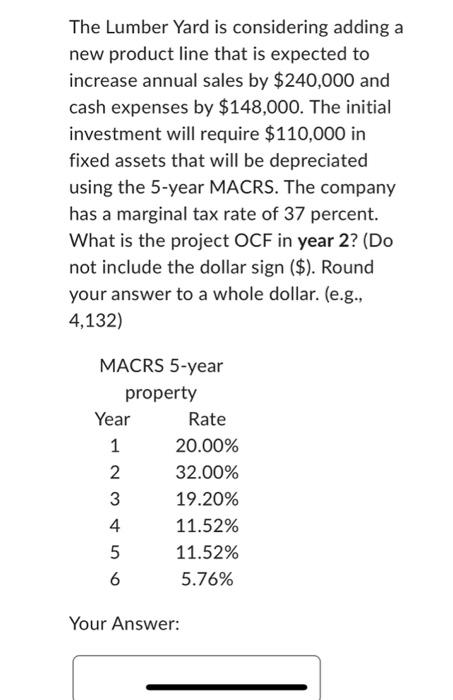

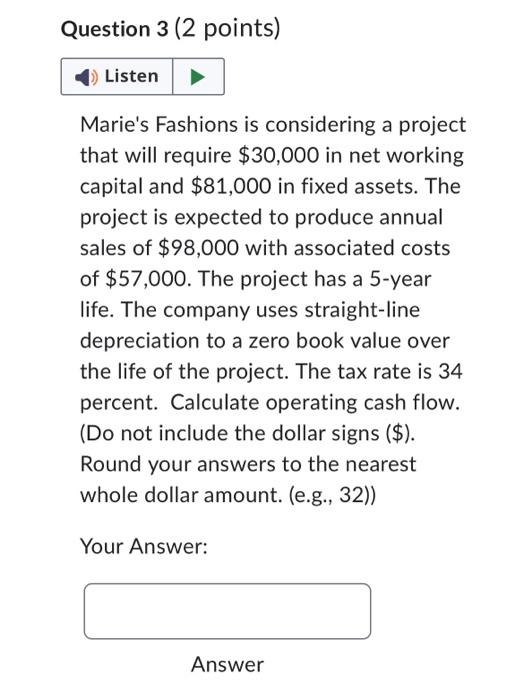

The Lumber Yard is considering adding a new product line that is expected to increase annual sales by $240,000 and cash expenses by $148,000. The initial investment will require $110,000 in fixed assets that will be depreciated using the 5-year MACRS. The company has a marginal tax rate of 37 percent. What is the project OCF in year 2? (Do not include the dollar sign (\$). Round your answer to a whole dollar. (e.g., 4,132) Your Answer: Marie's Fashions is considering a project that will require $30,000 in net working capital and $81,000 in fixed assets. The project is expected to produce annual sales of $98,000 with associated costs of $57,000. The project has a 5 -year life. The company uses straight-line depreciation to a zero book value over the life of the project. The tax rate is 34 percent. Calculate operating cash flow. (Do not include the dollar signs (\$). Round your answers to the nearest whole dollar amount. (e.g., 32)) Your Answer: Answer Sea Maters Inc. purchased a lot in Phenix City 6 years ago at a cost of $240,000. Today, that lot has a market value of $550,000. At the time of the purchase, the company spent $8,000 to improve the site for a future use. The company now wants to build a new facility on that site. The actual contruction cost is estimated at $1.3 million. What amount should be used as the initial cash outflow for this project? Put a positive dollar amount, and round it to a whole dollar, e.g., 123,456. Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts